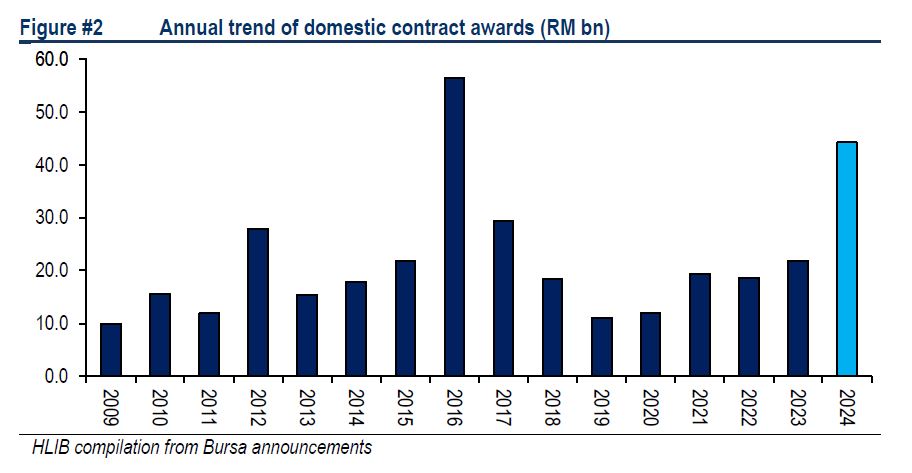

VALUE of domestic projects awarded in 2024 reached RM44.2 bil or +103% YoY the highest tally since 2016 and second highest since 2009.

For context, 2016 numbers were achieved driven by MRT2 underground, SPE and PBH Sarawak.

“The 2024 figure was within our base case expectation of >RM40 bil, but falling short of our blue sky case of >RM50 bil,” said Hong Leong Investment Bank in a recent report.

In our view, the only disappointment was absence of Penang LRT Segment 1 package which was the key for not breaching the RM50 bil mark.

Despite MOT announcing Gamuda as the single source RFP contractor in March-24, the contract has not been formalised to date underscoring delays that come with public infra projects.

Apart from strong DCs contribution in 2024 (RM7.5 bil), also driving the strong number was the bullish

property developer sentiment resulting in high residential/commercial development contracts with the Johor market in particular experiencing a noticeable resurgence.

On the infra side, there was also better job flows seen from roads, water, public housing and hospitals, but these were largely overshadowed by private sector contribution.

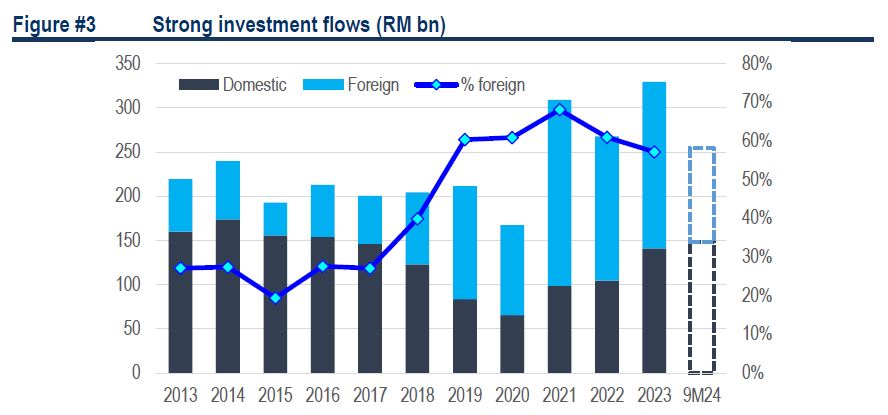

Based on pipeline reports, including PETRA’s own forecast of 7.7GW DC electricity consumption by 2030 (20.9GW by 2040), we stay positive on DC orderbook growth potential.

Further to this, Knight Frank estimates a 1.3GW of future supply. The recent finalisation of sustainable DC guidelines should help reaccelerate developments.

We see potential for sizable DC developments to venture into new areas beyond traditional hotspots like Johor and KV in 2025.

DCs aside, we also remain positive on continuing ex. DC private sector momentum in Johor (spurred by SEZ, RTS and potential LRT/ART) and Penang (NSS, healthcare, LRT) which should also continue to support rollout of residential/commercial developments as well as industrial developments.

While there is sustained focus on smaller scale infra (roads & water), for bigger ticket infra, we hope to see Penang LRT (~RM10bn) finalised and awarded this year, Penang airport expansion awards,

progress on Penang-Perak water project (RM5 bil), while Johor should benefit from tangible developments on its LRT/ART proposal.

Our view on the MRT3 and KL-SG HSR projects are unchanged – award ready stage for civil packages likely beyond 2025 if green lighted.

Development focus in Sabah & Sarawak continues to be healthy with various infra projects but have very selective impact on construction equities – e.g. for PBH Sabah 1B (RM15.7 bil) only three of 19 packages benefitted listed-cos.

PFI projects worth RM9bn announced in Budget-25 should translate to opportunities for well capitalised contractors, however we reckon not all will start construction in 2025.

Some notable projects in the PFI category include NPE 2.0 (RM1.5 bil), West Ipoh Span Expressway (RM6.2bn, turnkey contractor appointed), West Coast Expressway Southern Alignment, Juru-Sungai Dua Elevated Expressway (RM2.7 bil) and Sultan Aminah Hospital 2.

We retain our OVERWEIGHT sector call anticipating another year of sustained job flows anchored by DCs, infra rollout and buoyant private sector sentiments.

In our view, DC and Johor reinvigoration themes still has room to play out as more tangible developments come to the fore.

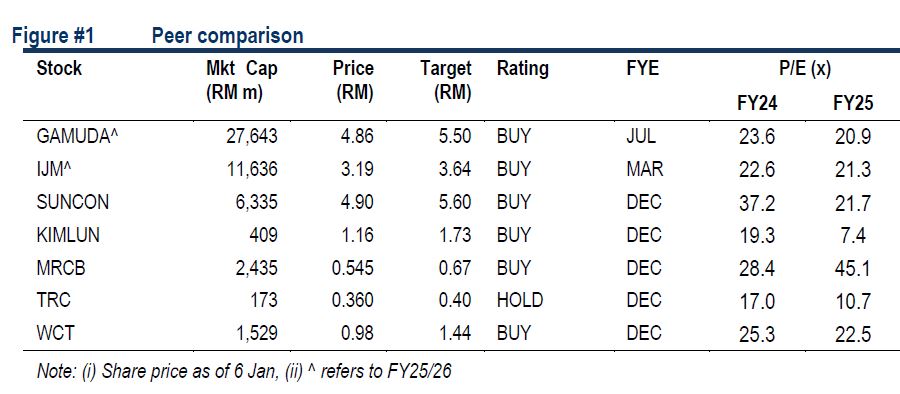

Valuations at current levels still provide room for upside. Our top picks are Gamuda (BUY; TP: RM5.50) and SunCon (BUY; TP: RM5.60).

Both have strong leverage onto the DC theme backed by earnings upcycle. Additionally we see short term trading opportunities for IJM (BUY; TP: RM3.64).

Key sector downside risks worth highlighting: (i) potential quotas on AI hardware (ii) higher-than-expected EPF contribution for foreign workers and (iii) punitive trade tariffs. —Jan 7, 2025

Main image: autodesk.com