MALAYSIA’s retail trade grew at an accelerated pace of +8.2% year-on-year (yoy) in Jan-25, compared to Dec-24’s +5.4% yoy, reflecting a positive start to the year.

“Growth was driven by higher spending on food, beverages & tobacco (+8.8%yoy) and non-specialized stores (+9.7%yoy),” said MIDF Research (MIDF) in the recent Monthly Sector Report.

On the macroeconomic front, Malaysia’s labour market remained a key pillar of support, with the unemployment rate unchanged at 3.1% and the labour force participation rate steady at 70.6%, signalling continued employment stability.

Additionally, headline CPI inflation remained at +1.7%yoy in Jan-25, while core inflation edged up to +1.8%yoy, reversing from the 35-month low recorded previously.

Despite policy adjustments, such as higher diesel prices and increased utility tariffs, overall price pressures remain contained, ensuring limited impact on consumer purchasing power.

Additionally, the postponed RON95 fuel subsidy rationalization until mid-2025 continues to provide relief, supporting household budgets.

“Looking ahead, we remain optimistic about the sustainability of domestic consumption, underpinned by stable employment conditions, rising wages, and government policy support,” said MIDF.

Factors such as higher civil servant salaries, an increased minimum wage, and continued cash assistance programs are expected to strengthen consumer spending power.

Additionally, the upcoming Aidilfitri festive seasons, combined with a recovery in tourism, will further support retail activity.

“Given this positive outlook, we continue to favour consumer staples and general merchandise retailers, which are well-positioned to benefit from sustained consumer demand,” said MIDF.

With the continued efforts to attract global visitors, the consumer sector remains a key beneficiary of Malaysia’s thriving tourism industry, ensuring sustained retail and F&B sector growth in the coming years.

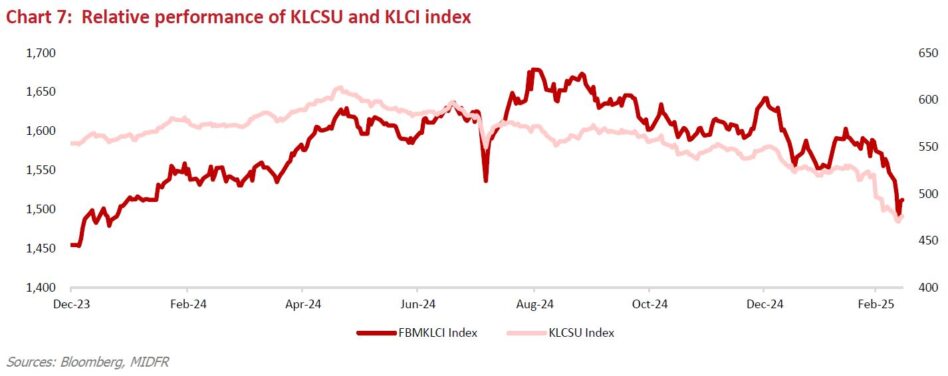

The consumer sector has lagged behind broader market performance over the past year, as the 2024 market rally was largely driven by strong catalysts in data centers, artificial intelligence (AI), and the Johor-Singapore Special Economic Zone (JSSEZ).

Meanwhile, the consumer sector lacked fresh sector-specific catalysts, leading to its underperformance.

“However, we believe the tide is turning for consumer stocks, as supportive macroeconomic policies and resilient domestic demand create a more favourable outlook for the sector,” said MIDF.

Moreover, the consumer sector’s defensive nature makes it an attractive play in uncertain market conditions, offering stable earnings, lower volatility, and consistent demand, particularly in consumer staples.

Malaysia’s consumer sector is set to thrive in 2025, driven by a more conducive economic environment that encourages higher spending.

A key catalyst is the anticipated increase in disposable income, supported by wage hikes in both the public and private sectors, as well as upsized cash handouts under Budget 2025. —Mar 17, 2025

Main image: NPR