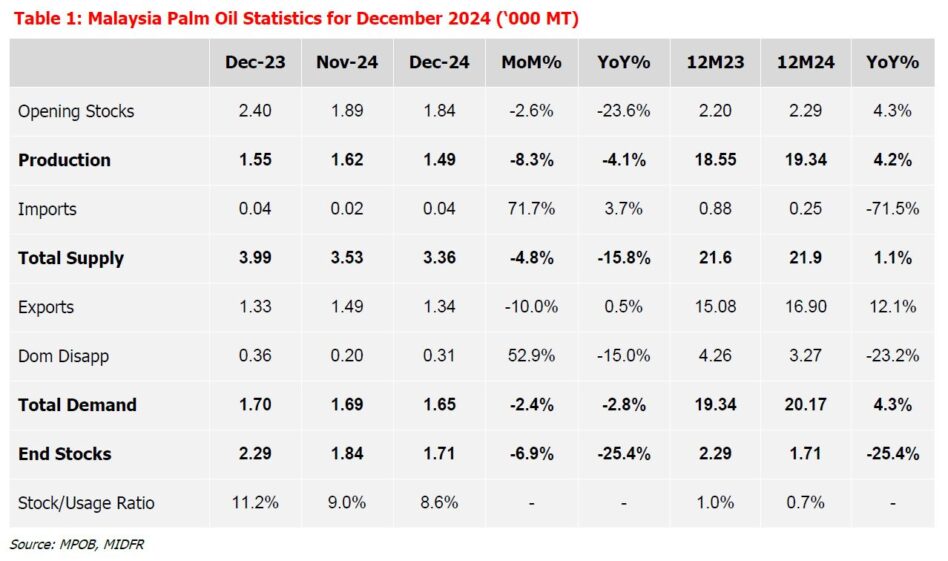

CRUDE Palm Oil (CPO) output in Dec-24 softened to 1.49 mil tonne (-8.3%mom, -4.1%yoy, +4.2%ytd) versus prior year, the slowing growth was seen in most of the states particularly in Negeri Sembilan (-18.8%yoy), Kedah (-18.2%yoy) and Sabah (-4.4%yoy) area.

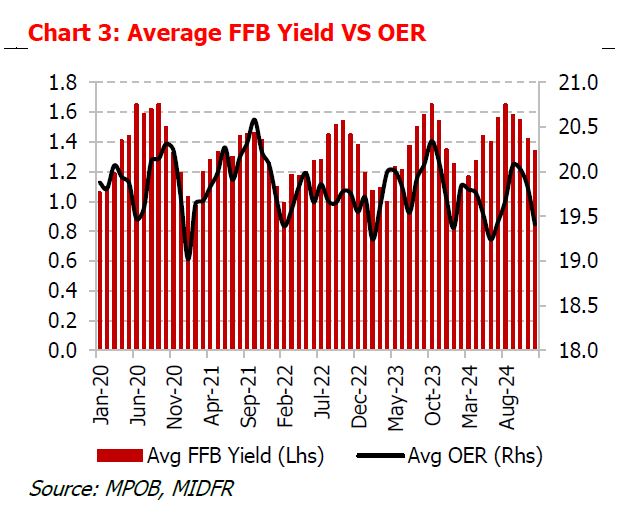

The Fresh Fruit Bunch (FFB) received by mills was also affected, down to 7.79m tonne (-2.0%yoy) with weaker average FFB yield and OER in mills of 1.34 tonne/ha and 19.41% recorded, the FFB evacuation process was interrupted by continuous rainy weather, which led to flooding in some areas, said MIDF Research.

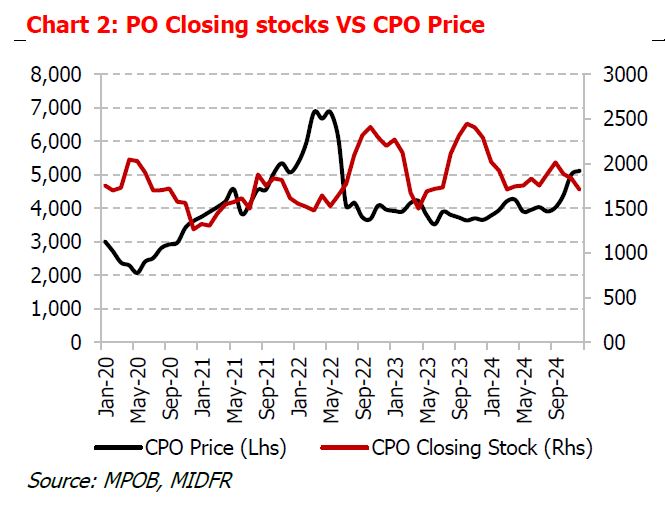

Looking ahead, with closing stocks now nearly at 1.7m Mt (vs CY19: 2.0m Mt), this marks -15.0% below from pre-pandemic level.

We opine that biological tree rest and a slower-than-expected recovery in output will persist, with local production projected to grow by only +1.0%yoy to 19.5m Mt in CY25F.

The continuation of an adverse weather event, such as La Niña and North-East Monsoon (Nov-Mar), could further impact crop productivity.

According to the met Malaysia, the likelihood of this event occurring in the 1HCY25 remains high, at 57%, although this is a slight decrease from the previous 60% probability.

As a result, peak production levels in the 2HCY25 are anticipated to be lower, which will likely support a high average CPO price trading during that period despite the peak seasonality.

Ending stockpiles dropped substantially to 1.71m tonne (-25.4%yoy), in tandem with lower production and flattish exports numbers recorded at 1.3m Mt (+0.5%yoy).

There was a notable increase in PPO (+22.7%yoy) and PPKO (+58.2%yoy) exports, however, CPO sales volume weaken to only 167,331 Mt (-29.7%mom, -58.9%yoy, +0.9%ytd), following smaller CPO output and price effect where the average CPO price expensively higher at RM5119.5/Mt.

Note that, Nov and Dec’s spread discount between the PO and SBO price were approximately around -USD23/Mt and -USD126/Mt.

The local CPO price delivery ended the month at RM5,001/Mt, and averagely higher to RM5,120/Mt (+2.2%mom) as supply risks kicked in.

Jumping into Jan 2025, with the expected slower recovery in the local output amidst low stock level on top of delayed B4O rate in Indonesia, we anticipate the average CPO price to stabilised RM4,815/Mt (-6.0%mom).

It is crucial to note the slower PO production growth in Malaysia and Indonesia and the potential PO export ban to La Niña event and biological tree rest, could pose risks to PO supply availability in 1Q-2QCY25, we opine this could create a favourable trajectory for CPO prices, potentially driving them from RM4,500/Mt to nearly RM5,000/Mt in the 2QCY25.

We maintain a POSITIVE outlook on the sector, but we foresee only a handful of players likely to benefit from elevated CPO prices.

Unlike in 2022, current local CPO production (as of 3QCY24 results) had underperformed, with many small planters such as TSH, Ta Ann, and Sarawak Plantation unable to fully capitalise on higher CPO prices due to a contraction in CPO production and sales volume.

This was mainly due to reduced external FFB purchases from smallholders, who have struggled due to factors such as lack of fertiliser application, inadequate upkeep and difficulty in evacuating FFB during wet weather, compounded by a lack of machinery.

Hence, we recommend avoiding smaller players with significant exposure to external FFB purchases, as the aforementioned factors could risk their CPO production, particularly during the current biological tree rest environment.

Instead, we suggest focusing on larger players like IOI Corp (BUY, TP: RM4.42), SD Guthrie (BUY, TP: RM5.43), and GENP (BUY, TP: RM6.10), whose CPO procurement (>50%) from their own estates offers more stability in realizing CPO prices. —Jan 13, 2025

Main image: MPOC