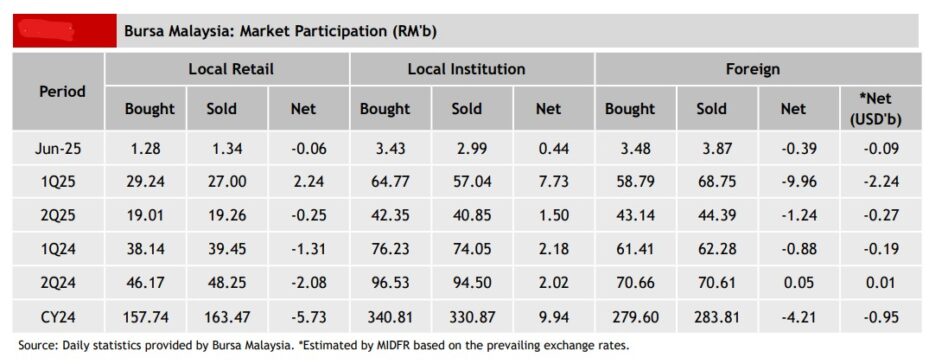

FOREIGN investors extended their net selling streak on Bursa Malaysia to three weeks during the Agong’s birthday-shortened trading week (June 3-6) with a net outflow of -RM387.4 mil which was smaller than the previous week’s outflow of -RM1.02 bil.

They were net sellers on every trading day with outflows ranging from -RM5.4 mil to -RM162.83 mil, according to MIDF Research.

“The largest outflow was recorded on Wednesday (June 4) at -RM162.8 mil followed by Tuesday (June 3) with -RM121.2 mil,” observed the research house in its weekly fund flow report.

The top three sectors that recorded the highest net foreign inflows were telco & media (RM16.4 mil), technology (RM16.2 mil) and property (RM8.0 mil).

On the contrary, the top three sectors that recorded the highest net foreign outflows were financial services (-RM193.1 mil), healthcare (-RM130.9 mil) and plantation (-RM40.4 mil).

However, local institutions continued their buying activities by extending their buying streak to a third week with net inflows amounting to RM444.6 mil.

Local retailers, meanwhile, reversed their two-week buying streak with an outflow of -RM57.3 mil.

The average daily trading volume (ADTV) saw a broad-based decline last week. Local institutions and local retailers saw a decrease of -8.1% and -15.8% respectively while foreign investors posted a plunge of -29.1%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, only the Philippines recorded an inflow of US$9.8 mil to reverse its three consecutive weeks of foreign outflows.

Elsewhere, Indonesia posted a net outflow of -US$288.4 mil to snap its three-week inflow streak while Vietnam posted a fourth straight week of foreign withdrawals with -US$80.4 mil in outflows.

Thailand posted the smallest net outflow at -US$72.7 mil to extend its foreign selling streak to three weeks.

The top three stocks with the highest net money inflow from foreign investors last week were Sunway Construction Group Bhd (RM76.4 mil), CIMB Group Holdings Bhd (RM55.8 mil) and My E.G. Services Bhd (RM55.4 mil), – June 9, 2025