YESTERDAY’S (March 15) unveiling of five turnkey contract packages for grabs for the Mass Rapid Transit Line 3 (MRT3) project – four construction contract packages and one project management contract – is a timely shot in the arm for the muted construction sector where most firms are all dressed up with nowhere to go in recent years.

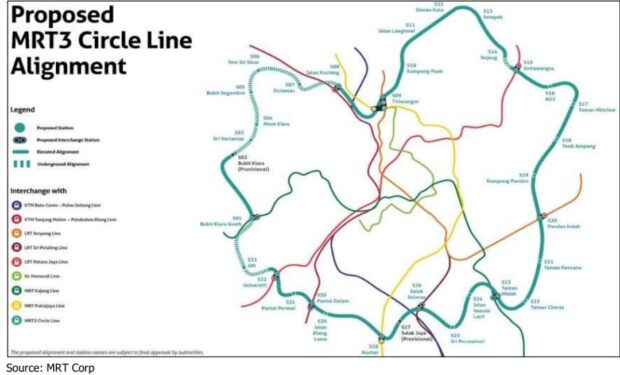

The four construction packages comprise two packages for elevated works, one for underground works and one for the integrated rail system. The tender process will begin in May with successful bidders re expected to be awarded in 4Q CY2022.

MIDF Research expects the MRT3 project to keep construction players busy for the next eight years until 2030 with strong order book replenishments while providing them with earnings visibility.

“While there could potentially be delays in the roll-out of the project due to multiple factors, we believe that the improving inflow of jobs – both domestically and overseas – will be able to keep most of the construction companies under our coverage engaged until they are able to start reaping the fruits of MRT3,” projected the research house in a construction sector update.

“Our optimism is also strengthened through the Government’s commitment to review and potentially revive previously canned projects such as the Kuala Lumpur-Singapore High-Speed Rail (HSR) which will see the Transport Ministry engaging its Singaporean counterpart in 2Q CY2022.”

Initial estimations of the project’s construction cost by MRT Corp stands at RM31 bil, similar to that of MRT2 (Putrajaya Line). The figure, however, excludes land acquisition costs of about RM8.4 bil.

The project which entails a total length of 50.8km – of which 40.3km is elevated and 10.7km underground – will be primarily funded through (green) sukuk that will be raised by the Government.

The first phase of MRT3 is expected to be operational in 2028 with the second phase to be fully operational by 2030.

Aside from the MRT3 project and the HSR, MIDF Research is not optimistic about the recent Melaka Government announcement that it has long-term plans to build an undersea tunnel for a rail system network linking Melaka and Dumai in Sumatra (Indonesia).

“Idealistic as these international links may sound, we are not factoring any of it into our assessment of the sector until there are more concrete actionable plans in sight,” the research house pointed out.

“Something similar was mooted years back, believed to be 1995, for a bridge connecting Melaka and Dumai but this was placed in the back burner due to the Asian Financial Crisis in 1997-1998.

“Talks on the project resurfaced in 2009 but there were no developments after that. Also, recall that in 2018, there was a proposal for an undersea tunnel project from Bagan Datuk in Perak to Sumatra which could cost up to US$20 bil.”

All factors considered, MIDF Research maintained its “positive” recommendation on the construction sector on the back of an optimistic outlook and economic recovery play, especially with MRT3 ready to kick off soon.

“We have “buy” calls on Gamuda Bhd (target price: RM3.63) which remains our clear favourite, IJM Corp Bhd (TP: RM1.90), Sunway Construction Group Bhd (TP: RM1.80), Gabungan AQRS Bhd (TP: 64 sen), Cahya Mata Sarawak Bhd (TP: RM1.62), Malayan Cement Bhd (TP: RM3.00), Muhibbah Engineering (M) Bhd (TP: 78 sen) and WCT Holdings Bhd (TP: 80 sen),” added the research house. – March 16, 2022