IN line with higher regional markets, KLCI soared 3 pts to 1,636.5, led by gains on PBBANK, CDB, KLK, PETDAG and CIMB.

Despite the headline gain, market breadth weakened to 0.52 vs 0.77 last Friday while daily volume fell 2.6% to 2.24bil shares valued at RM2.09bil.

Foreign institutions were major net sellers for a second session (-RM65mil, Oct: -RM1.1bil, year-to-date: +RM2.45bil) while local retailers (+RM10mil, Oct: +RM158mil,year-to-date: -RM4.7bil) and local institutions (+RM55mil, Oct: +RM950mil, year-to-date: +RM2.25bil) emerged as major net buyers.

Following the formation of a double top pattern and decisive breakdown below LT support trendline (near 1,660), KLCI could extend its profit taking consolidation in the near term, while supports are pegged at 1,625 (61.8% FR) and 1,606 (50% FR) zones.

Nevertheless, after retreating from year-to-date high of 1,684 to a low of 1,625 before ending at 1,636.5 yesterday, KLCI is oversold.

A successful rebound above 1,652 (20D moving average) and 1,660 hurdles will spur the index to revisit 1,684 and 1,700 levels.

Ahead of the Budget 2025 announcement on Oct 18, KLCI is likely to trend sideways, with major supports pegged at 1,600-1,606-1,625 while resistances are near 1,652- 1,660-1,684 levels.

Cautious sentiment and weak buying momentum are likely to prevail as investors navigate the ongoing US third quarter 2024 earnings results, the risk of long-feared regional war in the Middle East (as the US is sending an advanced missile defense system and associated troops to Israel), and the effectiveness of China’s outsized stimulus measures to address its economic malaise.

Technically, OSK is poised for a bullish triangle breakout after closing above multiple key moving averages.

A successful cross above RM1.62 (downtrend line) may spur greater upside towards RM1.72 (52W high) and RM1.80 (17Y high) targets, while downside is cushioned at RM1.55 (lower BB) and RM1.52 (200D moving average) levels. – Oct 15, 2024

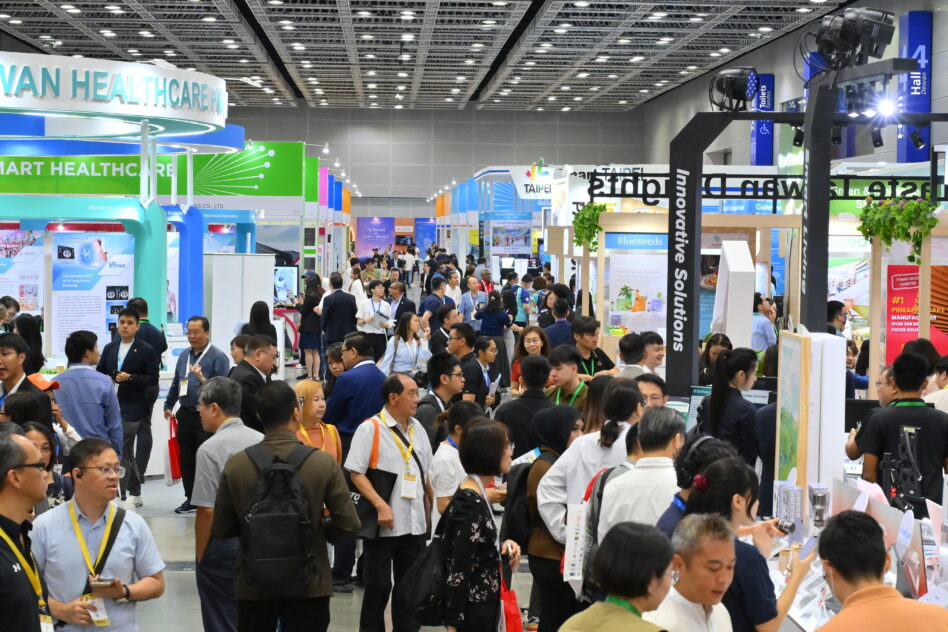

Main image: newstraitstime