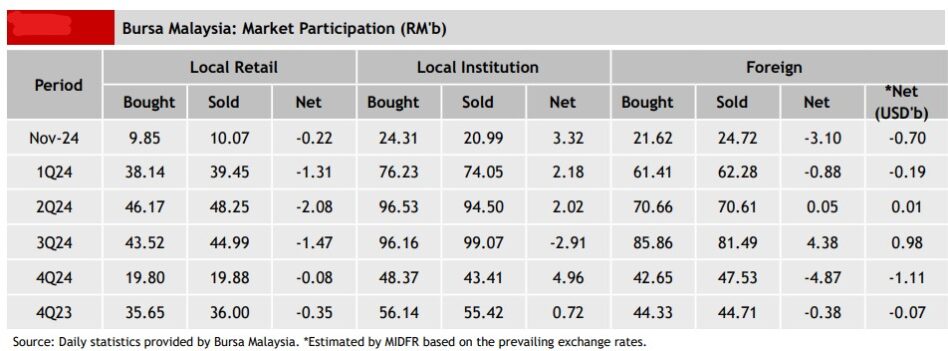

FOREIGN investors continued to sell equities on Bursa Malaysia for the sixth consecutive week with an elevated net outflow of -RM259.8 mil from the prior week’s RM165.3 mil as foreigners continued to dump Asian equities for a ninth successive week.

They net sold every trading session last week and have been net selling for seven straight trading days, according to MIDF Research.

“The heaviest net outflow was -RM104.4 mil on Monday (Nov 25), followed by -RM67.6 mil on Thursday (Nov 28),” observed the research house in its weekly fund flow report.

“Tuesday (Nov 26), Wednesday (Nov 27) and Friday (Nov 29) saw net outflows of -RM17.2 mil, -RM46.6 mil and -RM24.1 mil respectively.”

The top three sectors that recorded net foreign inflows were plantation (RM72.9 mil), healthcare (RM64.0 mil) and property (RM29.0 mil) while the top three sectors that registered net foreign outflows were transportation & logistics (-RM120.2 mil), utilities (-RM98.5 mil) and consumer products & services (-RM79.2 mil).

As opposed to foreign investors, local institutions were net buyers of Malaysian equities for the fourth consecutive week with net purchases of RM207.7 mil last week.

Except for Tuesday (Nov 26) when they net sold a minor -RM1.4 mil, they were net buyers for the rest of the week.

Local retail investors also returned to a buying stint last week by amassing RM52.1 mil of domestic equities. They only net sold -RM26.8 mil on Wednesday (Nov 27) but were net buyers for the remainder of the week.

The average daily trading volume (ADTV) showed declines across all investor classes. Foreign investors registered a dip of -8.8% while local institutional investors and local retail investors saw declines of -3.1% and -3.3% respectively.

In comparison with another four Southeast Asian markets tracked by MIDF Research, only Vietnam experienced a net inflow of US$39.3 mil which ended its seven straight weeks of outflow spurred by Typhoon Yagi.

Elsewhere, foreign funds continued to pull out of the Indonesian equity market for the sixth week in a row with an outflow of -US$245.7 mil. Likewise, net foreign outflow in the Philippines also extended to a six-week streak with -US$65.1 mil.

Thailand experienced a reversal of fortunes from the previous week’s inflow by reporting an outflow of -US$124.1 mil last week. – Dec 2, 2024