ON JUNE 30 2022, the Communications and Multimedia Minister reportedly announced that six telcos, including Axiata Group (Celcom), Digi, Maxis and U-MOBILE (collectively known as CDMU), have agreed to take up stakes in Digital Nasional Bhd (DNB).

The minister also assured the public that everything is going according to plan and that the equity uptake deal by the major telcos will be finalised and signed in another week’s time.

However, according to industry sources, what the telcos signed is just the Access Request Application Form (ARAF), which is merely permission to continue technical testing.

Furthermore, this non-binding agreement is only the first, small step in the standard overall transaction process, which is more rigorous, and, most importantly, includes the due diligence procedure that must be completed before public-listed companies such as Celcom, Digi and Maxis can sign a shareholders’ agreement for a stake in DNB.

On top of that, the outcomes of such a due diligence exercise shall become public knowledge since the public’s money is involved, which is good as the public has been anxious to open DNB’s books for proper due diligence.

This June 30 statement implying that CDMU telcos have agreed to take up stakes in DNB is even more interesting when we remember that on May 9, 2022, these same telcos reportedly sent a letter to the Ministry of Finance.

In this letter, CDMU used powerful words, basically to seriously question the fundamentals and viability of the current DNB-proposed business model, and make it clear that controlling 51% joint stake for their group is the “most viable” means of reaching an agreement to be able to “exercise influence and control to safeguard [their] investments”.

They also clearly expressed concern over the proposed Reference Access Offer as being “not commercially viable” and likely leading to higher customer costs and slower adoption rates.

“Points of contention”

Has DNB addressed these points of contention to claim that CDMU agreed or will agree to the DNB terms? Or is this only a desperate “narrative management” attempt to convince the public and the banks that everything is going as planned and there is cash flow in sight for DNB?

A reminder: to finance its “cost-recovery” model, DNB is planning to issue sukuk (Islamic bonds).

The sukuk will be raised as it would be given a high rating not because of its business model but because of the guarantee by the Government. After all, Malaysia still has oil and gas (people’s resources).

Therefore, should the DNB’s cash flows falter, covering the DNB’s debt will quickly become taxpayers’ responsibility.

However, how does all of this go with the recent statement by the finance minister on July 19 that Malaysia can’t take on any more debt?

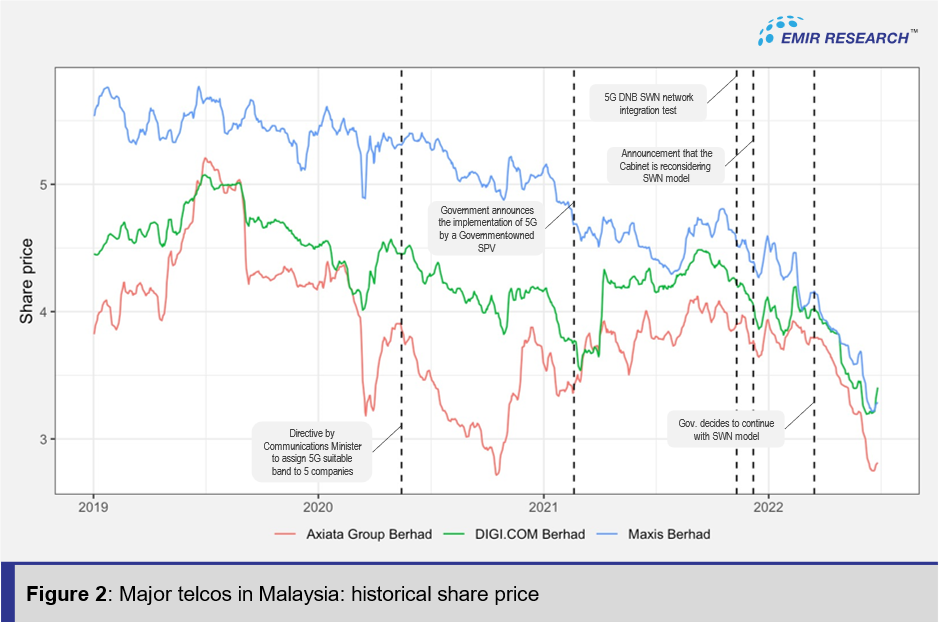

Meanwhile, the telecommunication industry in Malaysia appears to have caught a high fever as the Government’s seriousness in proceeding with the problematic Single Wholesale Network (SWN) becomes clear (Figure 2).

Previously, blue-chip stocks of Axiata, Digi and Maxis are now in permanent decline and all three are paying their earnings in full as dividends lately.

The corporates know that companies would do this only under circumstances where they see no prospects for industry growth and investment opportunities.

All of this is not because of “uncertainty” associated with the 5G rollout, but rather the certainty of the 5G rollout using the problematic SWN model for 5G rollout that is also unpopular in the whole world.

This model has already rolled us back a few years in terms of our Industrial Revolution 4.0 (IR4.0) industry development.

It continues to destroy our telecommunications industry, which is at the core of the digital economy, compromises our credibility in the eyes of global investors and places taxpayers’ money at risk. – July 23, 2022

Dr Rais Hussin is the President and CEO at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.