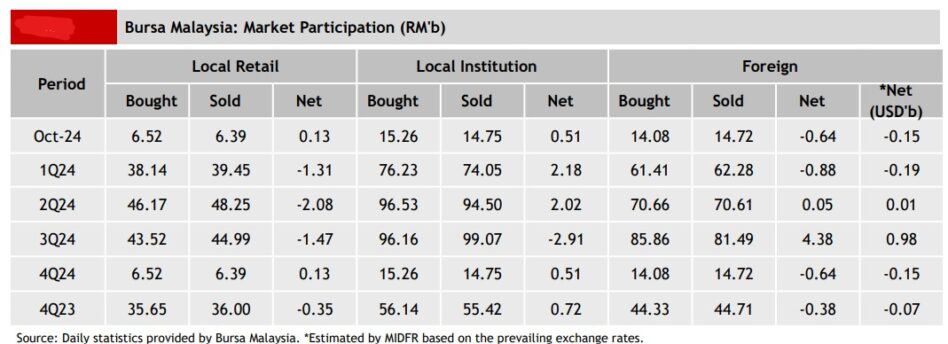

AFTER three consecutive weeks of selling, foreign investors shifted to buying domestic equities on the local bourse, resulting in a significant inflow of RM404.1 mil last week.

They were net buyers on every trading session except for Monday (Oct 14) which saw a net sell-off of -RM64.9 mil. The largest net foreign inflow occurred on Thursday (Oct 17) which amounted to RM226.3 mil.

“The sectors that recorded the highest net foreign inflows were financial services (RM181.0 mil), property (RM68.6 mil) and industrial products & services (RM63.8 mil),” observed MIDF Research in its weekly fund flow report.

“The sectors that registered the highest net foreign outflows were consumer products & services (-RM65.4 mil), technology (-RM13.9 mil) and energy (-RM10.0 mil).”

On the contrary, local institutions posted an overall net selling of -RM384.2 mil with a sole net purchase on Monday (Oct 14) amounting to RM55.2 mil.

Likewise, local retail investors decided to take profits after three straight weeks of buying, hence incurring a net sell of RM20.0 mil.

Except for foreign investors who gained 5.3%, the average daily trading volume (ADTV) showed declines across the other two investor classes with local retailers having experienced the highest decline at -10.7% while local institutions recorded a decrease of -4.2%.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia experienced a reversal with a net foreign inflow of US$78.5 mil after three consecutive weeks of net foreign outflows while the Philippines recorded its 10th consecutive week of net foreign inflows at US$18.7 mil.

Vietnam posted a net outflow for the second successive week at -US$83.4 mil while Thailand experienced a smaller outflow of -US$29.3 mil – a fourth week in a row – as market sentiment was affected by unexpected monetary policy changes.

The top three stocks with the highest net money inflow from foreign investors last week were RHB Bank Bhd (RM137.3 mil), Tenaga Nasional Bhd (RM98.7 mil) and United Plantations Bhd (RM43.8 mil). – Oct 21, 2024