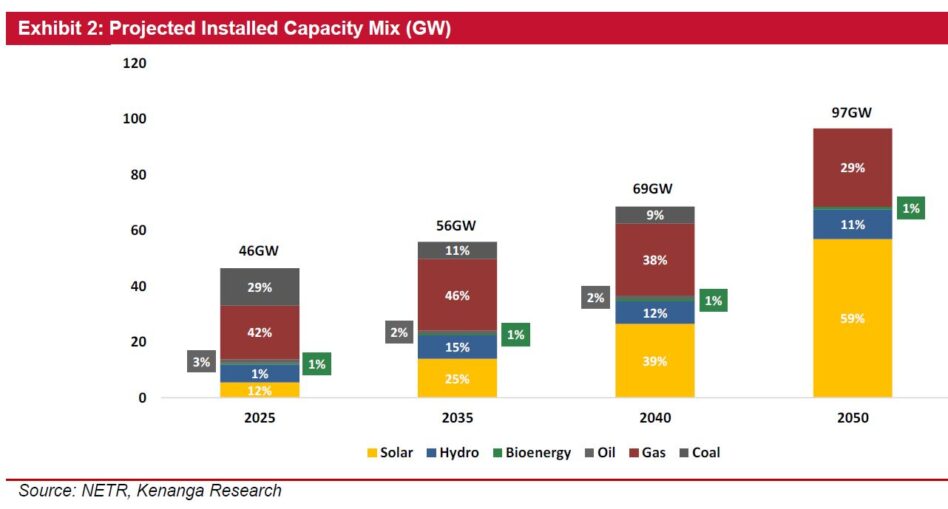

THE government is ramping up its Renewable Energy (RE) target, aiming to achieve 40% (23GW) capacity by 2035, up from the current 27% (12GW).

“While various initiatives have been introduced to boost solar power investment, we believe the current pace of RE capacity growth remains far from achieving the target,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

With solar expected to power more than 80% of the 11GW growth required by 2035, the government has initiated a new wave of LSS to accelerate the transition with another 2GW of capacity.

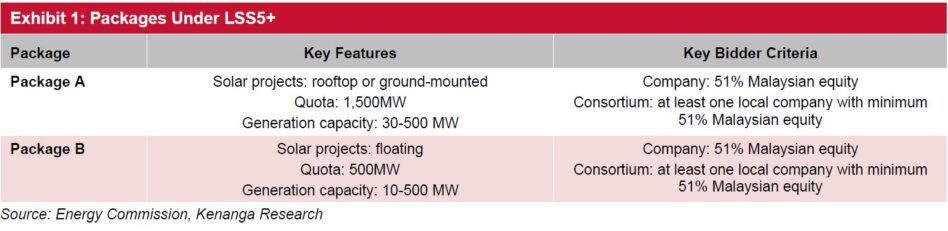

Under LSS5+, developers could bid up to 500MW with operations scheduled to commence in 2027.

Shortlisted bidders will be revealed in July 2025 and bid rates are expected to be similar to LSS5, with winning rates between RM0.14/kWh and RM0.18/kWh, yielding an 8% project IRR.

“We estimate at least RM5bil in additional EPCC contracts for PV systems from LSS5+. Currently, the total value of EPCC contracts in the market has risen to RM12.4bil, up from RM7.4bil, ensuring sustained sector activity through the end-2027,” said Kenanga.

The 26% drop in solar panel prices in 2024 was mainly due to a massive oversupply of manufacturing capacity and while the glut may persist, we don’t expect prices to drop much further.

A continued decline could push most solar manufacturers into loss-making territory as they struggle to maintain market share in a highly competitive environment.

The sustained low prices are already putting significant pressure on manufacturers with some unable to withstand the financial strain, potentially exiting the market.

While this pressure could set the stage for a potential recovery, a major rebound in 2025 seems unlikely.

As a result, solar EPCC players can still benefit from lower panel prices, with an estimated GP margin of around the low mid-teens for LSS5+.

“With current prices, we expect winning rates to fall between RM0.14/kWh and RM0.18/kWh, yielding an 8% project IRR,” said Kenanga.

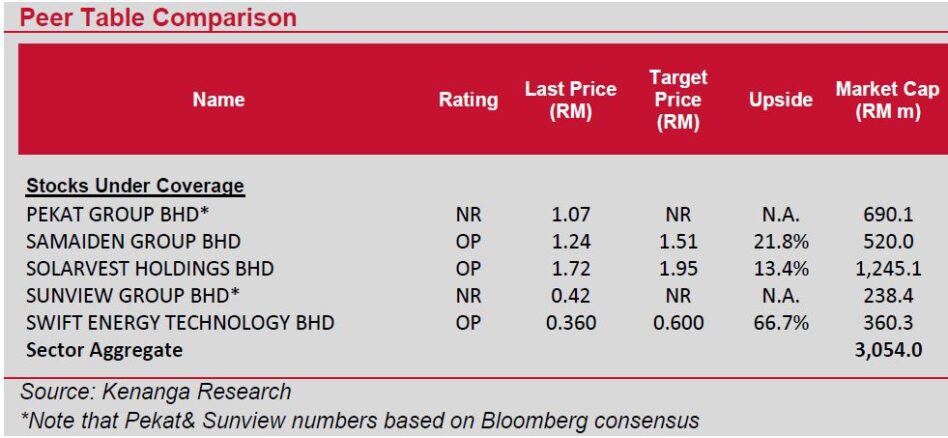

Kenanga sees EPCC solar players, including SLVEST, SAMAIDEN, PEKAT (Not Rated) and SUNVIEW (Not Rated), as key beneficiaries of this programme, potentially capturing at least 50% of the RM5bil contract opportunities under LSS5+.

Additionally, asset owners from past LSS rounds are well-positioned to benefit given their proven track records.

Notable past winners under Kenanga’s coverage include TENAGA, SLVEST, SAMAIDEN, TCHONG, UZMA.

“We see near-term prospects centred on the upcoming EPCC contracts from the CGPP which are expected to see a more active flow of contract awards in the coming months, followed by the 2GW LSS5 and the recent additional 2GW LSS5+ project,” said Kenanga.

Kenanga believes earnings for LSS5+ will likely start to accrue from 2027 onward; hence, we have not adjusted our earnings forecasts yet. Our sector top picks are:-

1/ SLVEST for its strong market position, execution track record, clientele and value proposition of its PV system financing programme, and its strong earnings visibility backed by sizeable outstanding order and tender books, and recurring incomes from a growing portfolio of solar assets.

2/ SAMAIDEN given its focus on residential and commercial projects that typically fetch higher margins, and similarly, its ability to provide end-to-end solutions, including financing to its customers, and strong earnings visibility backed by sizable outstanding order and tender books. —Jan 20, 2025

Main image: New Straits Times