PETRONAS’s second half of 2024 (2H24) results were uninspiring. Maybank Investment Bank (MIB) is selectively positive on the oil and gas sector, favouring the defensive midstream and floating production storage and offloading (FPSO) space.

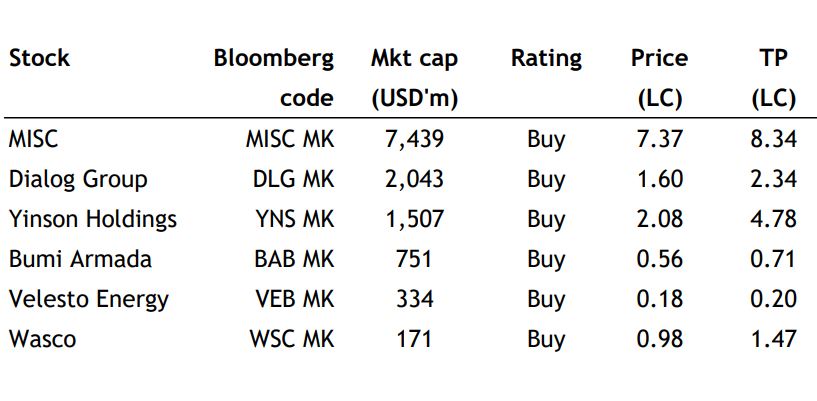

“Top picks are Dialog and BArmada. Our in-house Brent crude oil price assumption is unchanged at USD70 per barrel for 2025 estimate,” said MIB in a recent report.

Globally, the focus will be on whether OPEC+ will begin phasing out production cuts of 2.2 mil barrels per day from April 2025.

PETRONAS recorded a sequentially lower 2H24 core net profit of MYR24.5 bil, bringing cumulative financial year 2024 (FY24) core earnings to MYR54.9 bil.

The weaker year-on-year (YoY) showing was mainly due to higher tax rates, lower Brent average of USD76 per barrel in 2H24 and weaker USD/MYR rate of 4.4 versus 4.6 in 2H23.

Also, MIB notes a drag across segments in 2H24:

i) upstream segment due to lower realised prices & lower crude oil sales volume.

ii) gas segment due to lower product margins.

iii) downstream segment turned into losses of MYR1.6bil due to lower realised prices, higher tax and lower refining and petrochemical margins.

2024 total capital expenditure stood at MYR54.2bil, with 13% allocated to cleaner energy solutions & decarbonisation projects.

Domestic capital expenditure was up to MYR33.1bil in 2024, which was reflected in the performance of the local OGSE corporate earnings throughout the year.

On a separate note, from the Budget 2025, PETRONAS has committed a total of MYR32bil to the Malaysian government for 2025 estimate.

MIB identified a few key main subsegments which are expected to see and increase in activity from the latest PAO 2025-2027 document, notably:

i) fabrication of fixed structures like wellhead platform and central processing platform.

ii) FPSO.

iii) Number of onshore downstream plant turnarounds.

iv) Hook-up and commissioning and maintenance, construction and modification. Possible key beneficiaries include: BArmada, Yinson, MISC, Dialog, MMHE, Steel Hawk, Dayang Enterprise and Petra Energy. —Feb 26, 2025

Main image: ep2c-energy