IN A move that has raised eyebrows within corporate Malaysia, South Malaysia Industries Bhd (SMI) has appointed Leow Thang Fong as CEO almost immediately after shareholders voted him out as a director.

This unexpected decision has sparked debate about the company’s commitment to adhering to its shareholders’ wishes.

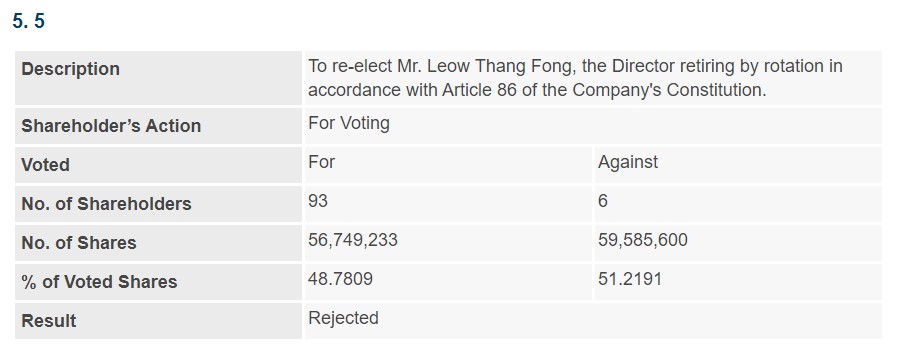

At the company’s 52nd annual general meeting (AGM) on March 27, six shareholders with 59.58 million shares or 51.2% of voted shares had voted against Leow to continue as a director.

On the contrary, 93 directors holding 56.75 million shares or 48.8% of voted shares polled in favour of Leow. Currently, SMI has an issued share capital of RM244.24 mil comprising 209.94 million shares.

“This move is unusual because it goes directly against what the shareholders wanted. It’s not common to see someone who was just voted out of a lower position suddenly land the top job,” a disgruntled shareholder who attended the March 27 AGM told FocusM. “It makes you wonder about how seriously SMI takes its shareholders’ opinions.”

A fellow of the Institute of Chartered Accountants of England and Wales (ICAEW) and member of the Malaysian Institute of Accountants (MIA), Leow who had served as an executive director of SMI since Sept 29, 1994 holds 1.15% interest in the company (0.85% direct stake and 0.29% indirect stake).

According to a corporate lawyer who speaks on condition of anonymity, Leow’s appointment as CEO after such “losing out in a valid voting process” sends a mixed message.

“On one hand, it’s legal. There’s no rule that says a company can’t do this,” the lawyer told FocusM.

“But on the other hand, it doesn’t look good. It appears as if the company is ignoring its own shareholders hence raising doubts over governance and trust building which is crucial to attract investors.”

Of the seven resolutions which included the re-election of Leow as director, only two were accepted at SMI’s AGM. They were (i) to re-appoint UHY as SMI’s auditors until conclusion of the company’s next AGM; and (ii) to re-appoint Datuk Dr Abdullah Sepien as the company’s director.

The rejected resolutions included (i) the approval of directors’ fees and benefits of RM225,000 to non-executive directors (from June 29, 2022 until March 27, 2024); (ii) allotment and issue of new shares; and (iii) adjournment of the company’s 52nd AGM in view of an originating summons filed by shareholder Honsin Apparel Sdn Bhd against the company.

“This kind of situation could make investors think twice about investing in Malaysia. Investors like stable markets where companies listen to their shareholders,” reckoned the corporate lawyer.

‘The decision has set the stage for more drama at SMI. How will shareholders react? Will there be more legal challenges? And what will this mean for SMI’s future? As we watch how this unfolds, it’s clear that the situation at SMI could influence how corporate governance is viewed in Malaysia moving forward.”

At the close of today’s mid-day trading, SMI which is primarily involved in the management of car parks and property development, was up 1 sen or 2% to 51 sen with 1.9 million shares traded, thus valuing the company at RM107 mil. – May 3, 2024

Main image credit: The Edge