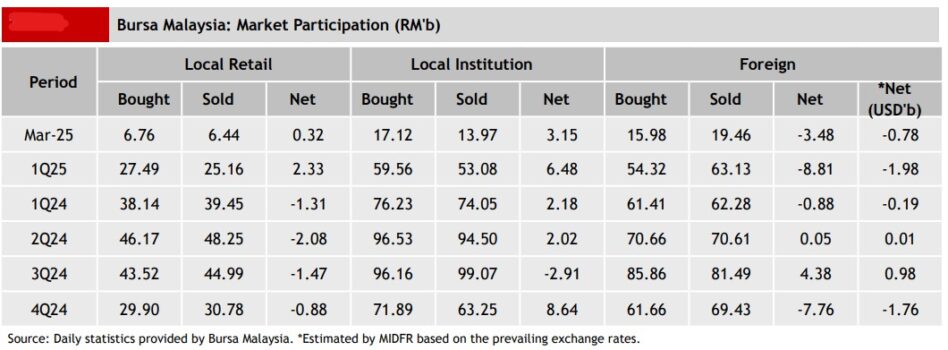

DESPITE a shortened trading week due to the Nuzul Al-Quran public holiday, foreign investors extended their net selling streak on Bursa Malaysia for the 22nd successive week with a net outflow of -RM1.25 bil during the March 17-21 trading week.

This was a slight decrease from outflows of -RM1.34 bil posted on the prior week, according to MIDF Research.

“Foreign investors were net sellers on every trading session with Wednesday (March 19) witnessing the heaviest outflow at -RM484.23 mil,” observed the research house in its weekly fund flow report.

“On the other days, the outflows range from -RM155.34 mil to -RM326.40 mil.”

The only sector that recorded net foreign inflows was plantation at RM2.4 mil while the top three sectors that recorded the highest net foreign outflows were financial services (RM609.7 mil), industrial products & services (-RM167.9 mil) and consumer products & services (-RM148.4 mil).

In contrast, local institutions remained steadfast in supporting the local bourse by marking their 22nd consecutive week of net buying with a RM1.23 bil inflow.

Likewise, local retail investors extended their net buying streak for a sixth straight week with net purchases amounting to RM25.5 mil.

The average daily trading volume (ADTV) saw broad-based decrease except for foreign investors. Local institutions and local retail recorded a decline of -11.9% and -14.8% respectively while that of foreign investors jumped +27.4%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, the Philippines recorded a net inflow of US$40.1 mil to mark a third straight week of positive trend.

Elsewhere, Indonesia registered its ninth consecutive week of foreign outflows at -US$432.1 mil amid economic and trade fluctuations.

Similarly, Vietnam experienced a net outflow of -US$156.2 mil – its seventh week in a row of foreign withdrawals – while Thailand posted a -US$103.9 mil of net outflow to extend its losing streak to four weeks.

The top three stocks with the highest net money inflow from foreign investors last week were Axiata Group Bhd (RM23.5 mil), Gamuda Bhd (RM22.6 mil) and Pecca Group Bhd (RM16.8 mil). – March 24, 2025