CHANNEL checks with builders indicate that there is no slowdown in ongoing data centre projects.

“In fact, GAMUDA and SUNCON have shared that they are in the final stages of securing new data centre contracts,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

GAMUDA mentioned that there is no downsizing or changes to its Springhill Industrial Park data centre development, believed to be built solely for a hyperscaler.

Several other data centre awards are also in the pipeline. SUNCON is likely to exceed its initial new job replenishment target of RM4bil-RM5bil this year, potentially reaching RM6bil-RM7bil, driven by strong demand for data centre jobs.

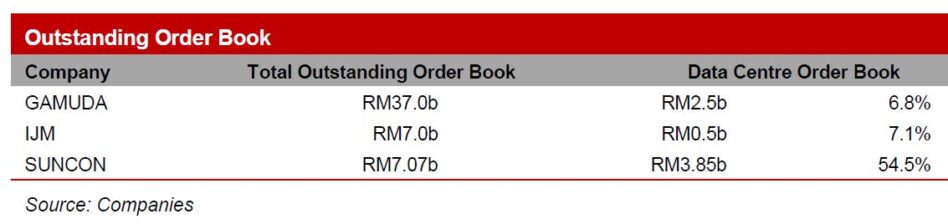

Apart from SUNCON, data centre projects account for only 7% each of GAMUDA and IJM’s portfolios. Currently, data centres jobs make up 55% of SUNCON’s outstanding order book.

Over the past two years, GAMUDA has secured major infrastructure projects, including Penang LRT, MRT projects in Taiwan and Singapore, water projects in Sabah and Australia, and, of course, data centres in Malaysia.

Any delay or cancellation of data centre projects would have an insignificant impact on GAMUDA. Meanwhile, IJM, despite having just 7% exposure to data centre jobs, was hit badly, and its share price has been slower to recover compared to GAMUDA and SUNCON.

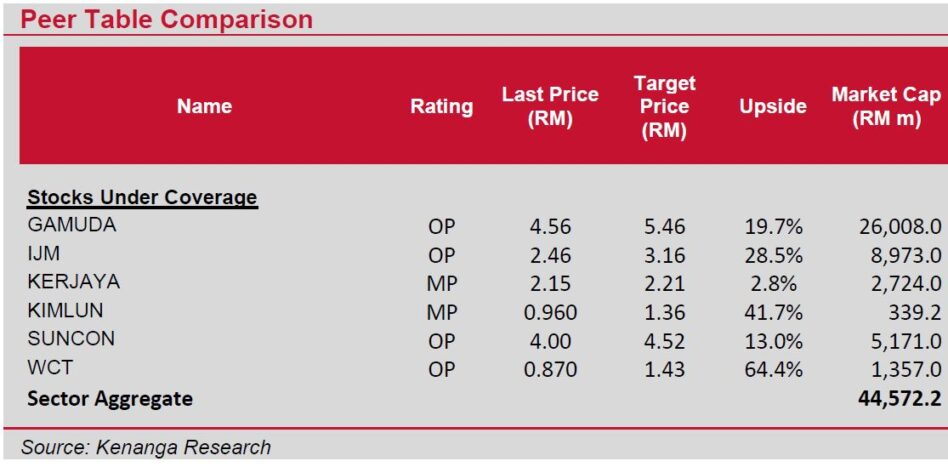

Following the recent sell-off, GAMUDA’s earnings multiplier has contracted by three multipliers to 17x, SUNCON’s fell six multipliers to 18x and IJM’s declined five multipliers to 15x.

Considering these valuations alongside recent share price volatility, we conclude that valuation for big cap builders appear reasonable given their strong job pipelines.

However, SUNCON is more sensitive to data centre developments due to its higher exposure to such projects in its outstanding order book.

“We maintain our assumption for new data centre contract wins over the next two financial years for GAMUDA, SUNCON and IJM at RM3bil, RM2bil and RM1bil, respectively,” said Kenanga.

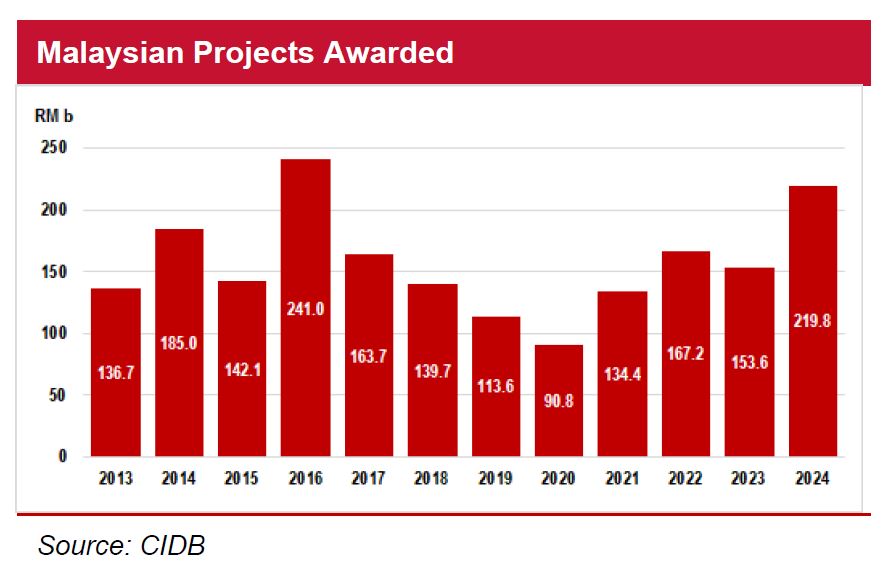

So far, actual 2024 contract awards have reached RM219.8bil, according to Construction Industry Development Board (CIDB), and Kenanga maintains their RM180bil target for 2025 and 2026.

Despite recent headwinds, Kenanga remains bullish on the construction sector as we believe demand for data centers is expected to persist, driven by ongoing capex spending from major tech firms.

GAMUDA remains our TOP PICK for the sector due to its diversified order book.

“We upgrade SUNCON to outperform from market perform as the recent sell-down presents a more attractive risk-reward profile,” said Kenanga.

However, SUNCON remains more vulnerable to data centre development given its heavier reliance on such projects. —Feb 10, 2025

Main image: MIDA