Letter to editor

IT IS not sufficient for the Genting Malaysia Bhd’s (GENM) board to only seek non-interested minority shareholder approval for the most recent transaction involving the remaining 51% stake in Empire Resorts.

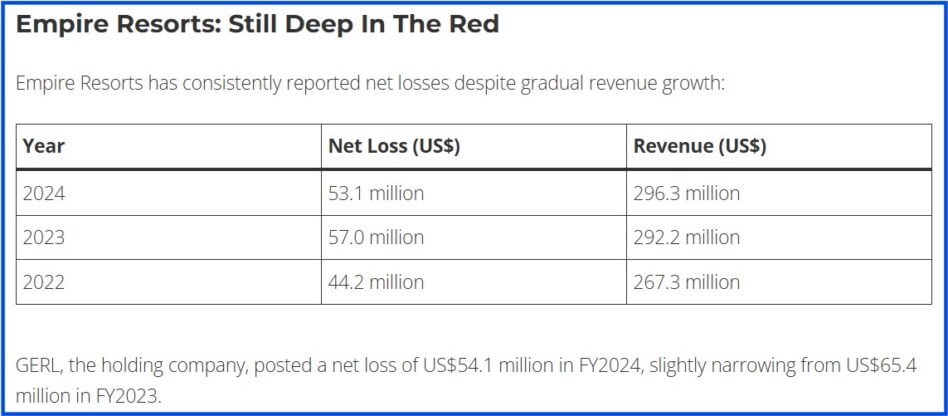

By this point, a substantial portion – over US$724 mil – has already been invested across multiple phases into this related-party transaction without the proper approval from minority shareholders.

This piecemeal approach to a clearly related and on-going investment should not shield the board from proper scrutiny.

The entire series of transactions – starting from the initial acquisition in 2019 through all subsequent capital injections and restructurings – should be considered as a single, connected related-party transaction.

As such, a comprehensive shareholder vote covering the full scope of these transactions is necessary.

Editor’s Note: Bursa Malaysia Securities Bhd had on May 8 placed under its radar GENM’s proposed US$41 mil (RM175.5 mil) acquisition to gain full control of the loss-making Empire Resorts Inc from Genting Group’s founding Lim family.

The stock market regulator slapped GENM with 20 questions on the deal which would see it buy the remaining 51% stake in Genting Empire Resorts LLC (GERL) that it does not currently own from Kien Huat Realty III Ltd.

GERL owns Empire Resorts while Kien Huat Realty III is owned by the Lim family led by Genting Group executive chairman Tan Sri Lim Kok Thay.

The acquisition will turn Empire Resorts, the operator of Resorts World Catskills, Resorts World Hudson Valley and Resorts World Bet in New York, from being GENM’s 49%-owned associate to a fully-owned subsidiary.

If the non-interested minority shareholders vote against the totality of the transaction, then the board and management must take steps to reassess or unwind the entire deal in the best interests of shareholders.

It is unacceptable to frame this issue as “too late” for corrective action – doing so would effectively legitimize regulatory evasion through strategic transaction structuring.

Moreover, seeking approval only at the final stage – when a majority of the funds have already been committed – renders any vote procedurally hollow and substantively meaningless.

This is akin to seeking consent after the outcome has already been decided and the value already eroded.

The integrity of the capital markets demands that companies cannot simply break up related-party transactions into parts to avoid triggering shareholder protection mechanisms.

The board should not be permitted to use time or transaction sequencing as an excuse to avoid accountability.

I again urge Bursa Malaysia and the Securities Commission Malaysia (SC) to treat this entire five-year investment as a single, related-party transaction (RPT).

Minority shareholders must be allowed to vote on the full scope of this deal – and their voice must carry real consequence, including the potential reversal or restructuring of the investment if deemed necessary.

Protecting minority shareholder rights is essential to maintaining confidence in Malaysia’s capital markets. – May 12, 2025

A Concerned Minority Shareholder

Kuala Lumpur

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.

Main image credit: SIGMA World