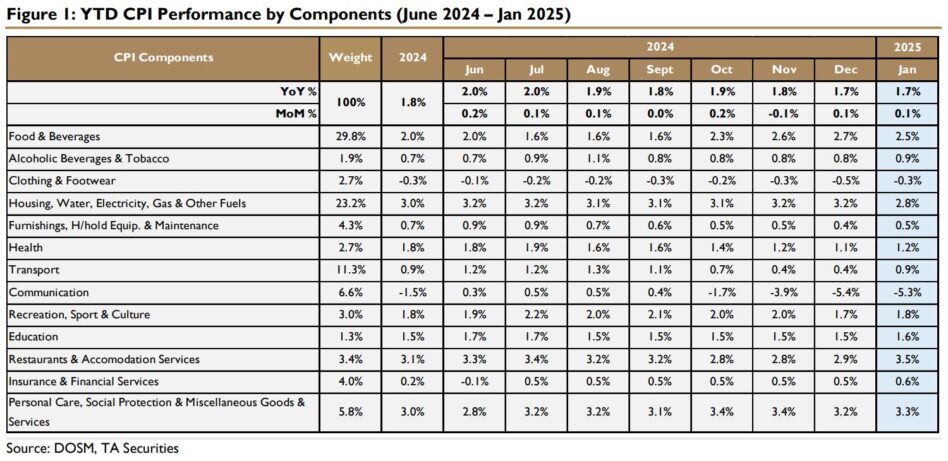

NINE components, representing 37.7% of the consumer price index (CPI) basket, experienced a notable acceleration in annual growth.

“However, this was tempered by a moderation in the two largest contributors, Food & Beverages and Housing, Water, Electricity, Gas & Other Fuels, which collectively account for 53% of the CPI basket,” said TA Global in the recent Economic Update Report.

The largest contributor, the Food & Beverages index (29.8% of total CPI), recorded a slower growth of only 2.5% year-on-year (YoY) during the month, down by 0.2% point due to a lower increase in the main subgroup of Food at home.

On the other hand, the main subgroup of Food away from home rose by 5.0% YoY, compared with 4.8% YoY previously.

Inflation within the primary group of Housing, Water, Electricity, Gas & Other Fuels saw a moderate increase of 2.8% in January 2025.

This rise was primarily driven by a 21.0% year-on-year increase in the subgroup of Water Supply & Miscellaneous Services Related to Dwellings.

Meanwhile, the expenditure class of Water Supply remained stable at 29.3% year-on-year, maintaining the same rate observed for the past six consecutive months since August 2024.

Several major groups saw a faster rate of increase compared to December 2024.

Noteworthy examples include Restaurants & Accommodation Services, which rose by 3.5% YoY (up from 2.9% in December 2024), and Transport, which increased by 0.9% YoY (compared to 0.4% in December 2024).

Meanwhile, the Clothing & Footwear and Communication sectors continued to experience contraction. However, growth in other segments helped to stabilise overall costs at the start of the year.

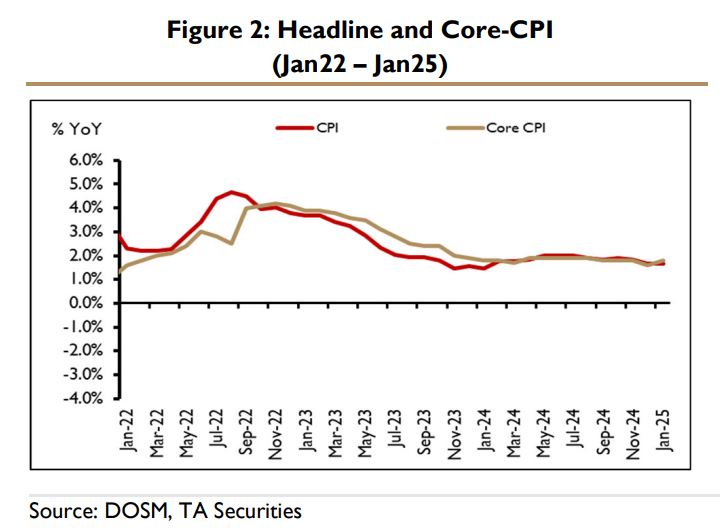

“We anticipate that inflation will remain manageable in the coming months, likely staying close to the long-term average of 2.0% year-on-year, based on historical data from January 2010 to January 2025,” said TA.

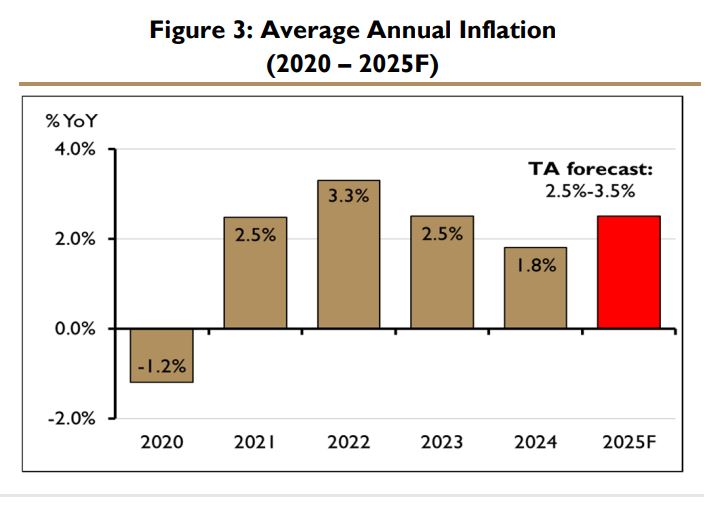

However, inflationary pressures may rise slightly in February 2025, driven by demand-pull factors, such as the minimum wage increase to RM1,700 and salary adjustments for government employees.

Furthermore, there is a potential demand-side catalyst as we approach the month of Ramadhan in March 2025, when households typically ramp up spending on food, clothing, and festive preparations.

This seasonal uptick in demand, coupled with possible supply constraints in certain goods could temporarily drive prices higher.

Looking ahead, the Ministry of Finance (MOF) forecasts that Malaysia’s headline inflation next year may accelerate to its highest level in eight years, with the CPI projected to rise between 2.0% and 3.5% YoY.

Apart from the wage rise, this increase will likely be driven by the mid-year adjustment of RON95 fuel prices.

The Monetary Policy Committee (MPC) is expected to keep the Overnight Policy Rate (OPR) at 3.0% this year, in line with a manageable inflation outlook and the need to sustain domestic economic growth amid global uncertainties.

Adjustments may only be considered if inflationary pressures from subsidy rationalisation or external shocks become unmanageable in 2025.

Further insights into the central bank’s stance will be provided during the next MPC meeting on 6 March 2025 and in Bank Negara Malaysia’s annual report, set for release at the end of March. —Feb 24, 2025

Main image: Concorde Hotel