FOREIGN investors switched to being net sellers on Bursa Malaysia, ending a four-week streak of net inflows with a net outflow of -RM93.1 mil for the week ended Jan 12.

Every trading day saw net selling except for Monday (Jan 8) when foreigners net bought RM29.8 mil with inflows observed in stocks like Public Bank Bhd (RM42.2 mil), Sime Darby Bhd ((RM29.4 mil), and YTL Power International Bhd (RM28.6 mil), according to MIDF Research.

“The top three sectors with the highest net foreign inflows were utilities (RM181.4 mil), construction (RM67.0 mil) and energy (RM51.8 mil),” the research house pointed out in its weekly fund flow report.

“Meanwhile, the sectors with the highest net foreign outflows were consumer products & services (-RM241.2 mil), transportation & logistics (-RM103.7 mil) and industrial products & services (-RM99.0 mil).”

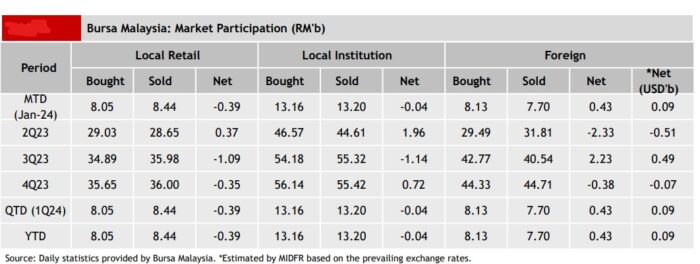

Elsewhere, local institutions also remained net sellers for the third consecutive week with a net outflow of -RM141.6 mil. The technology sector witnessed the highest net outflow from this investor group at -RM122.6 mil.

Likewise, local retailers also continued to be net sellers of domestic equities with a net outflow of -RM10.0 mil which is a much significantly slower place compared to the previous week’s -RM383.3 mil.

In terms of participation, there were increases in average daily trading volume (ADTV) among local retailers (+2.6%), local institutions (+3.4%), and foreign investors (+10.6%).

In comparison with another four Southeast Asian markets tracked by MIDF Research, Indonesia recorded a net foreign inflow at US$206.0 mil, extending its streak of positive inflows for the fifth consecutive week, followed by the Philippines with a third consecutive week of positive inflows at US$47.1 mil.

However, Thailand experienced a net foreign outflow of -US$120.8 mil, marking an outflow for the past two consecutive weeks, while Vietnam posted a net foreign outflow of -US$17.0 mil which represented net selling for two consecutive weeks.

The top three stocks with the highest net money inflow from foreign investors last week were YTL Power International Bhd (RM175.7 mil), Public Bank Bhd (RM68.0 mil) and Sime Darby Bhd (RM40.5 mil). – Jan 15, 2024