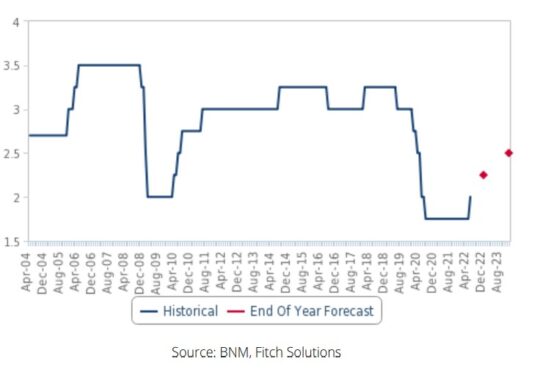

BANK Negara Malaysia (BNM) is likely to raise the current overnight policy rate (OPR) by another 25bps to 2.25% as the central bank seeks to ensure the stability of the ringgit and maintain its real interest rate differential over the US which is now expected to hike its interest rates by further 100bps for a total of 175 bps in 2022.

In justifying its forecast, Fitch Solutions Country Risk & Industry Research said even as inflation appeared to be well contained by government subsidies and price controls for key essential items and fuel, the ringgit has depreciated by 4.1%% since April and further losses could feed through to higher imported inflation, thus lowering the purchasing power of consumers.

For the record, BNM had on Wednesday (May 11) raised its OPR rate from a record low of 1.75% to 2% in its first adjustment since July 2020.

“We continue to see upside risks if major central banks around the world were to tighten monetary policy even quicker than we currently expect due to growing underlying inflationary pressures,” Fitch Solutions which is independent of Fitch Ratings pointed out in a commentary.

“In the statement accompanying the central bank’s decision to raise interest the OPR by 25bps to 2.00%, BNM struck a more optimistic tone about the domestic economy, noting that ‘growth is on a firmer footing, driven by strengthening domestic demand’ and that ‘the transition to endemicity on April 1 would strengthen economic activity’.”

Fitch Solutions further noted that it has revised down its average inflation forecast for 2022 to 2.8% year-on-year (yoy) (from 3.3% previously and 2.5% in 2021).

“Inflation came in at just 2.2% yoy in March, holding steady from February and slightly down from 2.3% yoy in January despite rising commodity prices over that period,” observed the research house.

“This is likely due to the price controls and subsidies implemented by the government which we expect to keep headline inflation relatively subdued over the rest of 2022.”

Although inflation may not present a very strong case for further interest rate hikes, Fitch Solutions expects BNM to still raise interest rates by an additional 25bps over the coming months to support the ringgit.

The ringgit has weakened by 5.1% against the greenback since the beginning of 2022 and 4.1% just between April 1 and May 11 to trade at RM4.38/US$ on May 11.

“We attribute this weakness largely to the much more hawkish stance of the US Federal Reserve since March as well as rising global financial market volatility,” justified Fitch Solutions.

“Given still-strong inflation data (8.3% yoy in April), we expect a further 100bps in rate hikes in the US which could further contribute to short-term US dollar strength. To be sure, real yield differentials have begun to move in favour of the US since March, coinciding with recent ringgit weakness.”

The average real yield advantage of Malaysia’s two-year and 10-year bonds has decreased to 6.6% on May 11 from a peak of 7.8% on March 1. – May 13, 2022