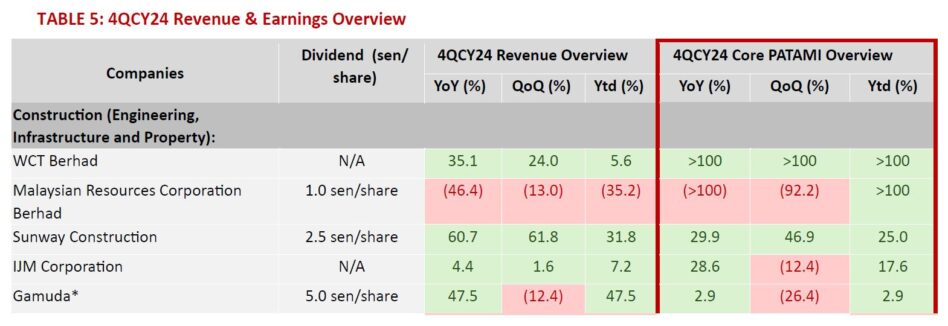

THE construction sector saw mixed performance, with three companies meeting expectations, one exceeding, and one falling short.

SunCon delivered earnings within expectations, with financial year 2024 (FY24) core earnings up +25.0% on the back of a +31.8% revenue increase, supported by a strengthened position in advanced technology facilities, particularly data centre projects.

“MRCB underperformed, with quarter four financial year 2024 (4QFY24) core earnings down -100% year-on-year (yoy) due to significantly reduced contributions from their property development & investment division, following the completion of two major projects,” said MIDF Research (MIDF) in the recent Sector Report.

Additionally, the group’s newly launched property projects were still in their early stages, resulting in minimal revenue recognition.

Moreover, there was also lower revenue contribution from the LRT3 construction project which nears completion, resulting in a -35.2% lower revenue in FY24.

“IJM Corp’s earnings, although slightly below our forecasts, came within estimates on the back of expectations of stronger construction progress in 1QCY25,” said MIDF.

This was also supported by a sale of parcel land in Penang which contributed to increased revenue in their property development segment.

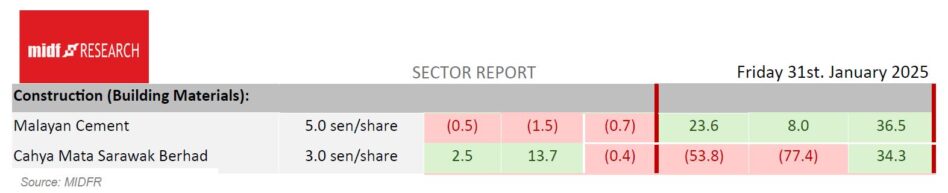

Performance was relatively positive, with one company meeting expectations and one outperforming.

CMSB came in within expectations with FY24 core earnings growing +34.3% to RM131.4 mil, driven by improved gross profit margins for its cement division.

Then there was the higher sales from its property development & road maintenance division and lower operating costs from its phosphate division.

Across the board, construction companies encountered varied conditions in 4QCY24, with some benefiting from robust progress in infrastructure and property projects, while others faced challenges due to project completions and regulatory delays.

MIDF maintains positive on the sector. Looking ahead, the first half of calendar year 2025 (1HCY25) is expected to show a recovery in construction sector performance.

This is driven by improved project execution momentum despite more challenging market conditions. Overall, MIDF’s optimism is anchored by several key factors:

1/ A diversified earnings base and strategic asset monetisation among key players such as IJM’s sale of land in Penang and the proposed launch of WCT’s real estate investment trust, mitigating individual project risks and regulatory delays.

2/ Sustained operational efficiencies and effective cost management, supporting margin expansion particularly among building materials producers.

3/ Continued strength in property development and higher property unbilled sales benefiting diversified construction firms.

4/ Accelerated progress in key infrastructure projects, particularly data centres supported by robust order books of industry leaders such as SunCon and IJM Corp, alongside increased infrastructure activity driven by national initiatives like the Penang LRT, airport expansions, and highway projects, enhancing earnings visibility and sector-wide performance throughout CY25. —Mar 21, 2025

Main image: World Bank