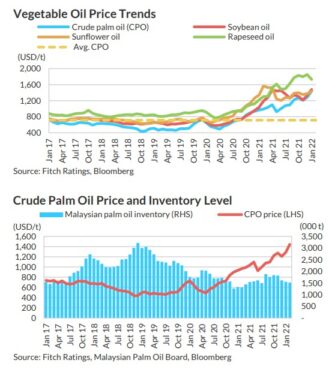

FITCH Ratings expects higher output over the next year to drive a gradual decline in crude palm oil (CPO) prices which rose to a record of over US$1,900 (RM8,000)/metric tonne (MT) in Malaysia in early March 2022.

The international rating agency attributed the price surge as driven by uncertainty over supply of sunflower seed oil from Ukraine and Russia, the impact of a drought on South American soybeans and Indonesia’s steps to curb palm oil exports.

“However, higher palm oil output in Indonesia is likely to be a significant contributor to better vegetable oil supply in 2022, and we assume an average benchmark price of US$1,000 (RM4,220)/MT in 2022, US$700 (RM2,950)/MT in 2023 and US$600 (RM2,530)/MT thereafter,” analysts Akash Gupta and Ilham Kurniawan pointed out in a non-rating report entitled “Asian Crude Palm Oil Watch 1Q 2022”.

“However, a prolonged Russia-Ukraine war may keep prices elevated in 2022-2023.”

Moving forward, Fitch Ratings expects CPO prices to decline gradually over the next year, spurred by higher output of palm and other vegetable oils. Despite cutting its forecast, the US Department of Agriculture (USDA) expects global vegetable oil production to grow by 2% in 2021-2022 after a decline in 2020-2021.

“We expect higher palm oil output in Indonesia to be a significant contributor,” projected Fitch Ratings. “Good weather and high CPO prices should encourage producers to raise yields in 2022 with Indonesia’s industry body estimating an increase in palm oil output of around 1 million MT after declines in 2020 and 2021.”

This should more than offset any weakness in Malaysia which has been hit by a shortage of foreign workers, according to Fitch Ratings.

“Plans to bring in foreign workers to work on plantations in Malaysia have continued to face delays and the country’s plantation industries minister now expects the first batch of workers to arrive in May and June – months later than the original plan for early 2022,” the rating agency pointed out.

Below are three key Fitch Ratings’ observations of Malaysia’s palm oil industry:

CPO Production: Malaysia’s CPO output in 2021 fell by 5% from a year earlier before rising 7% in the first two months of 2022. “We think the recent improvement is due to better weather conditions and producers making the effort to cope with the labour shortage,” noted Fitch Ratings.

Palm oil inventories: Palm oil inventories in Malaysia have been consistently higher year-on-year (yoy) since August 2021. However, inventories have remained lower than the levels in most previous years.

Palm oil exports: Malaysia’s palm oil exports fell by 11% in 2021 due to lower output and a cut in Indonesian export levies which improved the country’s palm oil competitiveness. – March 29, 2022