MALAYSIA’S 2H 2024 debt capital market (DCM) issuance is likely to stay at similar levels to 1H 2024 or fall due to the government’s gradual fiscal consolidation with the federal deficit expected to fall in the near term.

Fitch Ratings – one of the Big Three credit global rating agencies – expects impetus to come from financial institutions and corporate issuances which seek to re-finance and diversify funding.

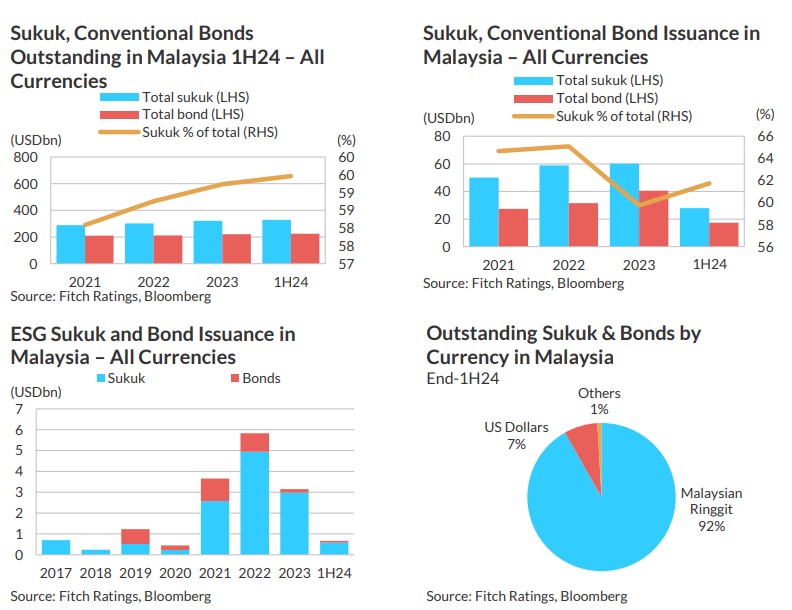

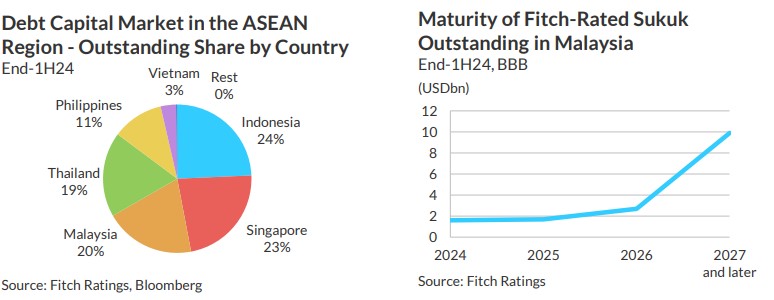

Alth0ugh Malaysia’s DCM expanded by 4.4% year-on-year (yoy) to cross US$550 bil outstanding at end-1H 2024, it faces risks from ringgit movement, interest rates, commodity price volatilities and global geopolitical events, according to Fitch Ratings.

“The Malaysian DCM is deep and well-developed compared to other Organisation of Islamic Cooperation (OIC) countries though it remains ringgit focused.” observed the rating agency’s Islamic Finance global head Bashar Al Natoor in a non-rating action commentary on Malaysia’s DCM performance in 1H 2024.

More broadly, Fitch Ratings foresees sukuk to stay dominant in Malaysia’s DCM due to its supportive ecosystem.

“Unlike most OIC countries, investors in Malaysia’s DCM are more diversified and include banks, provident and pension funds, Hajj funds, insurance and takaful operators, and fund managers,” contended the rating agency, noting that it rates US$16 bil of Malaysian sukuk – all investment grade – with “issuers on Stable Outlook”.

Statistics-wise, DCM issuance in 1H 2024 fell by 8.3% yoy to US$45.2 bil due to fiscal consolidation with the government deficit in 1H 24 lower than 1H 2023.

Around 60% of 1H 2024 issuance was from the government and the rest from financial institutions, corporates, project finance and others.

But a turnaround can be imminent in 2H 2o024 as Bank Negara Malaysia (BNM) is currently providing regulatory flexibility for multilateral development banks to issue ringgit sukuk and by providing ringgit financing to resident entities without prior approval.

“A stronger ringgit could attract more non-resident holding of domestic government bonds (3M 2024 share: 21.3%). We expect the factors driving ringgit depreciation, including negative interest-rate differentials and portfolio investor sentiment to wind down in 2H 2024,” projected Bashar.

“Government efforts to support the ringgit included encouraging government-linked companies (GLCs) to consistently repatriate foreign investment income and convert it to ringgit. In May, the central bank kept the overnight policy rate (OPR) at 3% with the same likely through 2H 2024 and 2025.” – Aug 12, 2024