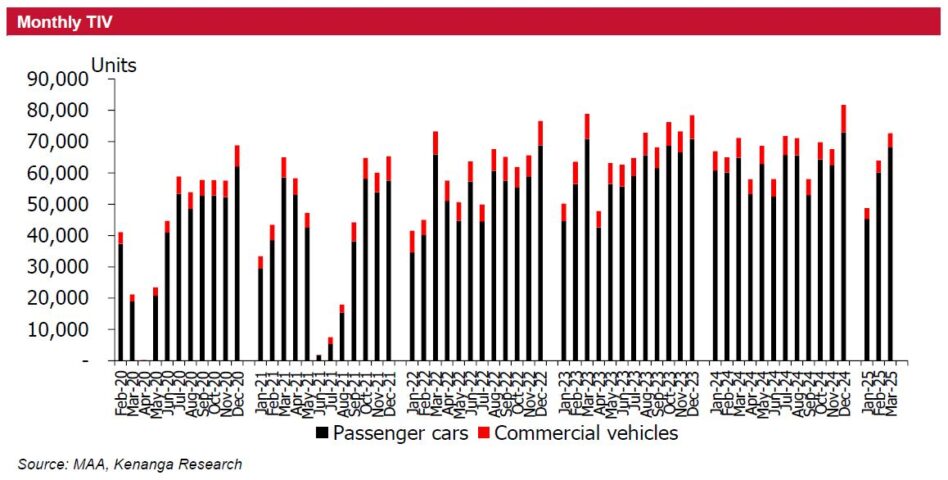

TOTAL industry volume (TIV) soared 14% month-on-month (MoM) and 2% year-on-year (YoY) on major festive promotional sales before the expected scheduled plant maintenance shutdown during the Hari Raya Aidilfitri holidays.

“Looking ahead, we believe April 2025 TIV will be lower than March 2025 TIV due shorter production month on scheduled plant maintenance shutdown,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

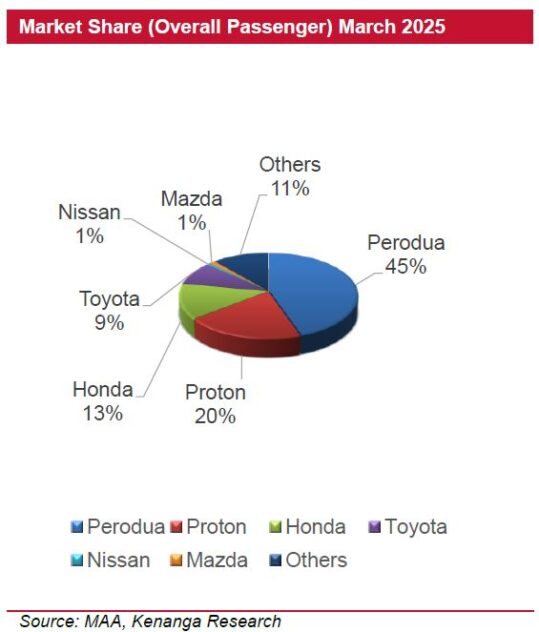

National marques stood their ground, reaping market share from the non-nationals marques, especially Perodua, backed by strong sustained demand in the affordable segment, attractive new launches, and a downtrading trend by mid-market buyers.

A two-speed automotive market locally will persist into 2025. It will be business as usual for the affordable segment as its target customers, that is the B40 and lower tier M40 groups, will be spared the impact of the impending RON95 subsidy rationalisation and could also potentially benefit from the introduction of the progressive wage model.

Kenanga’s 2025 TIV forecast of 805k units will be driven by the forward buying interest on the deferment of new excise duty regulations to the end of 2025 of which they expect Perodua to benefit the most at 44% TIV market share with the highest localisation rate as well as attractive new launches, higher household income and a stable labour market.

However, the same cannot be said for the premium segment as its target customers, that is the upper tier M40 and T15 groups may hold back from buying new cars, down-trade to smaller cars or switch to hybrids and electric vehicle (EV)s to cut their fuel bills upon the introduction of fuel subsidy rationalisation.

Concurrently, household bills will also be affected by the higher fuel bills, as well as expected 14% increase in base tariff for the higher-end usage which could also drive consumers to switch to solar-panels, in-turn boosting the demand for EV to funnel the excess grid electricity.

Additionally, EV routine maintenance costs are considerably lower than ICE’s due to fewer moving parts and wear & tear parts.

More battery electric vehicles (BEVs) in the market. Vehicle sales will also be supported by new BEVs that enjoy SST exemption and other EV facilities incentives up until 2025 for complete build ups and 2027 for complete knockdowns.

The new registration for BEVs leapt from 274 units in 2021 to over 3,400 units in 2022, 13,301 units in 2023, and 21,789 units in 2024, or 3% of TIV.

“We expect more favourable incentives from the government which has set a national target for EVs and hybrid vehicles of 20% of TIV by 2030 and 38% by 2040,” said Kenanga.

Meanwhile, the government will speed up the approval for charging stations. The number of proposed charging stations is currently at 4,299 (3,611 built to date) and this should more than double to 10,000 by the end of 2025. —Apr 28, 2025

Main image: Risk & Insurance