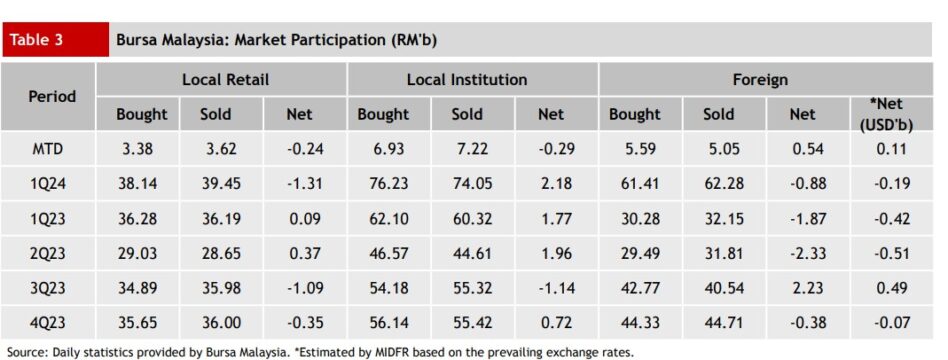

FOREIGN investors made a comeback to Bursa Malaysia after briefly emerging as net sellers the week prior with purchases valued at RM535.0 mil during the week ended June 7 despite it being a shortened trading week in view of the Yang di-Pertuan Agong’s birthday on Monday (June 3).

According to MIDF Research, foreign funds net bought RM253.7 mil on Tuesday (June 4), RM163.6 mil on Thursday (June 6) and RM186.8 mil on Friday (June 7). The only day they net sold was Wednesday (June 5) at -RM69.1 mil.

“The sectors with the highest net foreign inflows last week were utilities (RM167.5 mil), transportation & logistics (RM134.5 mil) and technology (RM115.7 mil),” observed the research house in its weekly fund flow report.

“The sectors with the highest net foreign outflows were plantation (-RM108.2mil), telecommunication & media (-RM32.1 mil) and energy (-RM22.4 mil).”

In contrast, local institutions returned to net selling mode at -RM293.5 mil after briefly net bought stocks on the local bourse the week before.

Likewise, local retailers also returned to becoming net sellers by disposing of -RM242.5 mil worth of equities after briefly net buying the week before. They net sold during the entire week.

In terms of participation, the average daily trading volume (ADTV) declined across the board by -6.3% for retailers, local institutions (-2.7%) and foreign investors (-21.7%).

In comparison with another four Southeast Asian markets tracked by MIDF Research, all recorded net outflows from foreign funds with Thailand posting its third consecutive week of net foreign outflows at -US$165.5 mil.

This was followed by Indonesia which posted its 11th straight week of net outflows at -US$144.0 mil while Vietnam saw a 14th consecutive week of foreign net disposal at -US$61.3 mil. Meanwhile, the Philippines recorded its third week of foreign net outflows at -US$35.6 mil.

The top three stocks with the highest net money inflow from foreign investors last week were Tenaga Nasional Bhd (RM263.0 mil), Press Metal Aluminium Holdings Bhd (RM111.0 mil) and MISC Bhd (RM92.8 mil). – June 10, 2024