THERE are many indicators used to gauge economic climate.

One of them is when large businesses start shutting down, proffering a variety of reasons ranging from tough business environment, heightened competition and price sensitivity.

The latest casualty in the ultra-competitive FMCG (fast moving consumer goods) retail sector is the Lulu Group which has shut down its hypermarket operations in Malaysia. However, it will continue to run the wholesale division in the country.

According to The Edge, the United Arab Emirates (UAE)-based Lulu Group had been making various rounds of promotions and clearance sales at its outlets earlier this year, culminating in a closure notice posted on the doors of its first ever outlet at CapSquare in Kuala Lumpur about the cessation of operations effective June 9.

News of the closure was also shared on Facebook on the Malaysia Shopping Mall page with the poster claiming that the Lulu Group had suffered losses of up to RM1 bil in the past decade (this remain unverified).

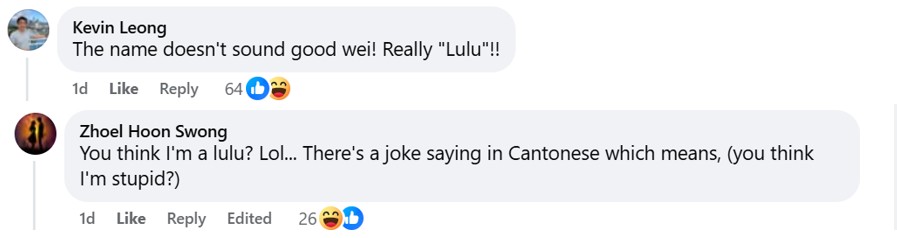

The FB post has generated plenty of comments with netizens positing why the hypermarket operations was a failure.

The name of the hypermarket was cited as a possible reason with some presumably Feng Shui fans highlighting that it sounds like “stupid” in Cantonese.

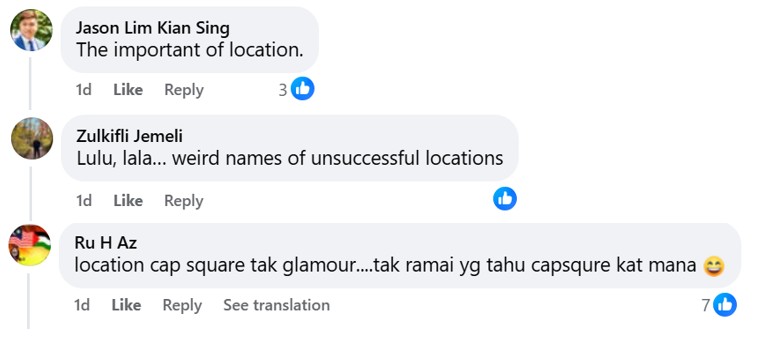

The mall’s locations were also cited as possible reason for the closure with CapSquare labelled as “unglamourous”.

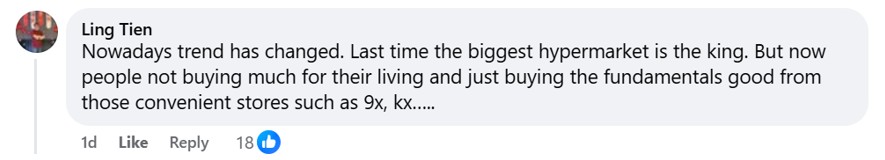

One commenter surmised that Lulu’s closure was down to tough economic times. With the cost-of-living crisis biting hard, consumers are spending only on essential household items which they tend to pick up in smaller quantities at neighbourhood convenience stores, namely 99 Speedmart and KK Super Mart.

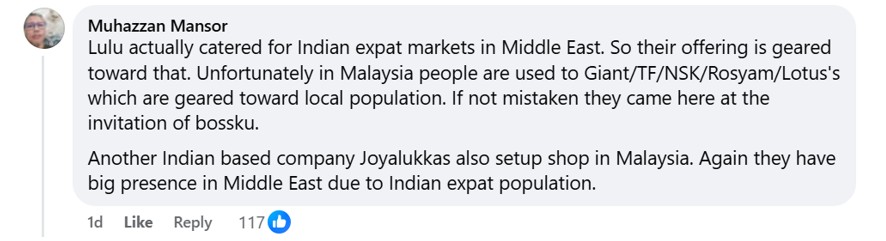

Pointing out that Lulu hypermarkets were thriving in the Middle East serving Indian customers, it was argued by one commenter that perhaps the approach of targetting this demographic could not sustain its operations here in Malaysia.

Stiff competition in this segment was also cited as a potential reason for Lulu shutting its doors.

Modern consumers mainly buy online was the reason posited by another netizen. He also pointed out that other businesses have contingency plans such as a hotel converting into luxury small home-office units.

It was also highlighted that the owner of Lulu Group – M.A. Yusuff Ali – was in the top 50 richest individuals in India, perhaps to show that the closure was down to business reasons alone and not because the parent company was going bust or had cash-flow issues.

A glut of retail outlets was also blamed for this hypermarket brand’s demise.

Some though did contend that it was unlikely that a business would only pull out after posting losses of RM1 bil. The plug would have been pulled sooner. One commenter even suggested that Lulu Group was “cashing out” having made enough profit.

Whatever the reason, it is a worrying sign when hypermarkets dealing in FMCG goods have struggled.

But tough times breed tougher business entities, ie those that can offer better services and better pricing will not only survive but thrive. Therein, lies the silver lining. – June 12, 2025