WHILE the local market remained subdued, global developments are actively shaping forex dynamics this week.

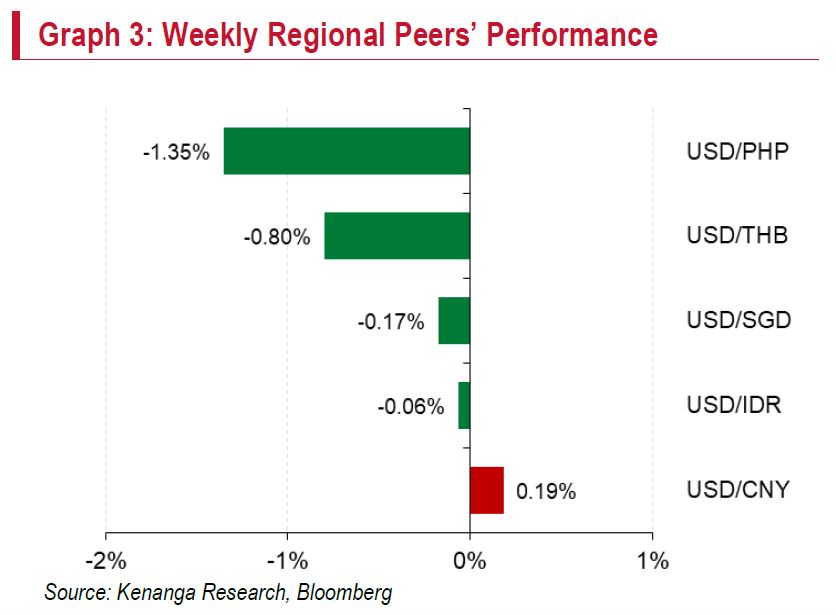

The USD Index (DXY) initially rallied, driven by Trump’s threat of a 100.0% tariff on BRICS nations, stronger-than-expected Job Openings and Labor Turnover Survey data, the collapse of the French government, and South Korea’s unexpected political turmoil.

“These events bolstered demand for safe-haven, high-yielding US assets,” said Kenanga Research (Kenanga) in the recent Economic Viewpoint Report.

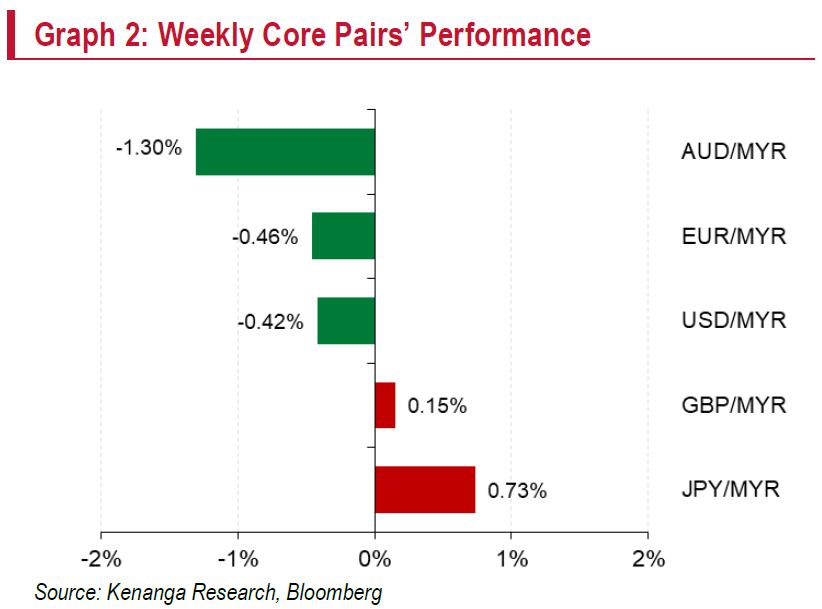

However, dovish remarks from Fed Waller hinting at a potential rate cut and a weaker ISM Services PMI pushed the DXY below 106.0, enabling the ringgit to strengthen to around 4.43/USD.

The market is not fully pricing in a December rate cut by the Fed yet, with tonight’s key labour data, particularly the unemployment rate which will be pivotal.

A higher-than-expected unemployment figure could nudge the Fed towards a rate cut at its December 18 meeting, potentially weakening the USD.

Meanwhile, Marine Le Pen’s commitment to deliver a budget within weeks has lifted eurozone sentiment, boosting the euro and adding pressure on the DXY.

However, persistent market volatility may continue to attract investors to the USD as a haven.

Fed Chair Powell’s comments on US economic resilience and next week’s expected 0.3% month-on-month core inflation reading could further reinforce the USD strength, capping the ringgit’s scope for further gains.

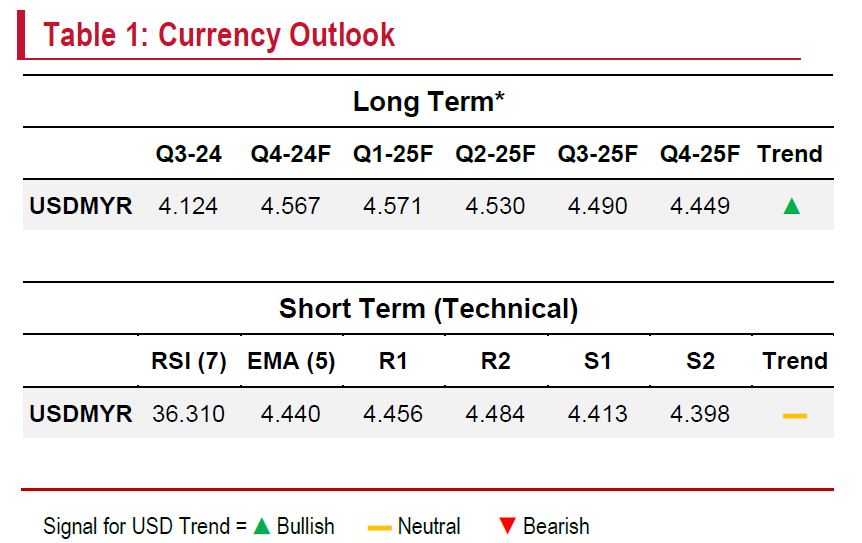

The USDMYR’s RSI indicates a mid-range position, signalling a neutral outlook and potential consolidation near the 4.440 level.

While the USD’s movement is likely data-driven, sustained safe-haven demand may keep the pair within the range of 4.413 to 4.456. —Dec 6, 2024

Main image: blueberrymarkets.com