A BOWL of prawn noodles which used to cost less than RM1 in the 1970’s is now priced as much as RM10.

In a span of 50 years, that would work out to be a relative increase of 900%. This is what we term the effects of inflation. Simply put, inflation is the price increase in the cost of goods and services over time.

Inflation reduces the real value of money. A reduced purchasing power will mean that “X” amount of money now will not be able to buy the same amount of goods in the future. Putting this in perspective – in a 4% inflationary environment – what used to cost RM100 is going to cost RM148 in 10 years’ time.

What are the main causes?

There are a few causes and types of inflation. Here, let’s examine cost-push and demand-pull factors.

Cost-push inflation happens when businesses pass on costs to their customers to protect their margins. They may have raised the price of certain goods due to an increase in prices of a crucial component in producing the goods, eg rise in labour cost, petrol, gas or sugar.

Demand-pull inflation occurs when the demand of goods increase to the extent that the existing supply is unable to catch up. When demand outweighs supply, prices increase. It is usually taken as a sign of a growing economy as consumers have more disposable income or experience an increased consumer sentiment.

How is inflation measured?

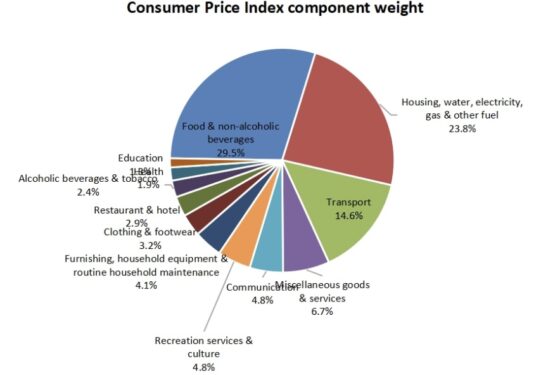

The Consumer Price Index (CPI) is one of the broader measures to track inflation, measuring the average changes in price of a basket of goods and services.

he CPI is made up of 12 broad items which are assigned their corresponding weights. A theoretical 10% increase in fuel price will have a +1.46% effect on the CPI. This is based on the Transport component’s weight in the CPI which is 14.6%

Inflation are expressed in terms of percentages. Hence, if CPI is up 4% year-on-year, this would mean that prices are generally 4% higher compared to the previous year.

Since inflation reduces purchasing power, wouldn’t it be better for us to have zero or negative inflation?

The opposite of inflation is deflation – categorised by a situation whereby prices of goods and services are decreasing. Sounds like a good thing, no? Well, here’s a short example:

In a deflationary environment, consumers will end up holding back on purchases. They believe prices will be even lower in the future, hence there is no incentive to buy now. This creates a downward spiral in the economy.

Due to lack of demand and poor consumer sentiment, businesses end up making losses. They are not willing to stock up on goods as no one is buying. Factories cut excess production capacity.

Eventually workers will get laid off. This will eventually affect the banks as individuals and businesses default on their loans. In short, economic activity is effectively brought to a halt.

So as you can see, deflation is an even worse enemy than inflation. It is better to have a gradual and stable increase in the rate of inflation over time.

Understanding inflationary effects

Recall that inflation reduces your purchasing power which means it gradually increases your cost of living. Secondly, money left un-invested eventually loses its value. For every RM100,000 left un-invested with inflation running at 4%, the money will lose a value of RM4,000 every year. The effects become even more pronounced over time.

In order to at least keep up with inflation, we must invest!

Investing in equities can be a good hedge against inflation. Over the long run, you can expect companies’ earnings to increase at least in tandem or higher than the inflation rate. Investment in real estate/properties is another example.

A lack of understanding of the need for returns net of inflation can lead to a faster-than-expected rate of capital attrition. For the average investor, it is important to achieve positive returns above inflation rate.

We think that the inflation risk is a silent killer; one that you must not under-estimate. It starts off as a thief in your wallet before eventually growing into a ravenous beast that eats away at your wealth if left unchecked. – Jan 15, 2023

Danny Wong Teck Meng, CFP is the CEO of Areca Capital Sdn Bhd and a certified member of the Financial Planning Association of Malaysia (FPAM).

Disclaimer: The article is produced based on material and information compiled from reliable sources at the time of writing. The article is not an offer, recommendation or advice to transact in any investment products, including the stocks or funds mentioned within. Investors are advised to consult professional investment advisers before making any investment decision.