THE recent volatility in Malaysia’s construction sector, particularly in stocks like Gamuda and SunCon, started from concerns over the AI Chip restriction implemented by the Biden administration.

“This policy restricts U.S. data centre (DC) operators from deploying more than 7% of their processing power in Tier 2 countries like Malaysia and caps GPU usage at 50,000 units per facility, triggering fears that large-scale DC investments in Malaysia would slow,” said MIDf Research (MIDF) in the recent Sector Report.

These concerns were compounded by Donald Trump’s Stargate initiative, a USD 500b plan backed by Microsoft and Meta to expand DCs in the US further shaking market confidence in Malaysia’s role as a global data centre hub.

“However, we believe that these fears may be overstated. Malaysia remains a prime location for data centres due to its abundant power and water resources, cost advantages, and established infrastructure,” said MIDF.

The feasibility of consolidating all data centres in the US is highly questionable given the massive energy and cooling requirements.

Moreover, the rise of DeepSeek, a Chinese AI model reportedly achieving ChatGPT-level performance using only 2,000 H-800 Nvidia chips (compared to ChatGPT’s approximate 11,000 H-100 chips which are more advanced), could nullify the impact of the AI Chip Ban.

If DeepSeek’s efficiency claims hold true, US firms would achieve the same processing power using far fewer GPUs, meaning the 50,000 GPU limit would allow for multiple data centres in Malaysia or an expansion of current data centres.

Beyond AI, data centres are not solely dependent on AI chips. The sector includes cloud-based and AI-based data centres, each serving different functions.

Some are located onsite for easy access, while others serve as backups to ensure resilience against natural disasters.

Strategic placement matters as geographically distributed data centres enhance latency and bandwidth, ensuring service continuity.

For instance, if an undersea fibre-optic cable connecting a U.S. YouTube DC fails, users may lose access, unless YouTube has a backup DC in Johor Bahru.

These factors reinforce Malaysia’s long-term attractiveness as a DC hub. Despite market reaction, major US analysts remain bullish.

Oppenheimer, a U.S-based financial house, suggests that greater efficiency will drive demand for AI chips and DCs. Wedbush calls this a golden buying opportunity, and Cantor likens it to Jevons Paradox, where efficiency boosts rather than reduces demand.

Crucially, DeepSeek is an open-source model running on US chips, meaning American firms can leverage these innovations.

Meanwhile, Microsoft CEO Satya Nadella has reaffirmed his USD80bil 0AI investment, and Meta CEO Mark Zuckerberg committed USD65bil in DC capital expenditure post-OpenAI V3.

This confirms that big tech investment in AI infrastructure is not slowing down and DC investments in ASEAN countries such as Malaysia are not expected to experience slowdowns.

This notion was also reaffirmed by MIDF’s meeting with SunCon’s management last week. “Overall, we opine that the sharp selloff in Malaysian construction stocks may be overdone,” said MIDF.

If DeepSeek’s efficiency claims are valid, the AI Chip restriction will be moderated in their view, reaffirming Malaysia’s role as a cost-effective, strategically located DC hub.

As clarity emerges, confidence in construction stocks should rebound in the coming months, reinforcing the sector’s long-term strength.

If efficiency truly increases, Malaysia could see a shift towards lower-value yet higher-frequency DC projects, which could impact revenue projections for major contractors. This is a key area to monitor going forward.

“We maintain our positive view on the construction sector as the softening steel bar prices continue to ease cost pressures, while cement prices remain stable, providing a supportive pricing environment for contractors,” said MIDF.

Despite concerns surrounding data centre investments following the AI Chip restriction, the Stargate initiative and the Deepseek developments, MIDF believes the market reaction may have been overdone.

Malaysia remains a key data centre hub due to its strategic location, abundant resources, and cost advantages, with industry feedback suggesting no major disruptions to upcoming projects.

As clarity emerges, MIDF anticipates a recovery in construction stocks, supported by strong job flows, mega infrastructure projects, and sustained private sector investments in data centres and other government-related infrastructure projects such as the RTS Link in Johor, the Penang LRT and others.

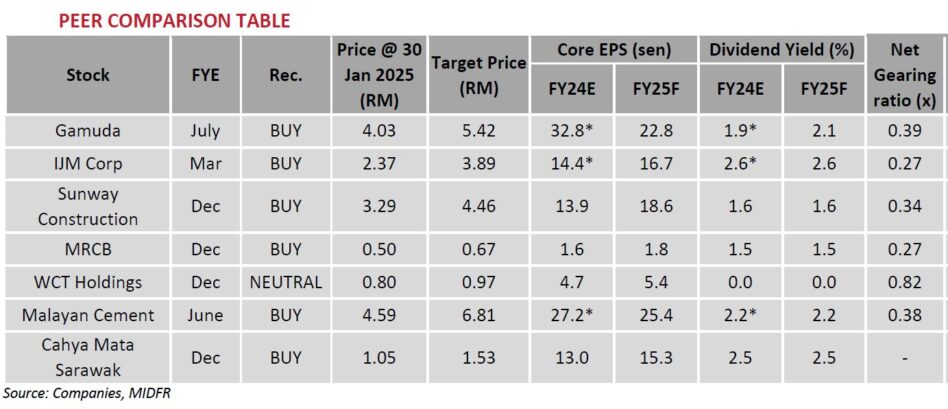

“Our top picks for the sector remain Gamuda, IJM Corp, and Sunway Construction. For the cement play, we recommend Malayan Cement as a key beneficiary of continued construction sector expansion,” said MIDF. —Jan 31, 2025

Main image: Pixabay