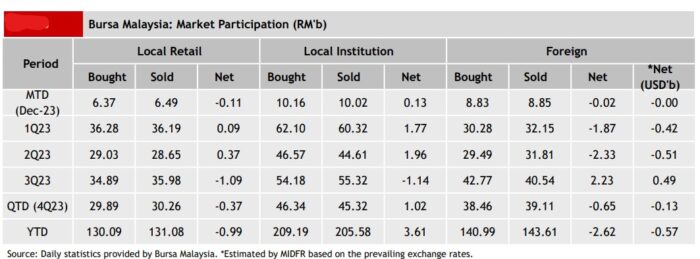

FOREIGN investors became net buyers of domestic equities at RM143.4 mil last week after briefly net selling the week prior.

Net foreign inflows into Bursa Malaysia began on Thursday (Dec 14) following the US Federal Reserve’s decision to maintain interest rates, according to MIDF Research.

“They net bought RM125.3 mil on Thursday (Dec 14) and RM190.2 mil on Friday (Dec 15), overturning their net selling amount of -RM172.0 mil from Monday (Dec 11) to Wednesday (Dec 13),” observed the research house in its weekly fund flow report.

The top three sectors with net foreign inflows last week were utilities (RM91.2 mil), healthcare (RM65.9 mil) and technology (RM33.5 mil). Meanwhile, the top three sectors with net foreign outflows were financial services (-RM66.8 mil), industrial products & services (-RM21.2 mil) and energy (-RM19.2 mil).

Interestingly, local institutions also continued as net buyers for the second consecutive week albeit with a reduced pace at RM82.0 mil compared with the previous week’s RM194.0 mil.

They net bought sectors such as plantation (RM58.6 mil), healthcare (RM55.1 mil) and financial services (RM51.0 mil).

On the contrary, local retailers shifted to becoming net sellers of domestic equities with an outflow of -RM225.5 mil following two consecutive weeks of net buying.

In terms of participation, there were increases in average daily trading volume (ADTV) across the board – local retailers (+22.7%), local institutions (+31.9%) and foreign investors (+62.8%).

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia posted the highest net foreign inflow with US$272.8 mil to reverse a brief period of net selling in the previous week.

After three weeks of net foreign outflows, foreign funds also returned to the Thai equity market by mopping up US$155.1 mil last week.

However, Vietnam experienced six weeks in a row of outflow with -US$143.6 mil last week while the Philippines conceded a modest -US$1.3 mil following three consecutive weeks of net inflows.

The top three stocks with the highest net money inflow from foreign investors last week were CIMB Group Holdings Bhd (RM157.3 mil), YTL Corp Bhd (RM131.5 mil) and Top Glove Corp Bhd (RM77.8 mil). – Dec 18, 2023