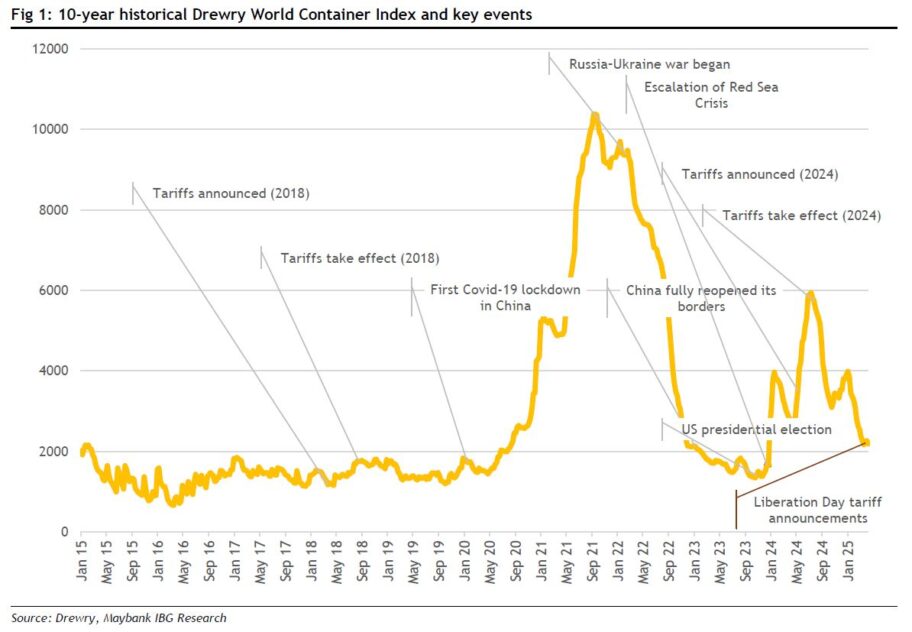

MAYBANK Investment Bank (MIB) believes container freight rates could remain on an upward trend in quarter two 2025 (2Q25), albeit softer year-on-year (YoY), driven by ex-China frontloading activities that have brought forward the traditional peak shipping season.

However, downside risks persist into second half of 2025 (2H25), including demand softening due to frontloading exhaustion and a potential slowdown in US-China trade flows, both of which could weigh on container freight rates.

“A key wildcard remains the Red Sea disruption, that is the reopening of the Suez Canal which could free up more vessel capacity, adding pressure on freight rates,” said MIB in a recent report.

Locally, Malaysian-listed logistics players has minimal exposure to the US market.

While MIB’s channel checks suggest that companies have received increased enquiries from foreign exporters due to trade diversion, upside on volume is limited by challenges including erratic order flows, poor shipment visibility, and infrastructure strain.

Port delays have been building up at key local ports like Westports and PTP, further strained by alliance reshufflings in February 2025 for PTP.

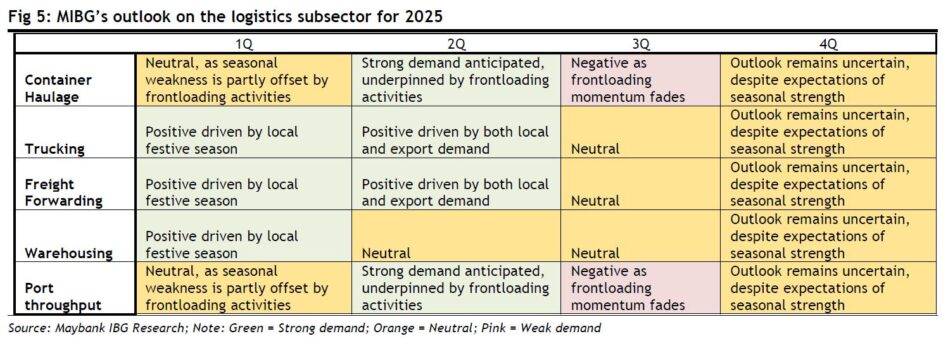

As the frontloading momentum fades post-grace period, volumes may retreat, with uncertainty and elevated costs clouding the sector’s near-term outlook, supporting MIB’s downgrade for the sector.

In contrast, Southeast Asia’s ocean freight rates have remained relatively resilient, supported by temporary demand stemming from the 90-day tariff reprieve announced on 8 April.

Some exporters have reportedly ramped up production to frontload shipments to the US ahead of the tariff implementation.

“However, in our view, this surge has not been sufficient to offset the steep decline in Chinese containerised exports, evidenced by last week’s -3% WoW decline in the WCI,” said MIB.

That said, it could still provide temporary support to local port throughput, particularly from intra-Asia trade volumes and gateway volumes.

MIB’s channel checks indicate a mixed picture across Malaysia’s logistics landscape.

Export orders have turned volatile, with some local industry players reported a temporary surge due to frontloading, while others faced order cancellations as exporters took a wait-and-see approach amid ongoing supply chain reassessments by US importers.

“Concurrently, we also note that local logistics firms have received rising enquiries from foreign exporters seeking alternative shipping routes amid trade diversion efforts, as they navigate the impact of the tariffs,” said MIB.

This aligns with findings from a Freightos survey, which revealed that 33% of US importers have paused shipments, 29% are exploring alternative sourcing options, and 19% are accelerating imports in response to the evolving tariff landscape.

Despite this uptick, the earnings impact on local listed logistics players is likely to be limited.

“We understand that most of these companies have minimal direct exposure to the US market, where high-value transpacific shipments are largely managed by global logistics players like DHL and FedEx,” said MIB. —Apr 22, 2025

Main image: Cerca Technology