THE rising cost of living is an oft-heard lament from all strata of society. It has been argued that it hits the B40 segment harder than most as basic essentials such as food, travel and education needs become more expensive.

But one housewife is determined to break this vicious cycle by being extra prudent. Her cautious use of her spouse’s wages (of RM1,335 post-statutory deductions) on just the necessary items show that it is possible to not only survive but also have a little extra for savings.

She even claimed that they are able to provide a RM100 stipend for each set of parents as well as bi-annual holidays at budget locations for her family which includes three kids.

Her efforts were shared on X by user finfluencer The Futurizts (@thefuturizts) who was in awe of her careful management of household finances.

Housewife shares on Facebook how she manages to save RM200-250 per month on husband’s RM1,500 salary.

After EPF deductions, the take-home pay is only RM1,335. 😬

Quite a few things to learn about budgeting from here.

Allow us to break it down for you. 🧵 pic.twitter.com/9zyyRgYCR5

— The Futurizts (@TheFuturizts) January 15, 2025

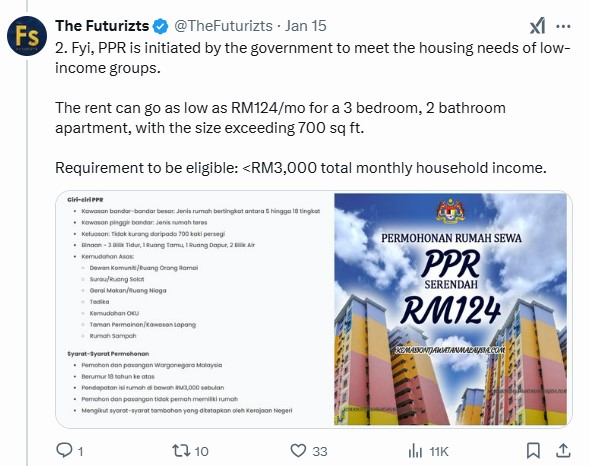

He broke down the key aspects of the housewife’s budgeting, starting with the benefit of having government sponsored low-cost housing. In fact, the People’s Housing Programme (PPR) is a big help as rent is as low for RM124/month for households with income lower than RM3,000.

The fact this government initiative provides a flat of a 700 sq ft flat with three bedrooms and two bathrooms mean that the family is housed in comfortable surroundings.

Note that many “luxury” condos are smaller than that. There may be no swimming pool and other amenities but that is a small price to pay with the rent being so low.

The poster also highlighted the fact that the housewife uses reusable cotton diapers (instead of disposable ones) and breastfeeds the baby to save on costs.

It was also highlighted that she paid everything in cash to avoid falling into the trap of paying more via instalments.

The poster was at pains to stress that such practice of paying in cash will avoid wastage on frivolous items – something that the new generation should take heed.

He also advised saving up to buy the more expensive items so as to avoid overspending.

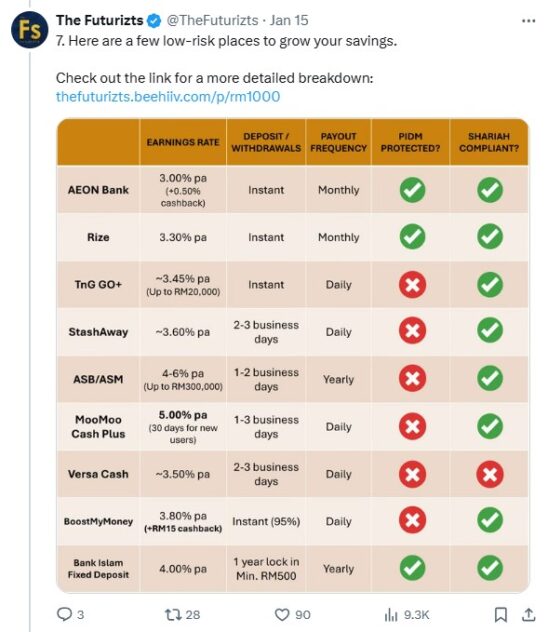

He also shared some low-risk places to invest or place savings in.

Many netizens only had positive things to say about the “finance minister” and her ultra-prudent use of resources.

Quite a few said the husband was a very lucky man to have such a good wife who expertly managed household expenses.

One pointed out that more newly-weds could learn a thing or two from this couple.

Indeed, everyone could learn a thing or two from this ultra-resourceful lady as she shows how every family could live within their means. However, one netizen hoped that this post does not lead to more employers paying a “poverty wage”. – Jan 17, 2025