THOUGH some loyal LPI Capital Bhd shareholders had parted way last Friday (Oct 11) with their entire/partial holdings in Malaysia’s sixth largest insurer in terms of 2023 market share out of panic selling due to Public Bank Bhd’s ‘cheap skate’ RM9.80 price tag, the truth is their investment is perfectly safe and rewarding.

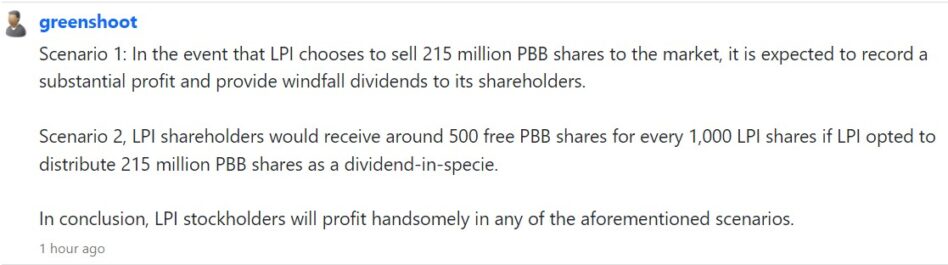

This comes about as Public Bank CEO and managing director Tan Sri Tay Ah Lek has disclosed that LPI holds some 215 million Public Bank’s shares which can no longer be held by LPI once the general insurer comes under ownership of Malaysia’s third largest bank by assets worth RM493.26 bil.

“If PBB holds LPI and these shares cannot be held by LPI (after Public Bank’s acqusition of LPI), what will happen to that block? Will it be sold to the market or distributed as a dividend-in-specie?” asked the most trusted lieutenant of the late Public Bank founder Tan Sri Teh Hong Piow to as question posed by StarBiz following last week’s corporate exercise.

“We’ll have 12 months from the date of completion of the proposed acquisition of LPI to address this matter.

“It is still premature for us to make a decision on this matter but rest assured, we will explore all possibilities and make a decision at the appropriate time that will not be disruptive to the share price of Public Bank whilst ensuring the interest of the shareholders of PBB and LPI is protected at all times.”

Added Tay: “I would also like to take this opportunity to assure all staff of the LPI group that there will be no retrenchment exercise to be undertaken following this acquisition. We will, however, set up a steering committee to oversee the smooth transition and make any necessary changes if required.”

To re-cap, Public Bank had on Thursday (Sept 10) revealed its intention to acquire the entire equity stake of 44.15% in LPI from Consolidated Teh Holdings Sdn Bhd (42.74%) and The Estate of the Late Tan Sri Dato’ Sri Dr. Teh Hong Piow (1.41%) for RM1.72 bil cash or RM9.80/share.

The steep 25% discount over LPI’s last traded price of RM13.00 prior to trading suspension to pave way for market abonnement has cast a cloud over LPI’s prospects if not triggered panic selling among minority shareholders when trading resumed last Friday (Oct 11).

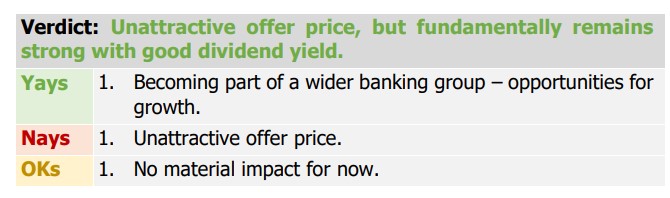

Tey aside, even MIDF Research head Imran Yassin Yusof has further assuaged LPI shareholders that the insurer is still fundamentally sound with good dividend yield and that Public Bank’s offer price is not a reflection of LPI’s fundamentals.

Above all else, he doubted that LPI’s minority shareholders will be attracted to accept the ensuing mandatory general offer (MGO).

“There is potential for synergies with PBB,” opined Imran in a LPI company update.

“However, given the discount, we believe that the MGO will not likely see any interest from the remaining shareholders especially as the current market price provides a more attractive avenue for minority investors looking to exit. (Moreover), Public Bank intends to maintain the listing of LPI.”

All in all, MIDF Research retained its “buy” call on LPI with a Gordon Growth Model (GGM)-derived target price of RM14.52 based on an unchanged FY2025F P/BV (price-to-book value) of 2.42 tines.

“LPI is still fundamentally sound with good dividend yields. We do not see the offer price as a reflection of its fundamentals,” reiterated Imran.

At 11.51am, LPI was up 10 sen or 0.79% to RM12.68 with 191,100 shares traded, thus valuing the company at RM5.06 mil. – Oct 14, 2024

Main image credit: The Star