THE Ministry of Energy Transition and Water Transformation (PETRA) announced updates to the Net Energy Metering (NEM) 3.0 program yesterday.

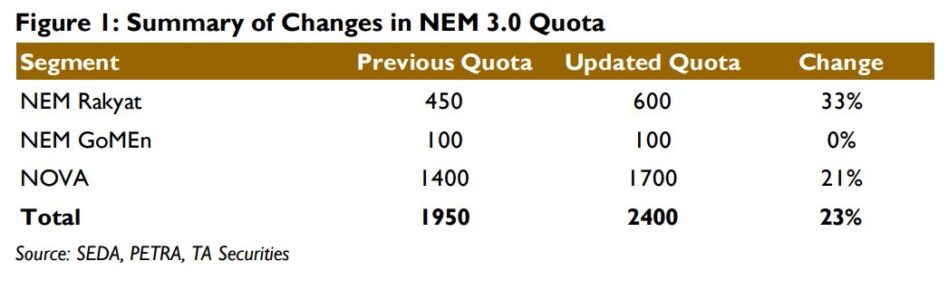

“Quota for NEM Rakyat has been increased by 150MW to 600MW, while quota for NEM NOVA (Net Offset Virtual Aggregation) has been increased by 300MW to 1700MW,” said TA Securities (TA) in the recent Sector Update Report.

For context, NEM Rakyat is offered specifically for the residential sector while NEM NOVA is mainly targeted at commercial and industrial consumers.

The announcement by PETRA comes after an extension of the NEM 3.0 program until 30th June 2025 announced under Budget 2025.

In addition, NEM 3.0 is now open to electricity consumers in the agriculture industry, while existing rooftop solar assets under earlier mechanisms are allowed to expand their solar system capacity and switch to the NEM program.

The latest quota update expands the NEM 3.0 quota by 23% to a total 2400MW, inclusive of the last quota addition of 350MW back in November 2024.

The latest quota update expands the NEM 3.0 quota by 23% to a total 2400MW, inclusive of the last quota addition of 350MW back in November 2024.

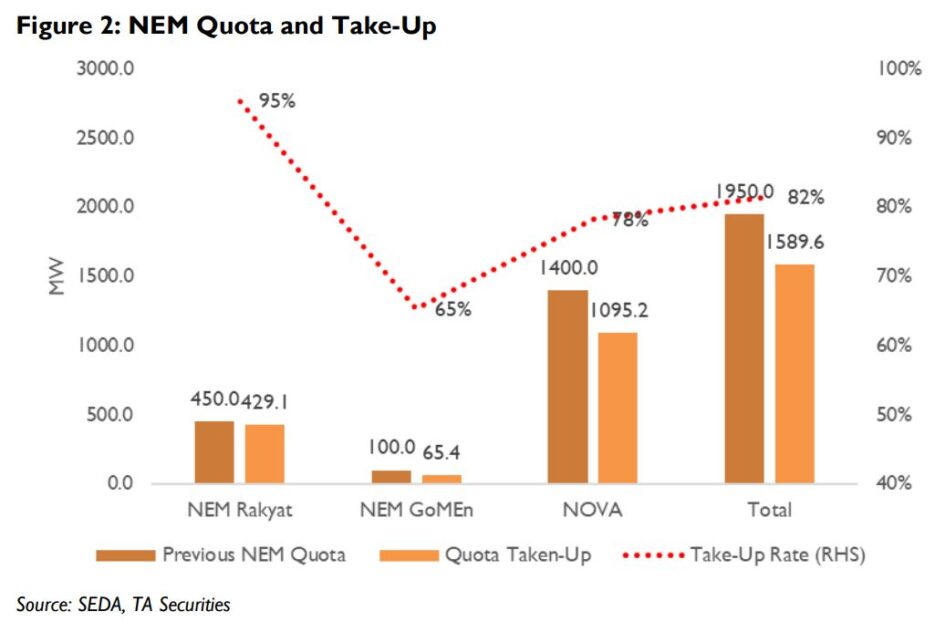

As at December 2024 and prior to the latest quota expansion, 82% of NEM 3.0 quota allocation has been taken up, with the highest for NEM Rakyat at 95%, followed by NEM NOVA at 78% and NEM GoMEn at 65%.

In addition to the quota expansion, PETRA also announced an extension of the Solar for Rakyat Incentive Scheme (SolaRIS) until 30th April 2025 (from the previous expiry on 31st December 2024).

As a recap, SolaRIS is an incentive program which offers a one-time cash rebate of up to RM4000 for NEM Rakyat customers who successfully commission their solar PV system installations, aimed at attracting new installations of solar PV systems in residential premises.

Originally introduced in April 2024, SolaRIS assists in reducing solar PV system installation cost, hence is expected to boost solar PV demand in the residential segment.

Originally introduced in April 2024, SolaRIS assists in reducing solar PV system installation cost, hence is expected to boost solar PV demand in the residential segment.

The latest development underpins our earlier Budget 2025 expectation of an expansion of NEM 3.0 quota and an extension of the SolaRIS program.

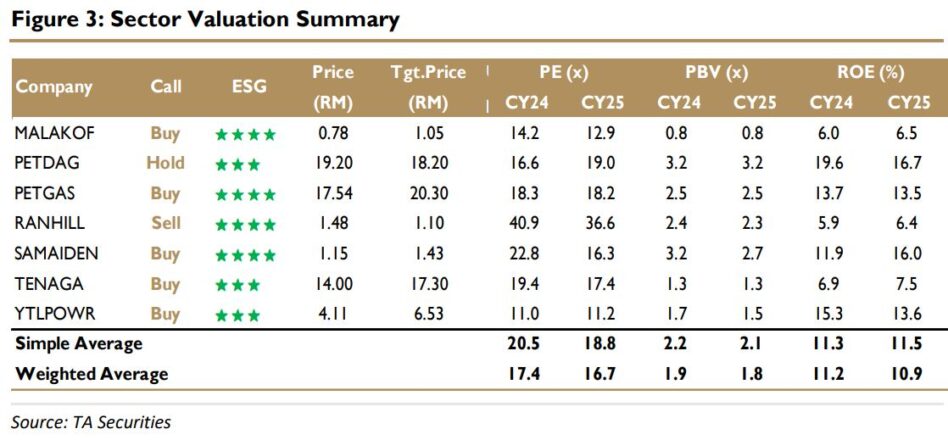

“We view this as a positive catalyst for the RE EPCC sub-sector given potentially increased demand for new rooftop solar installations coupled with the higher margins it carries relative to utility scale solar EPCC,” said TA.

Potential beneficiaries include SAMAIDEN, SLVEST, SUNVIEW and PEKAT.

In addition, TA believes Northern Solar Holding Berhad, which is scheduled for listing in February 2025, is also a key potential beneficiary given its focus on rooftop solar EPCC.

Broadly, RE EPCC players are expected to hit record high order books and revenues next year underpinned by rollout of the 800MW CGPP projects and a record 2000MW from the upcoming LSS5 projects, due for commissioning by the end of calendar year 2025 (CY25) and within CY26 respectively.

All in, TA maintains their Overweight rating on the Power & Utilities (P&U) sector premised on:

(i) Demand-supply tightness in the generation market.

(ii) Record-high RE rollout.

(iii) A potential step-up in grid capital expenditure to accommodate the energy transition.

(iv) Commencement of Malaysia’s RE export.

The P&U sector will continue to be driven by the energy transition backed by the National Energy Transition Roadmap’s aggressive 70% RE mix target by 2050, while the influx of data centre capacity is expected to drive strong demand growth, underpinning the requirement for new generation capacity.

Key risk to TA’s call is unfavourable changes to the regulatory and policy framework. —Dec 24, 2024

Main image: New Straits Times