ON 10 Dec 2024, PM Anwar announced that the government plans to amend the Private Healthcare Facilities & Services Act 1998 (Act 586) in 2025, with the aim of regulating private hospital charges amid rising medical inflation and escalating health insurance premium and takaful contributions.

As part of this initiative, the PM proposed the introduction of a Diagnostic-Related Group (DRG) payment system to replace the current fee-for-service model.

“To gain a deeper understanding of the DRG payment framework, we engaged Professor Dato’ Dr Syed Aljunid in Mar-25 to share his expert insights on the system,” said Hong Leong Investment Bank (HLIB).

Building on his perspective and HLIB’s internal research, they presented the following summary of the DRG payment system, its recent developments, and our evaluative outlook.

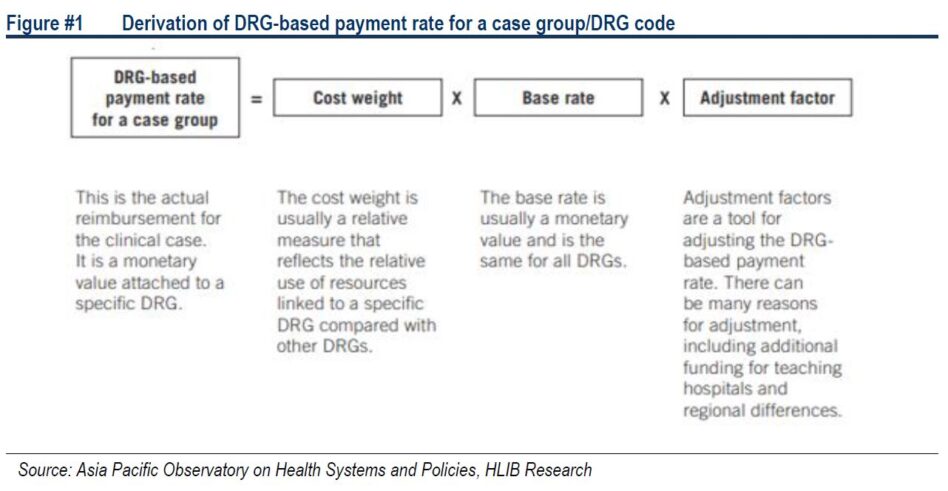

The DRG payment system is a financing or reimbursement model that uses a classification framework – DRG system – as its foundation for determining payment amounts to hospitals.

Under this system, hospitals receive a predetermined amount per episode of care, based on the assigned DRG code, irrespective of the actual treatment costs incurred.

Accordingly, hospitals would need to manage their resources efficiently within the allocated budget to ensure optimal quality patient care outcomes.

“All in, Malaysia has already developed a DRG grouping logic that is tailored to our country’s healthcare needs,” said HLIB.

Latest development in DRG application in the private sector are as follows: On 11 Mar 2025, Deputy PM Dato’ Seri Dr Ahmad Zahid Hamidi announced Bank Negara Malaysia (BNM), in collaboration with MoH and Employees Provident Fund (EPF), will embark on the development of “basic health insurance and takaful products” anchored on the principles of value-based healthcare.

Subsequently, on 24 Mar 2025, Health Minister Datuk Seri Dr Dzulkefly elaborated that these products will be positioned as default options for Malaysians seeking access to private healthcare services.

While open to the general public, the initiative will primarily target private sector employees, with reimbursement structured around the DRG payment model.

Moreover, the proposed scheme will leverage on the extensive provider network, inclusive of mid-priced private hospitals, non-profit hospitals, and Rakan KKM facilities.

“That said, we expect participation by mid-priced private hospitals to be voluntary, as there are no indication of legislative amendments to Act 586,” said HLIB.

From a financing perspective, Malaysians will be able to utilise savings from their EPF Account 2 to purchase these basic plans via the existing i-Lindung platform.

However, the precise implementation timeline has yet to be announced. HLIB is positive on the government’s recent decision to implement the DRG payment system, specifically for the upcoming “basic health insurance and takaful products,” particularly when compared to the earlier proposal, announced in Dec-24, that is, to amend Act 586, replacing the current fee-for-service model with DRG based payments.

This targeted approach helps to improve accessibility for those priced out of existing insurance or takaful plans, while preserving the commercial viability of the private healthcare sector; those who can afford comprehensive coverage are likely to retain their existing plans to access premium benefits and branded hospital networks, rather than being limited to mid-priced or non-profit providers.

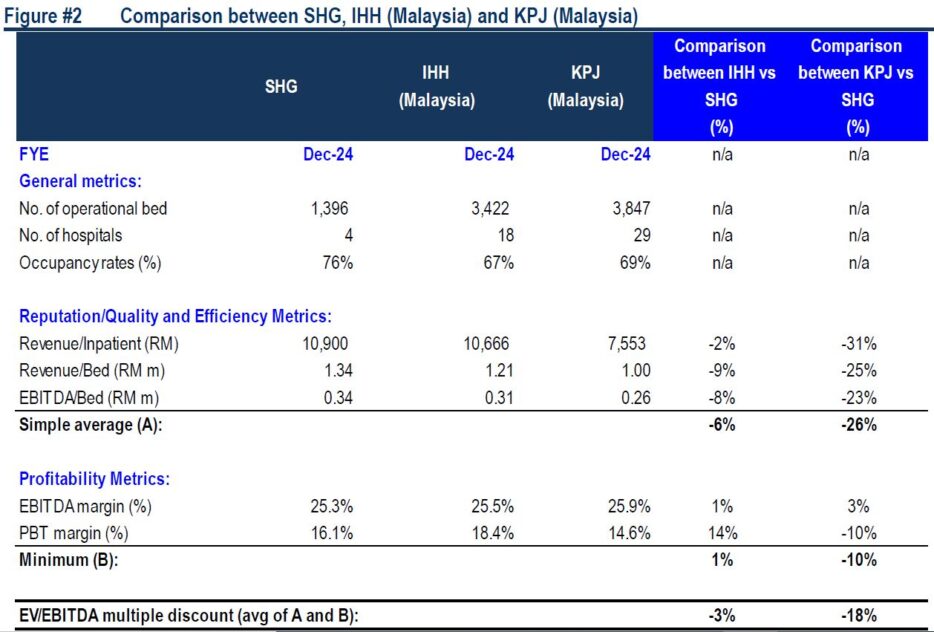

HLIB maintains an overweight stance on the Malaysian healthcare sector for 2025, with a clear preference for the hospital segment.

“We continue to like the sector for its resilient long-term structural growth drivers, positioning it as a compelling defensive play amid ongoing macroeconomic uncertainty,” said HLIB. —Apr 16, 2025

Main image: The Star