A POST by lawyer and political commentator Zee How Tai on Facebook has generated a lively discussion among netizens. The post on Ulasan Ah Pek Cina’s Facebook page urged readers to be wary of “happily obliging” to become guarantors for loans.

He highlighted the many potential pitfalls becoming entangled in such arrangements such as if:

- The borrower dies;

- The borrower fails in his/her business;

- The borrower is declared a bankrupt; and

- The borrower is overwhelmed by debt.

When any of the above arises, guarantors are sure to come under duress from the borrowers whether individuals, financial institutions or banks. Therefore, Zee offered the following seven advice to circumvent the so-called pitfalls:

- Only be a guarantor for one’s own children and spouse (husband or wife);

- Parents should avoid asking their children to be their guarantors because they (the children) have a life of their own and should not bear unnecessary risk;

- Avoid being a guarantor for relatives EXCEPT for your nephews/nieces for educational purposes;

- Don’t be a guarantor for friends no matter how close they are for there is a high probability of friendship is lost when a problem occurs;

- Don’t be a guarantor for a boyfriend or girlfriend especially if the couple is still unmarried. You certainly don’t wish to be declared a bankrupt prior to getting married just because your girlfriend/boyfriend defaulted on her/his bank loans;

- Don’t be a guarantor for a business partner. As a partner in business, you should behave like a borrower by being vigilant and by taking calculated risks in your business dealings; and

- Don’t ever show that you are very big-hearted. If banks come after you, you will not be suffering alone for other family members will likely be dragged into a similar predicament.

Zee’s thorough and sound advice has been met with over 2,400 likes with the post having been shared over 430 times at time of writing.

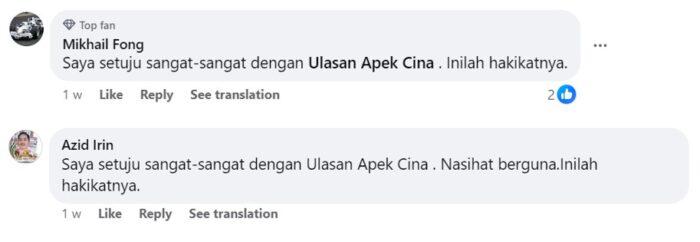

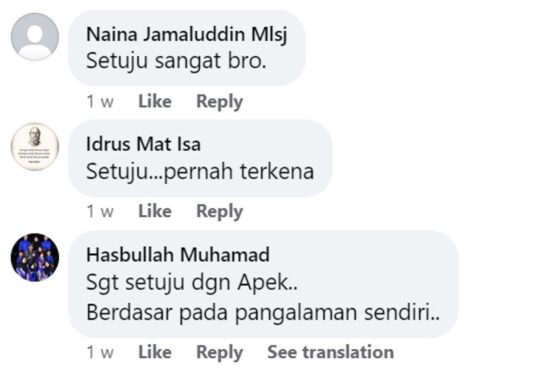

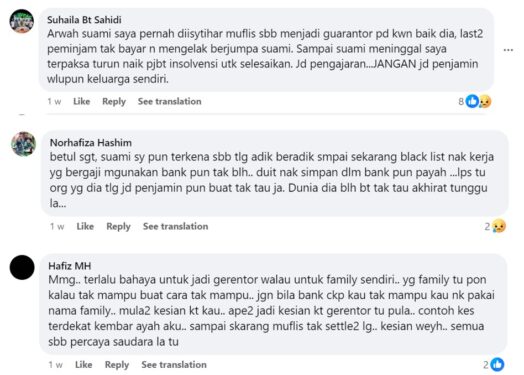

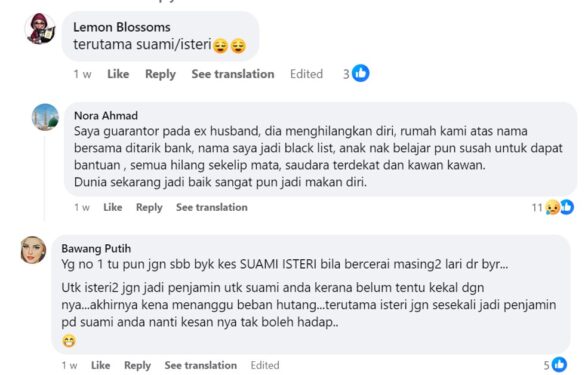

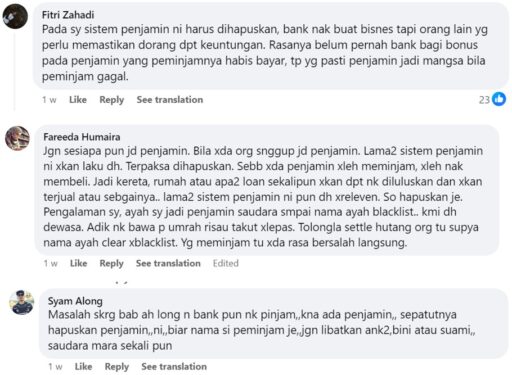

Here is what some netizens had to say about Zee’s advice with many agreeing on the need to be cautious:

More than few shared personal experiences whereby such arrangements involving close friends or family members had gone awry.

Some said this thinking should even be extended to married couples.

Some advocated a change in the banking system which allowed guarantors to be the “victims” while the financial institutions continued to rake in profits continuously and unfettered.

Judging by the number of comments and those sharing personal experiences, this is a deep-rooted problem among many. The lower the income grouping, the more pressing the need becomes.

Perhaps this is among the reasons that prompted the Federal Territory Mufti’s declaration that working in conventional banks is not halal income.

But what is a viable alternative? Zee is cautions against becoming loan guarantors but not really offering solutions to those seeking loans.

This is a tricky question that needs addressing. – Jan 24, 2024

Main pic credit: Investopedia