THE world is currently experiencing high inflation. While Malaysia has yet to see an inflation rate over 8%, many believe that this is due to price controls and/or subsidies. In times of high inflation, gold is seen as an inflation hedge.

For thousands of years, gold has been used as money and considered a store of wealth. Many consider gold an investment. According to Investopedia, an investment is an asset acquired with the goal of generating income or price appreciation.

The challenge with holding physical gold is that there is no interest or dividends associated with it. Any gain will have to come from price appreciation.

In view of this, there are many stock market investors who look at gold miners as proxies of gold. The logic is that the performances of such companies are linked to the price of gold. This can lead to price appreciation. On top of this, there is the potential for dividends.

There is one Bursa Malaysia gold mining companies – Bahvest Resources Bhd. But there are listed gold jewellers – Poh Kong Holdings Bhd, Tomei Consolidated Bhd and Niche Capital Emas Holdings Bhd (NICE). The question then is whether investing in these companies can be proxies for investing in gold.

To answer this question, I compared the performance of these four Bursa Malaysia-listed companies with the price of gold. I looked at two scenarios.

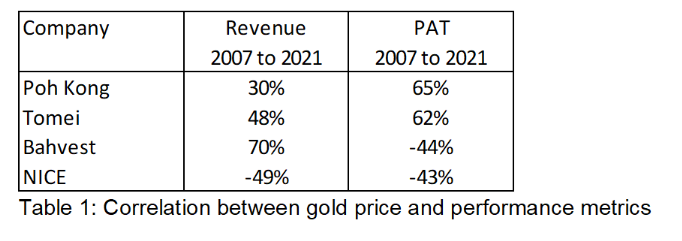

In the first scenario, I compared gold price movements with the fundamental performance of these companies. I covered a 15 years period from 2007 to 2021 by looking at the year-end prices with the results for the year. I used two metrics to represent the fundamental performance, namely revenue and profit after tax (PAT).

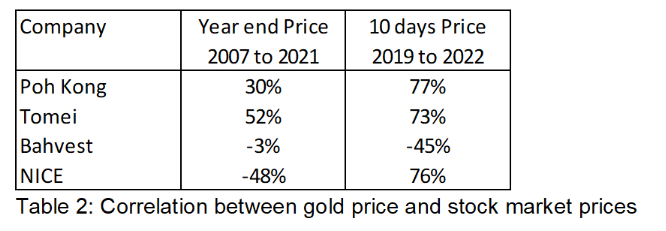

In the second scenario, I compared the gold price movements with the share price movements. I looked at two situations.

- The first covered the year-end prices over 15 years from 2007 to 2021.

- The second was for a shorter time frame from January 2019 to August 2022. I knew that gold prices had a significant jump around mid-2020 and I wanted to see the impact of this. For this analysis, I look at prices every 10 days.

Fundamentals

The rationale for this analysis was that gold represented the raw materials for these companies. Any changes in the price of gold would affect the revenue and profit margins.

If these companies are good proxies for gold, then we should have a significant correlation between the price of gold and their performance. I would consider a 70% or higher correlation as significant.

Table 1 summarises the correlation between the year-end price of gold and the revenue and profits for the year. You can see that the only Bahvest had any significant correlation but this was based on its revenue. There was actually a negative correlation when it came to profits. In other words, it lost money as the price of gold increased.

I would consider the correlation between gold prices and profits to be borderline for both Poh Kong and Tomei.

The analysis suggests that there are other factors rather than the price of gold that are driving the profits of these four companies.

Share prices

The share price of a company is a function of the business fundamentals and market sentiments. Rather than try to explain which has greater impact, this part of the analysis merely takes the share price as one variable. The other variable is the gold price.

In the first scenario, I took the perspective of a long-term investor by looking at year-end prices over a 15-year period. In the second scenario, I took the perspective of a shorter-term investor looking at more frequent price changes.

Table 2 summarises the results of the correlation between gold prices and stock market prices of these four companies.

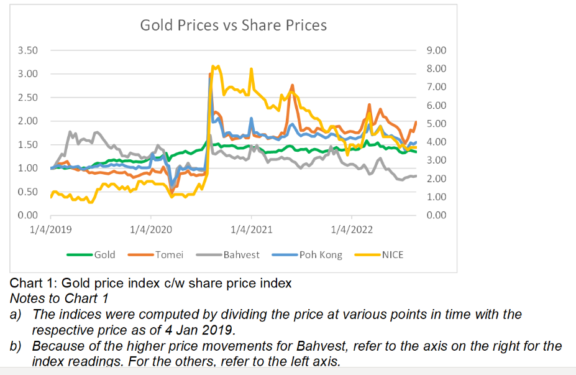

You can see that there is no significant correlation based on the year-end prices. But when you look at price changes every 10 days, there is a significant correlations for Poh Kong, Tomie and NICE. The links between the gold price and the share price can be clearly seen in Chart 1.

Are you better off investing in gold?

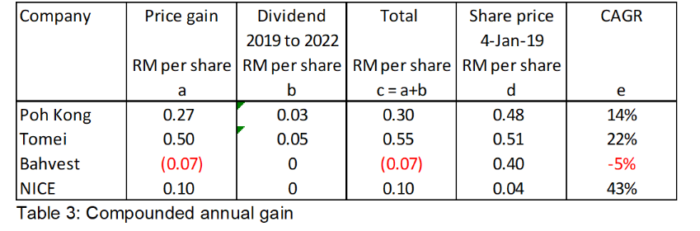

To answer this question, I compared the gain from the various investments based on the short-term situation, ie 2019 to 2022.

From Jan 4, 2019 to 26 Aug 2022, gold appreciated by 35%. If you have invested in the Bursa Malaysia-listed gold jewellers, your compounded annual gain is shown on Table 3. The gain comprises both the capital gain as well as dividends.

You can see that only NICE achieved a better gain than that for gold. But then this was due to its low share price. I would consider those from Poh Kong and Tomei to be more realistic. This is on a basis that there is nothing to be gained from investing in proxies

Conclusion

This article looks at two questions:

- Can gold miners or jewellers be proxies for gold?

- Are you better off investing in gold or gold proxies?

To determine whether an instrument is a proxy, I looked at the correlation between the gold price and the appropriate metric. The analysis shows that there is no correlation between revenue or PAT and gold prices. There is only a significant correlation when we look at the stock prices on a short interval basis.

In the Bursa Malaysia context, investing in gold jewellers can be proxies for investing in gold. I would not draw the same conclusion for the sole gold miner.

As for the second question, the approach is to compare the gain from investing in gold with the gain from investing in proxy companies. In the Bursa Malaysia context, it is better to invest in gold.

A self-taught value investor who has been investing in Bursa Malaysia and SGX companies from a value investment perspective for more than 15 years, Datuk Eu Hong Chew was re-appointed to the board of i-Bhd as non-independent non-executive director on Jan 1, 2022.

The data for this article was extracted from “Are there Bursa proxies for gold?” on i4value.asia. Refer to the article for the methodology and further analysis.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.