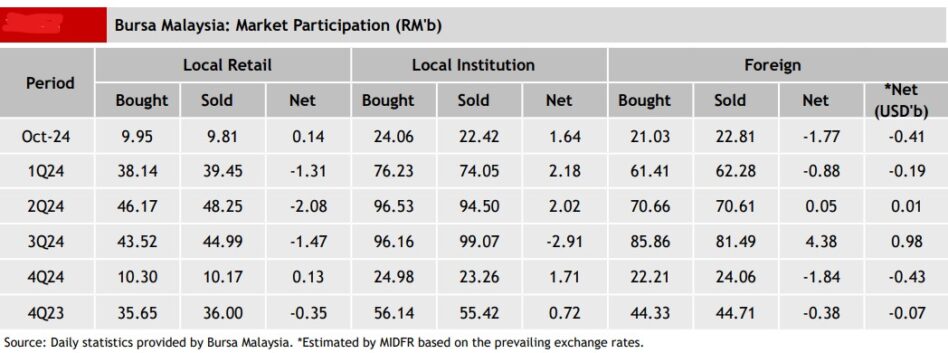

FOREIGN investors continued to dispose of equities on Bursa Malaysia for the second consecutive week at a significantly larger outflow of -RM1.01 bil or a four-fold increase from the -RM196.2 mil recorded the week prior.

They net sold on every trading day last week with the highest outflow occurring on Wednesday (Oct 30) at -RM473.9 mil before the market closed on Thursday (Oct 31) for Deepavali, according to MIDF Research.

“On the other days, the outflows ranged from -RM71.5 mil to -RM346.2 mil,” observed the research house in its weekly fund flow report.

The sectors that recorded the highest net foreign inflows were plantation (RM25.9 mil), property (RM11.6 mil) and REITS (RM7.2 mil) while sectors with the highest net foreign outflows were financial services (-RM600.2 mil), utilities (-RM190.9 mil) and consumer (-RM86 mil).

On the contrary, local institutions supported the local bourse over the past two weeks with a net buying of RM960.4 mil last week.

They were joined by local retailers who made net purchases of RM49.4 mil in domestic equities after having emerged net sellers during the previous weeks.

All in all, local retailers and local institutions experienced a decline in average daily trading volume (ADTV) of -10.8% and -6.9% respectively while foreigners saw an increase of +27.9%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, all stock exchanges incurred outflows of foreign funds led by Vietnam with a fourth consecutive week of net foreign outflow amounting to -US$302.6 mil which is a multi-year high.

Elsewhere, foreign funds also maintained their exit for a sixth week in a row from the Thai equity market with outflows reaching -US$285.3 mil.

Indonesia recorded a net foreign outflow for the second straight week totalling -US$168.5 mil last week while the Philippines saw foreign investors continued to be net sellers for the second successive week which resulted in an outflow of -US$49.5 mil.

The top three stocks with the highest net money inflow from foreign investors last week were Gamuda Bhd (RM25.9 mil), Capital A Bhd (RM21.5 mil) and Alliance Bank Malaysia Bhd (RM14.2 mil). – Nov 4, 2024