THE Western world is currently experiencing high inflation. But we seem to have avoided this phenomenon:

- In May 2022, Bank Negara Malaysia (BNM) projected Malaysia’s headline inflation to average between 2.2% and 3.2%.

- According to the Department of Statistics, the Malaysian consumer price index increased by 3.4% year-on-year in June 2022.

The most common way to quantify inflation is to use the Consumer Price Index (CPI). This is a price index based on a fixed basket of goods and services that represents the spending of an average consumer.

What is considered high inflation? The US and most European countries have a target 2% inflation rate but:

- The US reported an 8.3% annual inflation rate in April 2022.

- The UK reported an annual change in its CPI of 7.8% for April 2022.

Both the US and UK are currently considered facing high inflation. I assumed that an inflation rate that is four times the target rate could serve as a basis that a country is experiencing high inflation.

In the case of Malaysia, BNM does not have a target inflation rate although its goal is price stability. However, the median annual inflation rate for the past 30 years was 2.3 %. As this is close to the 2% target inflation rate for the US and UK, we can refer to 8% as high inflation for Malaysia.

Measuring inflation

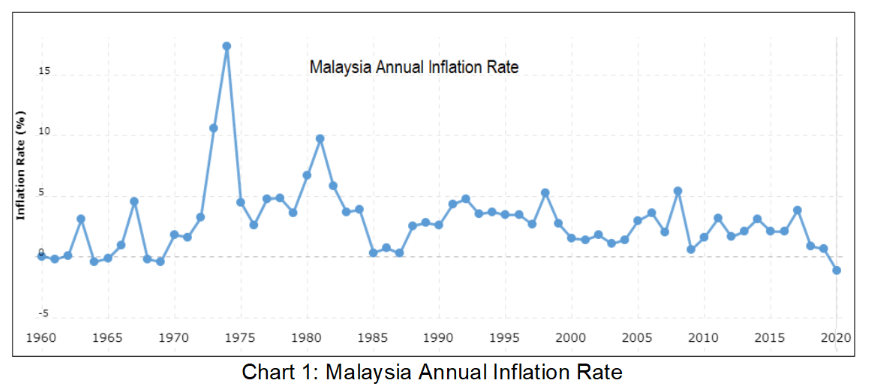

Chart 1 shows the annual inflation rates as measured by the CPI for Malaysia for the past 60 years. You can see that there were three years when the annual inflation rate exceeded 8%. They were:

- 10.6 % in 1973 and 17.3% in 1974 following the OPEC Oil Crisis.

- 9.7 % in 1981 when the Malaysian economy was affected by the fall in commodity prices. This was the result of the oil price hike and the interest rate increases in the US.

After 1981, there were no periods with more than 8% annual inflation rates. However, there were two peaks rates after 1981:

- 5.3% in 1998 following the Asian Economic Crisis.

- 5.4% in 2008 following the US Subprime Financial Crisis.

We are already into 2H 2022. The CPI numbers does not point to an inflation rate of greater than 8% for 2022. Does this mean that we are unlikely to experience high inflation for 2022?

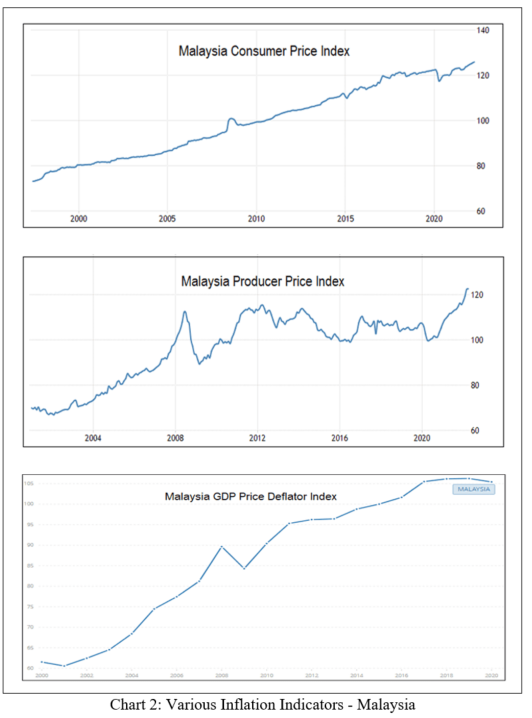

The CPI is not the only way to measure the increase in the prices of goods and services. Examples of other inflation indicators are the Producer Price Index (PPI) and the gross domestic product Price Deflator Index (GDP Deflator).

The PPI measures change in the prices paid to the producers of goods and services. The PPI is a measure of wholesale inflation while the CPI measures the prices paid by consumers. The PPI is a more accurate measure of a country’s economic output because it is not affected by consumer demand.

On the other hand, the GDP Deflator measures the changes in prices for all the goods and services produced in an economy. The GDP Deflator is a more comprehensive inflation measure than the CPI because it is not based on a fixed basket of goods. It captures any changes in an economy’s consumption or investment patterns.

Chart 2 below illustrates the index trends for the Malaysian CPI, PPI and GDP Deflator for the past 20 years.

Different outlook

As they have different basis of measurements, you should not expect the CPI, PPI or GDP Deflator to give the same results. For example, from end-December 2021 to the end-May 2022:

- The CPI increased by 1.7%.

- The PPI increased by 7.4%.

The GDP Deflator which was available on a quarterly basis increased by 3.8% for 1Q 2022. For the same period, the CPI added 0.9% while the PPI rose by 5.8%.

Because of the many price-controlled items in the CPI, you should not be surprised that the CPI has the lowest rates.

Does it mean that we are not likely to experience high inflation in 2022? Yes, from a CPI perspective. But this is due to the price-controlled and subsidised nature of goods and services in Malaysia.

In fact, our Prime Minister has said that we have lowest inflation rates in Southeast Asia because of the continuing subsidies.

But if you are a producer of goods and services, you are likely to look at the PPI. If you accept that the PPI and the GDP Deflator would be higher than the CPI, then we may have high inflation. – July 29, 2022

A self-taught value investor who has been investing in Bursa Malaysia and SGX companies from a value investment perspective for more than 15 years, Datuk Eu Hong Chew was re-appointed to the board of i-Bhd as non-independent non-executive director on Jan 1, 2022. The data for this article was extracted from “Should You Rush to Buy a House Anticipating High Inflation?” published on i4value.asia. Refer to the article for further details.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.