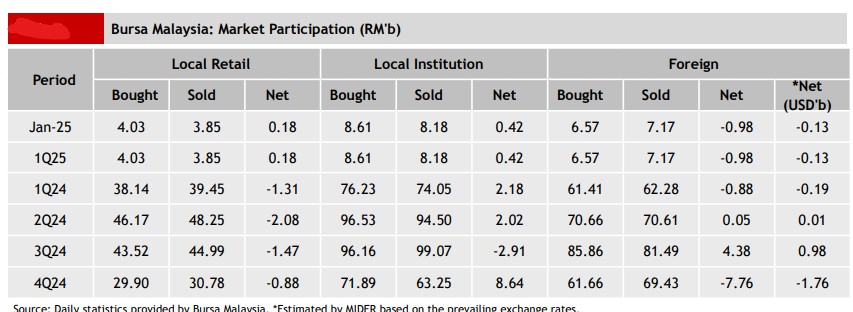

FOREIGN investors extended their relentless selling streak on Bursa Malaysia to the 12th consecutive week with net outflows amounting to -RM502.2 mil for the week ended Jan 10 which surpassed the previous week’s -RM427.1 mil.

Outflows were observed every trading session with the largest on Thursday (Jan 9) at -RM162.3 mil while other days ranged between -RM56.1 mil and -RM111.5 mil, according to MIDF Research.

“The only two sectors that recorded the net foreign inflows were construction (RM271.1 mil) and REITs (RM20 mil),” observed MIDF Research in its weekly fund flow report.

“Meanwhile, the top three sectors that recorded the highest net foreign outflows were utilities (-RM142.7 mil), financial services (-RM130.0 mil) and transport and logistics (-RM92.5 mil).”

On the contrary, local institutions remained net buyers for the 12th week with RM281.9 mil in net purchases, thus extending their buying streak to 36 consecutive trading days.

Local retail investors also shifted gears by turning net buyers after two weeks of net selling by contributing a robust RM220.3 mil in net inflows.

Trading activity surged across all categories with average daily trading volume (ADTV) increasing by +30.8% for foreign investors, +29.8% for local institutions and +19.8% for retail investors.

In comparison with another four Southeast Asian markets tracked by MIDF Research, all posted net outflows led by Indonesia with -US$130.9 mil which extended its streak of foreign exits to two weeks.

Similarly, Vietnam and Thailand also recorded net outflows of -US$42.9 mil and-US$39.7 mil respectively which also marked their second week of foreign exits.

Elsewhere, the Philippines which posted net inflows in the previous fortnight saw a reversal with an outflow of -US$25.7 mil.

The top three stocks with the highest net money inflow from foreign investors last week were Gamuda Bhd (RM205.1 mil), CIMB Group Holdings Bhd (RM61.1 mil) and Nationgate Holdings Bhd (RM58.4 mil). – Jan 13, 2025