MAIN Market-listed information technology (IT) software and platform provider ARB Bhd expects its Internet of Things (IoT) and enterprise resource planning (ERP) products to boost the group’s growth in the medium-term at least.

The group posted a commendable net earnings of RM92.93 mil for the 18-month of its maiden financial year ended June 30, 2022 on the back of a revenue of RM622.6 mil.

The strong earnings recorded during FY2022 was driven mainly by a stable revenue generated from both its ERP and IoT business segments.

There is no year-on-year comparison provided for ARB’s FY6/2022 given the change in its financial year from Dec 31 to June 30 in February this year to enable the group to better manage the allocation of its resources to facilitate the proposed listing of its IoT division on the Nasdaq stock exchange.

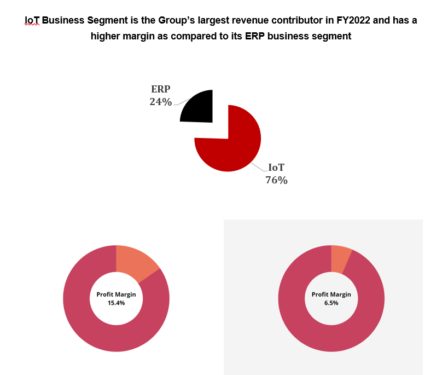

“The IoT business segment is now the biggest revenue contributor to the group at 75.5% with the balance coming from our ERP business segment,” revealed ARB’s executive director Datuk Seri Larry Liew Kok Leong.

In its FY6/2022, the IoT business segment is ARB’s largest revenue contributor with a higher margin as compared to its ERP business segment. Additionally, the segment also boasted a higher profit margin of 15.4% as opposed to 6.5% for the ERP business segment.

Moving forward, Liew said the group would maintain its vigilance despite the push for growth in both the IoT and ERP business segments.

“We have continued to maintain our positive cash flow to ensure the sustainability of our businesses,” he pointed out.

“This is reflected by the strong operational cash flow during the current financial year. In fact, net cash generated from our operating activities has breached the RM100 mil to RM126.8 mil during the 18 months of FY6/2022.”

The positive operational cash flow has helped to grow ARB’s cash and bank balances position to RM102.5 mil as of June 30, 2022 from RM24.5 mil at the beginning of FY6/2022. For context, the group’s cash and bank balances position consists of about 65% of the total market capitalisation of ARB.

“We are cautiously optimistic that ARB’s financial performance in FY6/2023 will remain strong, supported by the robust demand for the ERP and IoT business segments even as the COVID-19 pandemic has accelerated the shift towards digitalisation and automation,” envisages Liew.

“Moreover, the roll-out of 5G network in Malaysia will continue to boost the earnings momentum for both the ERP and IoT business.”

In line with the strong performance and robust outlook in the near-term, ARB has proceeded with its proposed listing of ARB IoT Group Ltd on the Nasdaq Stock Exchange in New York which is expected to raise a minimum of US$4 mil (RM17.9 mil) and up to a maximum of US$13 mil (RM58.18 mil) to accelerate growth and capture the new market.

At the close of yesterday’s (Aug 30) trading, ARB was down 0.5 sen or 3.85% to 12.5 sen with 718,800 shares traded, thus valuing the company at RM152 mil. – Aug 31, 2022