TAN Sri Tong Kooi Ong wants former Bank Negara Malaysia (BNM) assistant governor Datuk Abdul Murad Khalid to withdraw the statutory declaration (SD) he made back in 1999 where the latter accused the owner of financial publication The Edge of stashing billions of ringgit in ‘master accounts’ belonging to Prime Minister Datuk Seri Anwar Ibrahim.

This has ignited speculation that the former banker could be seeking a return to the banking sector.

Tong’s ‘second gambit with banking’ comes on the heel of the corporate marketplace being abuzz with talks that he might buy into Public Bank Bhd or be involved in a takeover following the demise of its 92-year-old founder, chairman, director, and adviser Tan Sri Teh Hong Piow on Dec 12.

It has been reported that none of Teh’s four children (three girls and one boy) is in the business or is interested in taking over the banking business that he left behind.

However, Tong’s return to banking can only be realised if he clears his name in the eyes of BNM. In other words, the damning SD by Murad, now 68, could stand in his (Tong) way of making a return to the banking scene.

According to Tong, Murad’s SD had forced him and his late wife Carol Tong to sell PhileoAlliedBank whereby they were robbed of their shareholdings in the bank’s parent company – Phileo Allied Bank (M) Bhd – which was listed on Bursa Malaysia after the bank was sold for cash.

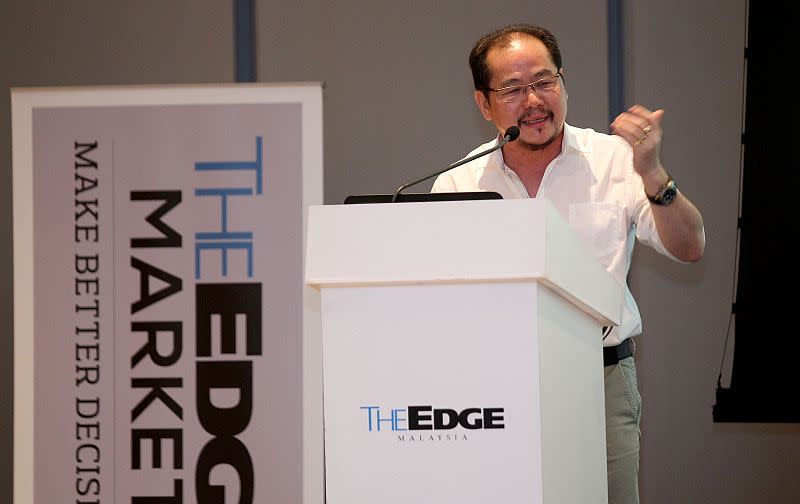

In his ‘appeal’ to Murad via The Edge weekly, Tong, 63, called on Murad who resigned from his BNM post on Feb 1, 1999 to publicly withdraw his SD so that he will be able to clear his name.

“What I seek is simple. For Murad to publicly withdraw his SD now. Apologies are not necessary,” he said in an article that appeared in the financial publication. “This is the only way this episode will finally end.”

However, current banking laws in Malaysia don’t allow an individual to acquire more than a 10% stake in a banking group, hence Tong’s route might have to be through a partnership with other parties.

Public Bank could also be eyed by Hong Leong Bank Bhd which was co-founded by tycoon Tan Sri Quek Leng Chan. If that happens, the powerful merged entity backed by Tong and Quek will challenge Malayan Banking Bhd (Maybank) as Malaysia’s largest banking group.

Apart from Quek, Tong could also be eyeing a foray into the banking industry vis-à-vis Public Bank via a partnership with Berjaya Group tycoon Tan Sri Vincent Tan Chee Yioun who of late has been downsizing his stake in Berjaya Corp Bhd (BCorp).

Between Jan 3-5 alone, the BCorp patriarch had disposed of 41.75 million shares in five tranches which further reduced his direct stake in BCorp to 12.74% from 21.34% on Dec 2, 2022. Recall that Tong and Vincent Tan had a partnership in media company Nexnews Bhd at one time before the duo parted ways.

Aside from Vincent Tan, Tong could also forge a deal in his Public Bank conquest with Tan Sri Tan Teong Hean who was CEO and major shareholder of Southern Bank Bhd from 1983 until 2006 when the bank was sold.

Teong Han who is also a son-in-law of the late Tan Sri Lim Goh Tong, founder of Genting Group, can buy a stake in Public Bank through his private equity firm Southern Capital Group. – Jan 9, 2023