THE local CPO price delivery ended the month at RM3,855/Mt with an average price of RM3,881/Mt on higher ending stocks as concerns over limited supply risks dissipated.

“Moving ahead, we anticipate that the crude palim oil (CPO) prices will remain stablised, hovering within the range of RM3,900–4,200/Mt,” said MIDF Research (MIDF) in the recent Monthly Sector Report.

This is typically in line with seasonal production trends, as the pollination period ends in March and PO output is expected to recover, potentially leading to an increase in closing stock levels.

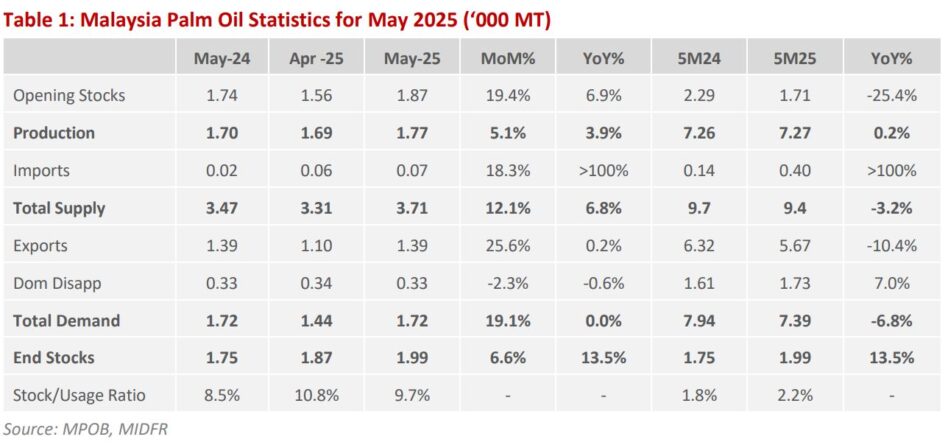

CPO output in May-25 grew to 1.77 mil tonne or +3.9% year-on-year (yoy) versus prior year, supported by robust growth from the eastern estates, particularly in Sarawak (+6.4% yoy) and Sabah (+13.0% yoy).

The fresh fruit bunch (FFB) received by mills inches to 9.05 mil tonne (+1.3% yoy) well supported by a decent average yield of 1.48 tonne /ha, inline with the onset of the seasonally fruitful months.

Additionally, the average oil extraction rate (OER) in the mills improved to 19.89%, driven by betterset of crops across most estates.

Favourable weather conditions have allowed quicker FFB evacuation activity, bringing the fruitlets with higher oil content.

Looking ahead, with the end of the inter-monsoon and pollination periods, drier weather and a faster recovery in FFB evacuation activities expected from May onwards, this allows estate productivity to gain momentum, particularly in terms of harvesting and manuring activities.

Note that, local CPO production is projected to reach 19.5 mil Mt in 2025 (+1.0% yoy), with the bulk of the recovery anticipated to materialise in the second half of 2025 (2H25), driven by improved set of crops and estate efficiencies.

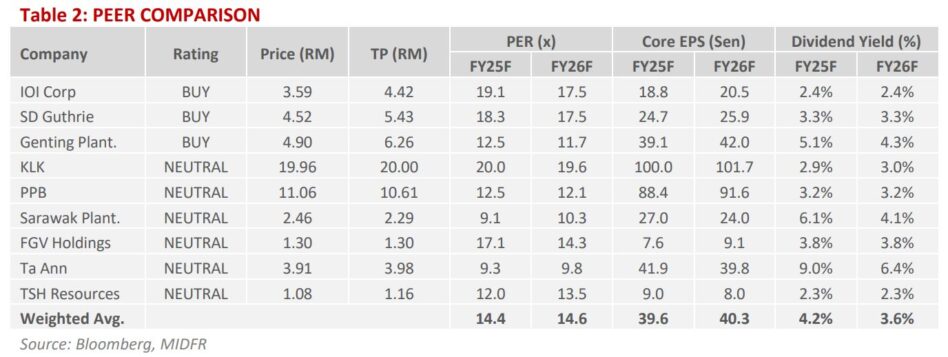

“We opine sector’s top-line to continue uptick in 1HCY25 in-line with higher average CPO price assumptions,” said MIDF.

However, margins are likely to remain under pressure due to the persistent elevated cost of production, caused by higher locked in fertiliser costs of 2HCY24, coupled with elevated external FFB purchase expenses amid low mills utilisation rates.

“We are maintaining neutral call at this juncture, while CPO prices are expected to remain under pressure, production is likely to perform, leading to a ceteris paribus performance for CY25,” said MIDF.

Therefore, MIDF foresees only a handful of players likely to benefit from elevated CPO prices.

Hence, they recommend avoiding smaller players with significant exposure to external FFB purchases, as the aforementioned factors could risk their CPO production, particularly during the current biological tree rest environment. —June 11, 2025

Main image: Musim MAS