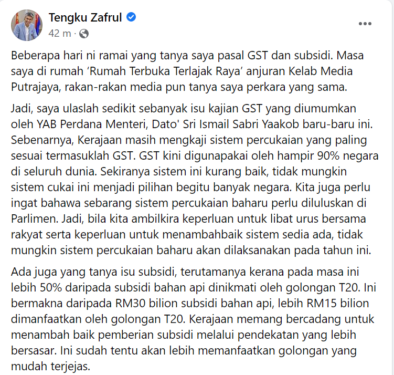

FINANCE Minister Datuk Seri Tengku Zafrul Abdul Aziz defended his decision to review the nation’s taxation system, which includes the possibility of reintroducing the Goods and Services Tax (GST).

“The GST is implemented in nearly 90% countries across the globe. It would be impossible to comprehend all these countries imposing it if it was a bad tax system.

“In any case, we must remember that any new taxation system must be approved by the Parliament. Therefore, we will consult all stakeholders before improving on our tax regime.

“Given the huge task ahead, I don’t think the reforms on our tax system will happen this year,’ he said, on Facebook.

In a special interview with Nikkei Asia in Tokyo two weeks ago, Prime Minister Datuk Seri Ismail Sabri Yaakob said the Government was studying whether to reintroduce the GST to widen the country’s revenue base.

It is to note that in April 2015, former prime minister Datuk Seri Najib Tun Razak replaced the Sales and Services Tax (SST) with GST; at a 6% quantum.

However, the Pekan MP exempted an array of essential goods from the tax regime.

Targeted subsidy

When Pakatan Harapan took over Putrajaya in 2018, the administration abolished the GST and reverted back to SST.

Touching on the ballooning subsidy, Tengku Zafrul said that the Government was mulling to introduce a targeted subsidy programme so as to ensure only the needy enjoyed its benefits.

As of now, he added, more than 50% of the subsidy was being enjoyed by the T20 community instead of others.

“It means that from the RM30bil allocated on fuel, more than RM15bil goes to the T20 group.

“That’s why the Government is looking at a targeted approach, which will definitely benefit the underserved communities,” Tengku Zafrul quipped. – June 9, 2022