THE overhang on the data centre (DC) theme in Malaysia has eased for now, after the US scrapped its AI diffusion rules that were proposed during the waning of the Biden Administration.

“We expect a revival of investor interest in the DC theme keeping hotspots in Johor and Cyberjaya on the boil,” said RHB in a recent report.

For instance, Johor’s planned DC capacity of 822MW may entail around MYR16 bil worth of potential job opportunities for contractors.

The policy shift will ease investors’ concern over the potential delay in or cancellation of the major DC projects signed with the landowners, developers, and contractors in Malaysia.

Ongoing negotiations with DC players for upcoming deals will be smoother, although landowners will be more vigilant on potential regulatory risks.

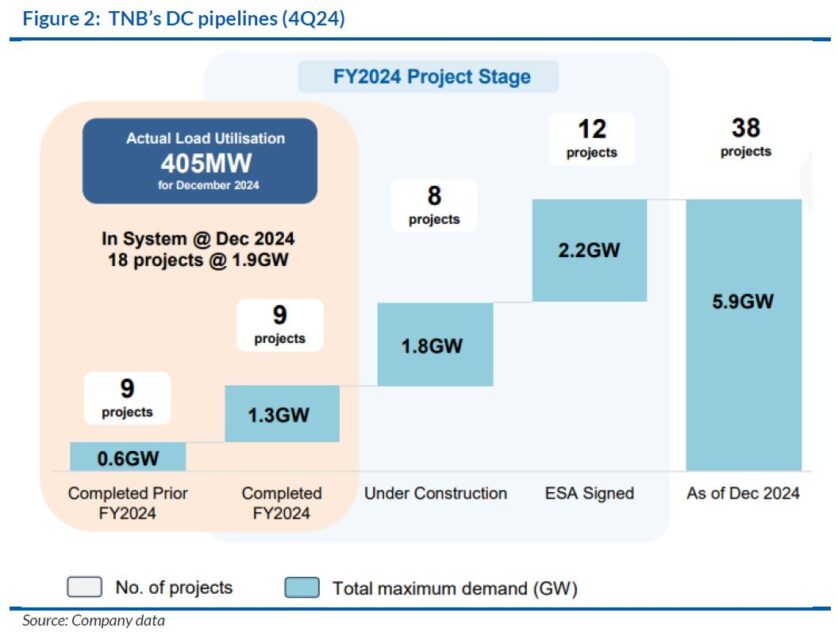

The burgeoning DC pipeline will support long-term demand for electricity and water infrastructure.

Total capacity related to electricity supply agreement signed projects expanded to 5.9GW in quarter four of 2024 from 4.7GW in quarter three of 2024, anchoring demand for higher renewable energy (RE) targets.

“We believe the DC story still has legs, with consistent positive investment news flow seen through the past months despite the US AI diffusion overhang,” said RHB.

The favourable environment in Malaysia for DCs remains, pending further details on the bilateral negotiation process.

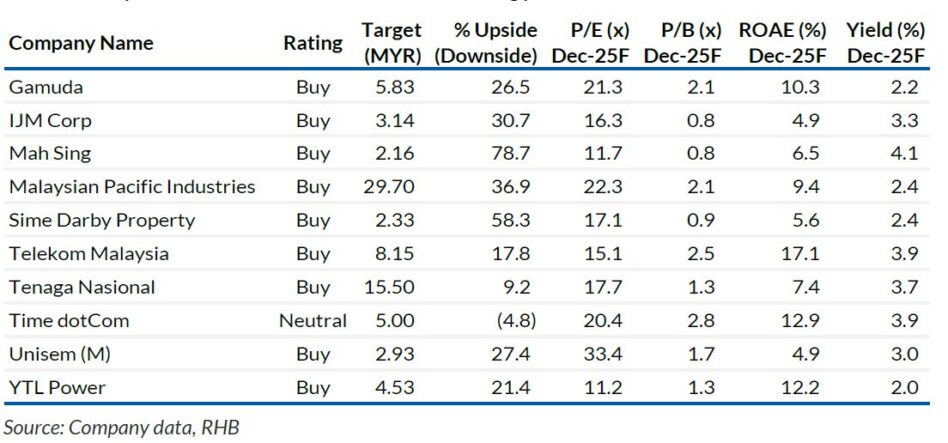

Top DC plays include Tenaga Nasional, Gamuda, YTL Power, Sime Darby Property and Sunway Construction.

“While the trade war de-escalation has reduced market risk premiums, we cannot rule out more Trump-induced volatility further out. We continue to lean into a defensive stance, sell-into-strength and buy-on-weakness investment strategy,” said RHB.

RHB remains overweight in the construction sector. The move by Donald Trump’s administration to rescind the curbs on chips exports is an overall positive for builders involved in the DC space.

It enables US tech giants to expand more freely out of the US, as opposed to being confined to the 7% restriction of AI computing capacity to any country outside Tier 1 countries, such as Malaysia.

RHB flags a risk whereby one of the elements of the move to repeal the diffusion rule will be to impose chip controls on countries that have diverted chips to China, including Malaysia and Thailand.

Nonetheless, President Trump’s new approach may require negotiations on a country-to-country basis, and his preference is for a deal eventually. —May 19, 2025

Main image: StarProperty