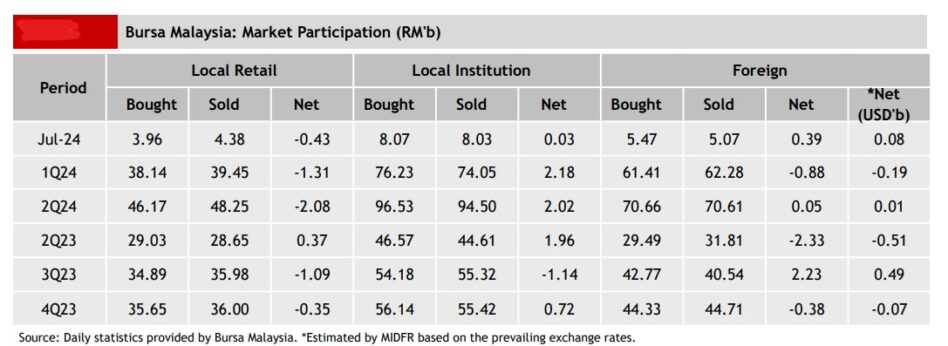

FOREIGN funds made a comeback to Bursa Malaysia with net inflows of at RM394.5 mil last week (July 1-5) after two weeks of net selling which culminated in net outflows totalling RM790.8 mil.

They net bought every session of last week with the bulk of the inflows seen on Wednesday (July 3) and Thursday (July 4) at RM259.4 mil and RM86.3 mil respectively, according to MIDF Research.

“The sectors that recorded the highest net foreign inflows last week were transportation & logistics (RM152.9 mil), industrial products & services (RM151.5 mil) and technology (RM93.6 mil),” the research house pointed out in its weekly fund flow report.

“Sectors with the highest net foreign outflows were consumer products & services (-RM91.1 mil), construction (-RM28.6 mil) and plantation (-RM27.2 mil).”

Local institutions continued to play its role in supporting the local bourse with a net purchase of RM32.2 mil last week.

The main sellers of the week were local retailers who net sold-RM426.7 mil of equities from Bursa Malaysia. They net sold every trading day except on Friday (July 5) when they net bought RM400,000.

In terms of participation, there were increases in average daily trading volume (ADTV) among local retailers and local institutional investors by +14.1% and +5.8% respectively while foreign investors recorded a decline in ADTV by -6.7% last week.

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia recorded its second straight week of net foreign inflows at US$161.4 mil followed by the Philippines who also saw second successive week of foreign net buying at US$4.3 mil.

However, Vietnam saw its 18th consecutive week of net selling by foreign at -US$90.7 mil last week while Thailand saw its seventh successive week of net foreign outflows at -US$22.6 mil.

The top three stocks with the highest net money inflow from foreign investors last week were Tenaga Nasional Bhd (RM162.9 mil), MISC Bhd (RM102.1 mil) and Malayan Banking Bhd (RM90.2 mil) – July 9, 2024