ALTHOUGH energy-related products are given exemptions from the sweeping “reciprocal” tariffs imposed by the US, the policies could spark inflation, slow economic growth, dampen consumer spending and industrial activities.

“As such, this should hurt oil demand should the new tariff regime come in full force,” said Hong Leong Investment Bank (HLIB) in the recent Sector Update Report.

Meanwhile, OPEC+ has surprisingly decided to accelerate its planned oil production hikes, bringing forward three months’ worth of previously scheduled increases.

Due to deteriorating fundamentals, Brent oil price plummeted to USD63 per barrel, at the time of writing.

“We see the domestic centric operational contractors as a bright spot in the O&G sector as they are largely insulated from the rising global trade tensions,” said HLIB.

HLIB likes the maintenance service providers as they are the least prone to spending cuts due to Petronas’s emphasis in maintaining its hydrocarbon production.

Despite lower offshore support vessel (OSV) requirements for drilling activity in 2025, HLIB views that OSV players will remain resilient this year as buoyant operational activities will continue to keep offshore vessels busy amidst the persistent fleet capacity constraint.

“In our view, companies with exposure in upstream exploration and production could see earnings contraction in the coming months due to lower average realised oil prices,” said HLIB.

As the street starts revisiting their oil price forecasts to align with the macro developments, HLIB expects consensus forecasts of oil and gas names that have substantial exposure in upstream assets to be reduced due to their high earnings sensitivity to Brent oil prices.

Separately, the oil price dip may potentially result in exploration cutbacks, and in turn lower the demand for JU rigs from the likes of Velesto.

Due to the drop in oil price and policy uncertainties, we reckon oil majors may delay their capex spending to reassess the supply chain impact and project economics brought by the US tariffs tantrum.

Therefore, the temporary pullback on development projects may, in our view, slowdown new floating production storage and offloading (FPSO) project awards from oil majors.

Nevertheless, revenue streams for FPSO players like Yinson and Armada should remain resilient due to its existing long-term contracts.

The delay in energy project rollout, if any, could also spell slower orderbook replenishment for engineering and fabrication contractors such as Wasco.

The Malaysian petrochemical industry is insulated from the US tariffs as petrochemical exports are mainly directed to the Asian region.

“However, we reckon the declining oil price will increase the downside risk of petrochemical prices due to easing feedstock costs like naphtha,” said HLIB.

Additionally, the global petrochemical glut may worsen amid a slowing global economy triggered by the ongoing trade war, as petrochemical demand growth is closely linked to overall economic activity.

While polyolefin prices have remained steady so far, HLIB sees the risk skewed to the downside.

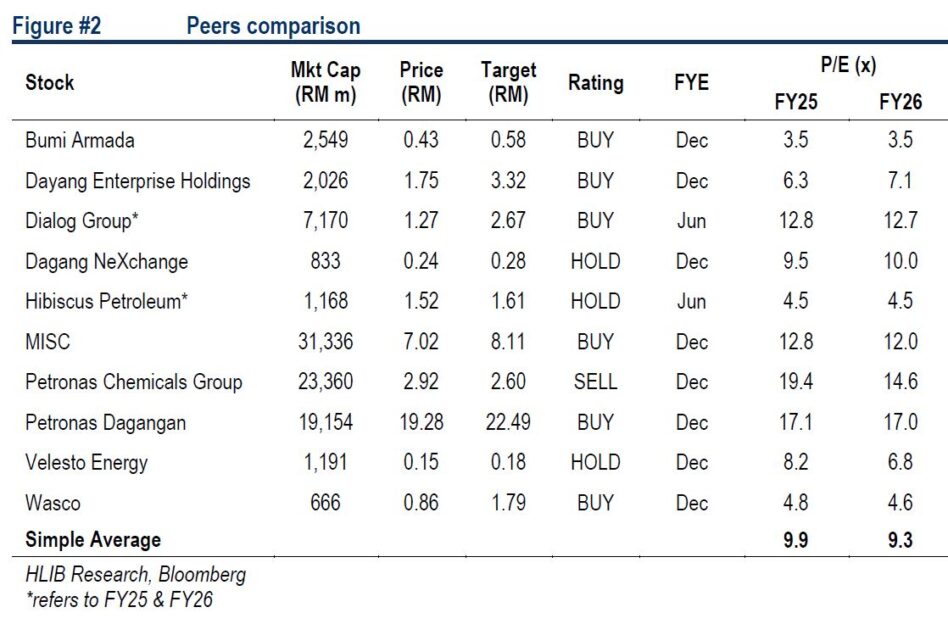

HLIB maintains NEUTRAL rating on the oil and gas sector as they stay prudent and selective on names with low earnings sensitivity to oil prices as well as oil majors’ upstream capital expenditure programs. —Apr 11, 2025

Main image: iea