EARNINGS delivery of telco companies under Kenanga Research (Kenanga)’s coverage improved sequentially in quarter four of calendar year 2024 (4QCY24), with 50%, 33%, and 17% exceeding, meeting, and missing, their projections, compared with 40%, 40%, and 20% respectively, for the previous quarter.

In CY24, service revenue growth (+1.4%) for domestic MNOs was primarily driven by MAXIS.

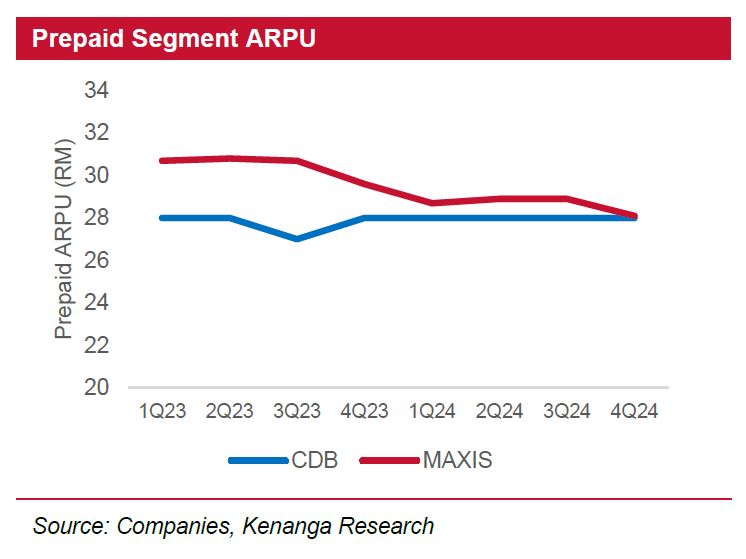

“This more than offset service revenue contraction at CDB, due to weakness at the prepaid segment,” said Kenanga in the recent Sector Update report.

Meanwhile, revenue for the fixed players expanded by 1% YoY, primarily attributed to TIMECOM, driven by its retail segment.

For the overall sector, Financial Year 2024 (FY24) core net profit expanded by 24%, driven by AXIATA, on the back of better earnings.

In the prepaid segment, CDB fared better in 4QFY24 with QoQ ARPU holding steady and churn finally reversing after four consecutive quarters of net attritions.

On the other hand, MAXIS struggled as subscriber attrition surged to 39k (CDB net adds: 23k) while ARPU continued its descent to its lowest level of RM28 since 3QFY23 (RM31).

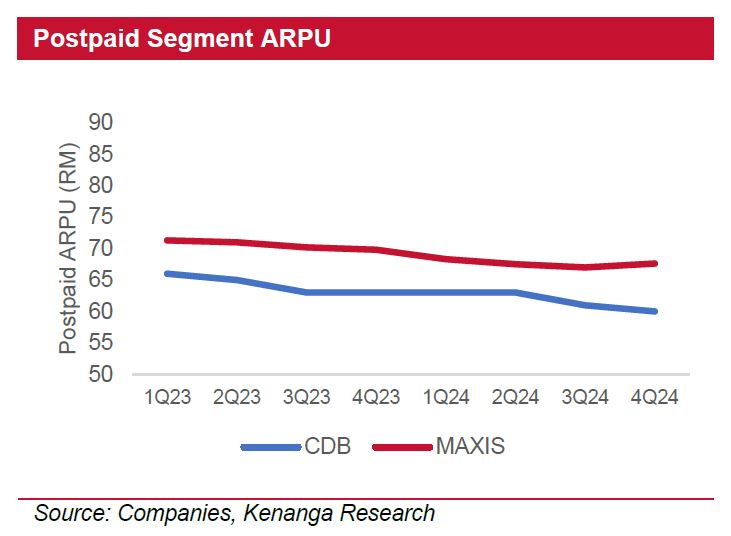

Postpaid momentum remained strong for the MNOs in 4QFY24, with MAXIS’ net adds rising QoQ to a solid 85k, while CDB extended its growth streak with 83k net adds.

These positive trends likely reflect improved customer loyalty, driven by effective convergence strategies that have been demonstrated to reduce churn by up to 3x.

For fixed-line operators, Malaysia’s rapidly expanding data center (DC) capacity is expected to significantly boost demand for global and terrestrial bandwidth services.

The country’s DC pipeline remains robust, with 38 upcoming projects collectively requiring maximum electricity supply of 5.9GW.

In contrast, nine DC projects completed in 2024 accounted for a total maximum demand of 1.3GW.

This substantial growth in DCs is anticipated to drive demand for managed wavelength and wholesale bandwidth services, including hot standby bandwidth allocation (HSBA) and indefeasible rights of use (IRU) contracts.

These services are critical for global data transmission, facilitating connectivity between hyperscale DCs, DCs and public/private cloud infrastructures, and DCs to end users.

Fixed Line providers are well-positioned to benefit, leveraging their ownership and operation of critical DC connectivity infrastructure, including:

(i) international submarine cables and their landing stations,

(ii) terrestrial fiber optic networks, and

(iii) global points of presence.

“We maintain our NEUTRAL stance on the sector, with TM and TIMECOM as our top picks,” said Kenanga. —Mar 7, 2025

Main image: The Star