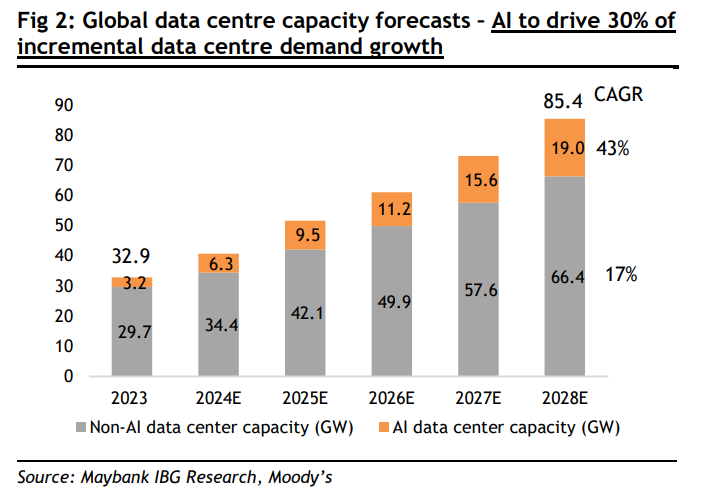

MAYBANK Research (MBB) expects data centre demand in ASEAN to increase at 20% compounded annual growth rate and a potential data centre total addressable market of USD11bil per year till 2028.

Their high expectations is underscored by:

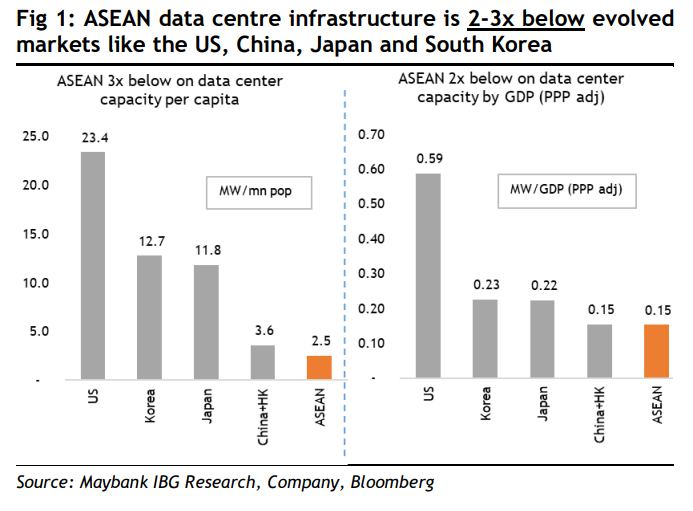

1) ASEAN is 55-70% underpenetrated in data centre supply vs more evolved markets like the US, China, South Korea and Japan.

2) Rise of AI adding another leg of data centre demand growth, which also helps ASEAN companies in the global supply chain.

3) Geopolitics, conducive upstream supply and favourable unit economics as tailwinds for ASEAN to emerge as a global data-centre hub.

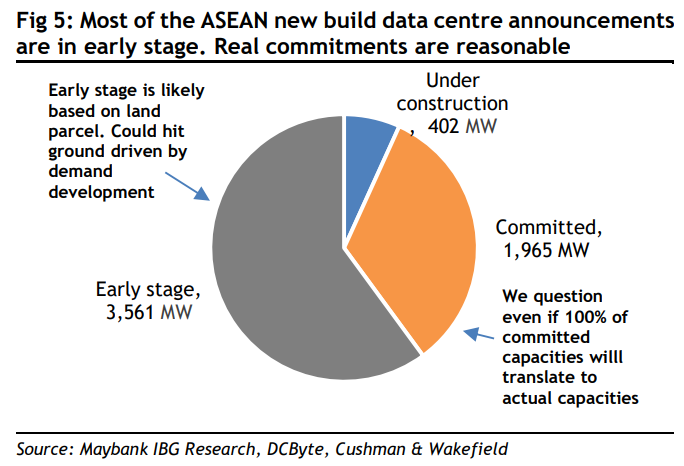

Risk of overbuild/supply is overhyped as actual capital commitment is just 40% of the theoretical new capacity announcements.

“Drawing insights from our analysts across sectors, economics and ESG teams, we highlight key opportunities and stock picks across the entire data centre value chain,” said MBB.

Beyond data centre demand for its own need, MBB sees potential for ASEAN to emerge as a hub for meeting broader Asian/global data centre needs.

ASEAN is emerging as a favourable destination for data centres and subsea cable builds owing to its neutral geopolitical stance and US-China trade tensions.

While power/water remains a major concern globally, ASEAN is placed favourably with higher power-reserve margins and water-stress levels in line with the global average.

Renewable-energy-addition targets are 10 times of incremental demand for green data centres.

On capital expenditure/operating expenditure economics, ASEAN (excluding Singapore) is 20% below the global average on the cost to build and 20-30% lower in terms of power cost.

Despite high vacancy rates in some smaller markets, overall ASEAN colocation vacancies stand at 10%, a rate considered healthy and consistent with global norms.

New capacity addition announcements of ~6GW, reflects 3.5x supply increase. Such builds mainly reflect theoretical capacities based on land availability, not actual capital commitments.

“Under-construction supplies are just 24% of the live supply while committed is 116%. These suggest a 2.4 gigawatt (GW) or 1.4x supply increase, although we doubt that even 100% of the committed supply goes live,” said MBB.

The rest of the announcements are in early stages and MBB thinks they will hit the ground based on demand development.

Granular analysis shows that average data centre capacities in large markets like Kuala Lumpur and Jakarta are modest at just 9 megawatt (MW) per facility vs large announcements in 100MW to GWs. – Sept 24, 2024

Main image: media.datacenterdynamics.com