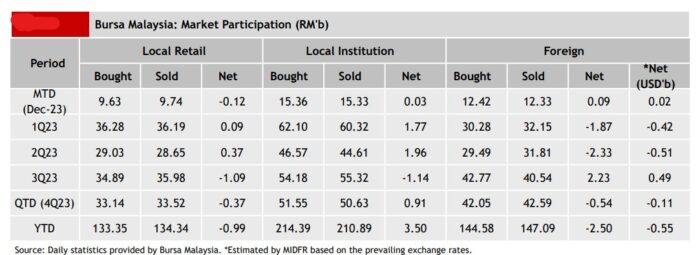

FOREIGN investors have remained net buyers of domestic equities on Bursa Malaysia for the second consecutive week with an inflow of RM112.3 mil last week.

Except for Monday (Dec 19), the remaining four trading days during the week witnessed net foreign inflows, according to MIDF Research

“Foreigners were net sellers on Monday (Dec 19) at -RM26.5 mil with the stocks experiencing the most outflows being Public Bank Bhd (-RM37.2 mil), RHB Bank Bhd (-RM27.4 mil) and Gamuda Bhd (-RM14.0 mil),” the research house pointed out in its weekly fund flow report.

“For the week, the top three sectors with the highest net foreign inflows were financial services (RM202.0 mil), technology (RM23.3 mil) and property (RM18.3 mil) while the top three sectors with the highest net foreign outflows were healthcare (-RM69.4 mil), consumer products & services (-RM40.7 mil) and utilities (-RM28.2 mil).”

However, local institutions switched to becoming net sellers after two consecutive weeks of net buying with an outflow of-RM106.7 mil. The sector that recorded the highest net outflow by this investor group was financial services (-RM384.3 mil).

Likewise, local retailers remained net sellers of domestic equities for the second consecutive week with -RM5.6 mil. This amount was significantly moderate compared to the previous week’s figure of -RM225.5 mil.

In terms of participation, there were marginal increases in average daily trading volume (ADTV) among local retailers (+0.9%), and local institutions (+0.4%) but a decline among foreign investors (-29.0%).

In comparison with another four Southeast Asian markets tracked by MIDF Research, only Indonesia posted a net inflow for the second week in a row with US$93.3 mil.

Meanwhile, Vietnam continued to record foreign fund outflows for the seventh consecutive week at -US$110.6 mil followed by Thailand (-US$106.9 mil) and the Philippines (-US$13.0 mil).

The top three stocks with the highest net money inflow from foreign investors last week were Malayan Banking Bhd (RM176.1 mil), CIMB Group Holdings Bhd (RM133.9 mil) and Frontken Corp Bhd (RM36.4 mil). – Dec 26, 2023