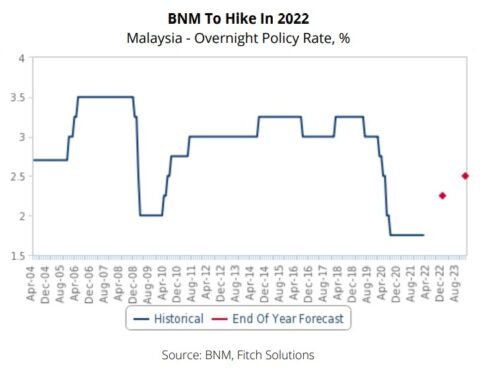

BANK Negara Malaysia (BNM) is highly expected to raise its overnight policy rate (OPR) to 2.25% in 2022 as the central bank seeks to ensure the stability of the ringgit and maintain its real interest rate differential over the US which is now likely to begin hiking in 2022 rather than in 2023.

Against the backdrop of building inflationary pressures, BNM is still mandated to maintain price stability although it does not have a numeric inflation target, according to Fitch Solutions Country Risk & Industry Research.

“We continue to see some upside risks if major central banks around the world were to tighten monetary policy even quicker than we currently expect due to growing underlying inflationary pressures,” opined the research house which is independent of Fitch Ratings in a commentary.

On Jan 20 2022, BNM decided at its monetary policy committee meeting to hold its benchmark OPR at 1.75%.

In the statement accompanying its decision, BNM highlighted uncertainties surrounding the global economy, noting that while the “global economy continues to recover”, risks such as “the emergence of new variants of concern, risks of prolonged global supply disruptions, and risks of heightened financial market volatility amid adjustments in monetary policy in major economies” have remained.

“The Government expects growth to range between 5.5% and 6.5% in 2022 against our own forecast of 5.5% growth, and the stronger growth picture will provide the central bank space to hike in order to head off inflationary pressures and rebuild policy space,” projected Fitch Solutions.

“We have (also) revised our average inflation forecast for 2022 upward to 3.3% from our 2.5% estimate for 2021. The main driver of inflation in 2022 will likely be higher average oil prices and higher input costs as economic activity normalises.”

Fitch Solutions now expects the Brent crude prices to average slightly higher at US$72.00/barrel in 2022 from US$70.95/barrel in 2021.

Elsewhere, Malaysia’s consumer price index also surged by 12.6% year-on-year (yoy) in Nov 2021, marking the eighth consecutive month of double-digit increase, and this will likely feed through into higher consumer prices in the coming months.

“Risks to our interest rate forecast are slightly tilted to the upside. A surge in inflation could prompt the central bank to accelerate the rate hiking cycle in 2022 in order to ensure positive real interest rates and rebuild policy buffers in anticipation of global monetary policy tightening,” Fitch Solutions pointed out.

“This contingency becomes more likely if major central banks accelerate their rate hiking cycle, perhaps in response to a swifter increase in inflation than they currently anticipate.”

Although there remains the possibility of another negative shock to the economy from an emergence of another variant of concern that causes greater strain on the healthcare sector, the high vaccination rates should prevent another large-scale lockdown similar to the full movement control order (FMCO) imposed from June to October 2021, added the research house. – Jan 24, 2022

Pic credit: AFP/Getty