THE New Year is still wrought with many uncertainties for the benchmark FBM KLCI but we expect clearer skies by 2H 2023 to propel the index higher.

In 2022, we witnessed excessive liquidity and unusual fiscal expansion that went into rescuing world economies from the clutches of COVID-19 biting back in the form of higher inflation and aggressive monetary tightening.

The impact of those tightening will be more visible in 2023 as it finally eats into consumption and private investment. It will precipitate a global slowdown. The question is whether it will be milder or more severe.

China to cushion US economic weakness

The world’s two largest economies – the US and China – have their limitations. Nevertheless, China’s economy is expected to perform better next year with easing of its Zero-COVID restrictions and sweeping measures to revive the ailing property sector.

The jury is still on out whether the US will go through a soft or hard landing. The US is expected to record lower economic growth or a mild recession next year as the lag impact of monetary tightening becomes more evident.

Layoffs and cooling of its job market apart from the high base effect this year will ease inflationary pressures and contribute to a pause in rate hikes by 2H2023.

We believe the improvement in real disposable income as inflationary pressures ease will cushion some of the negative impacts on consumption.

Europe can be facing a deeper slowdown or recession than the US due to its energy crisis that caused inflation to shoot through the roof. This eroded purchasing power and consumption, and will spill over to affect businesses.

Unity government should last

Malaysia is not an island, and it will definitely feel the heat. Weakness in the external sector can be addressed partly through more intra-Asian trade, trade diversion attributed to the US-China stand-off and greater domestic demand.

A stable and able government is a must to address these challenges while implementing structural reforms to address the fiscal gap, growing competition from the region, deteriorating race relationships, dissipating religious tolerance and improving the socio-economic conditions of every Malaysian.

It is our view, this unity government will prevail – withstanding the vote of confidence, UMNO election by May 19 and state elections next year.

All six state assemblies will be dissolved automatically between next June and July 2023 with elections due within 60 days after that. Political parties are expected to strategise their moves and hold the state elections in 1H 2023.

As such, we believe the current unity government can deliver the much-needed reforms in stages while crossing the different hurdles and earn the confidence of investors.

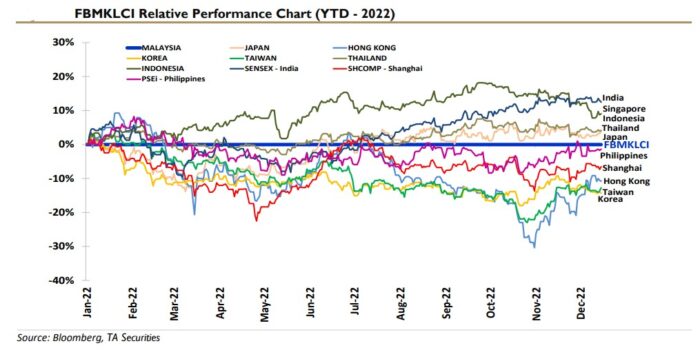

As Malaysia’s economy is expected to be resilient due to robust domestic activities despite an expected global slowdown next year, there is a strong possibility for significant improvement in foreign shareholdings of Malaysian equities which is only 20.7% as of end-November 2022.

Hence, we believe the FBM KLCI could end 2023 on a positive note at 1,700 based on CY2024 PER (price/earnings ratio) of 14.5 times which is -0.5 standard deviation from a long-term mean of 15.9 times and a 14.7% discount to average five-year forward PER of 17 times. Thus, investors should take a long-term view of Malaysian equities. – Dec 26, 2022

Kaladher Govindan is head of TA Securities Research. This is an excerpt from the research house’s Annual Strategy 2023.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.